|

Getting your Trinity Audio player ready...

|

XRP, the native token of Ripple, is currently in a critical phase, according to renowned cryptocurrency analyst CryptoBull (@CryptoBull2020). Recently, the analyst shared insights suggesting a potential breakout for XRP, based on a key chart pattern that could signal a major upward movement in the near future.

Is XRP Set for a Surge?

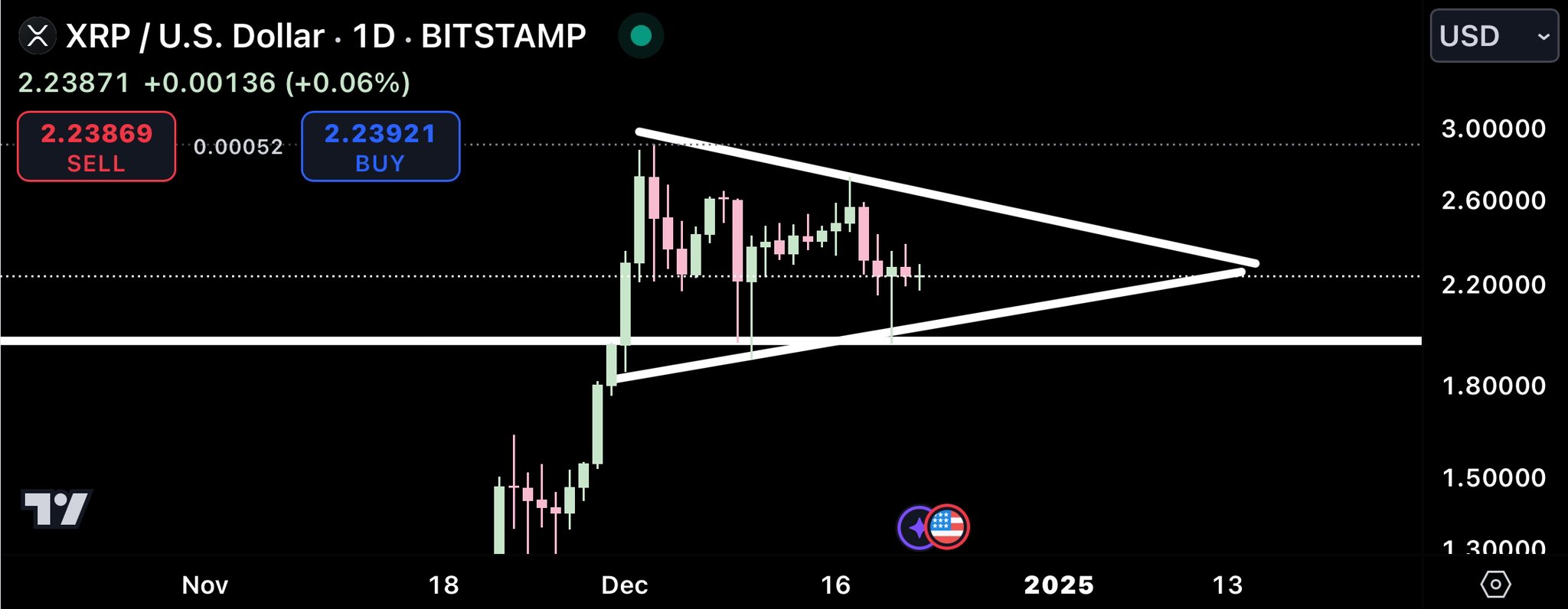

CryptoBull’s analysis points to a symmetrical triangle pattern forming on XRP’s daily chart. After reaching a high of $2.86, XRP entered a period of consolidation, typical of a symmetrical triangle. This pattern usually precedes a significant price move—either up or down—but CryptoBull anticipates a breakout to the upside.

The analyst highlights the critical support level at $1.96, which is XRP’s 2021 peak. This level is crucial for preventing further losses, and XRP has managed to hold above $2, indicating strong buyer interest. CryptoBull expects the consolidation phase to last for about two more weeks, with a potential breakout and new all-time high around January 5, 2025. This timeframe gives XRP investors an exciting New Year prospect, as it could usher in a major surge for the cryptocurrency.

Also Read: XRP Could Surge to $35 in 2025, Analyst Predicts, Riding on Bullish Momentum

The Broader Market Sentiment

CryptoBull’s prediction is further backed by positive market sentiment surrounding XRP and the broader cryptocurrency market. XRP’s recent surge to $2.86, its highest point since 2018, has reignited discussions about its future potential. Despite the ongoing consolidation, the asset’s ability to remain above the $2 mark suggests strong demand from investors.

The easing of regulatory uncertainties around Ripple, coupled with the resignation of SEC Chair Gary Gensler and the appointment of Paul Atkins, may also contribute to XRP’s bullish outlook.

With XRP currently trading at $2.17, all eyes are on its next moves. If the symmetrical triangle plays out as anticipated, XRP could soon see significant price action, potentially reaching new heights.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.