|

Getting your Trinity Audio player ready...

|

Ripple’s XRP token has been stuck in a tug-of-war between bulls and bears, leaving investors yearning for a decisive move. However, recent indicators are hinting at a potential bullish breakout, sparking cautious optimism in the XRP community.

Chart Signals Point Towards a Uptrend

The XRP/USD chart suggests the end of a consolidation period, characterized by the ongoing battle between buyers and sellers. The Relative Strength Index (RSI) hovering around 60 indicates a slight bullish bias without overbought signals. Additionally, the bullish crossover and upward trend of the Moving Average Convergence Divergence (MACD) line further reinforce this momentum.

The current price of around $0.52 faces immediate resistance at $0.53, a level that has repeatedly rejected XRP’s advances in recent days. A sustained breach of this resistance could trigger further buying, potentially pushing the price towards the next hurdle at $0.55.

Also Read: Ripple’s XRP Primed for Breakout? Analyst Predicts “Massive Rise” After Historic Pattern Emerges

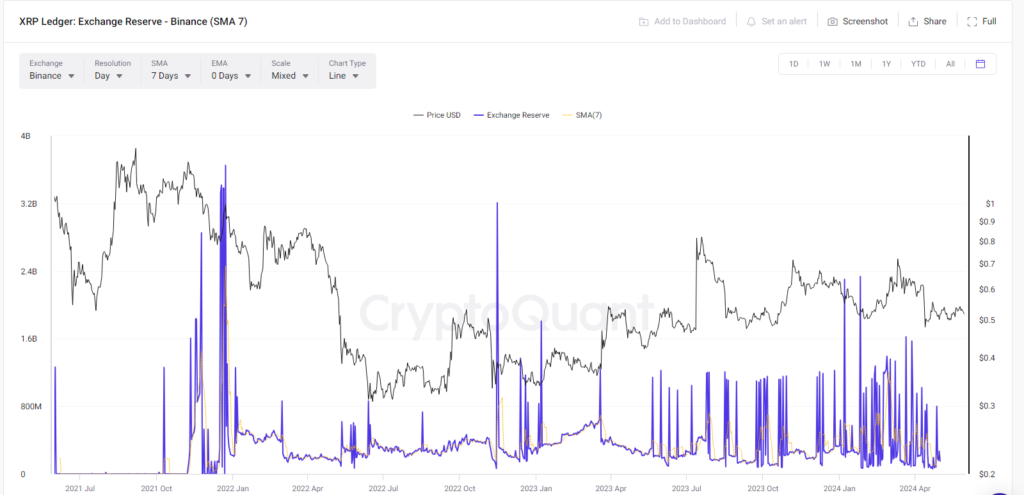

Furthermore, a decrease in XRP’s exchange reserves over the past week suggests reduced selling pressure or potential accumulation by holders, often a precursor to price increases if demand remains steady or grows.

Notably, Whale Alert reports indicate significant whale activity, with nearly $30 million in XRP accumulated within the past 24 hours.

Social Buzz and Sentiment Remain Subdued

However, a potential social media-driven bullish breakout seems less likely due to a decrease in XRP’s social volume. The lack of sustained high levels of social activity suggests limited hype surrounding the token. Additionally, the Ripple Fear and Greed Index for XRP currently sits at 42%, indicating a neutral market sentiment.

While the overall neutral sentiment highlights some social optimism, a closer look reveals weaknesses in XRP’s bullish case. The combination of very negative sentiments in key areas like dominance, whale activity, and search interest suggests that bulls might still lack the strength for a decisive takeover.

A Wait-and-See Approach for Investors

The current situation presents a mixed bag for XRP investors. While technical indicators and whale activity hint at a potential bullish breakout, subdued social media presence and a neutral market sentiment raise concerns about its immediate sustainability.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!