Bitcoin recently shattered records, reaching a new all-time high of $73,700 on March 13th. However, whispers of a potential correction loom as the April halving event approaches. Analysts debate whether history will repeat itself, mirroring the price drops observed before previous halvings.

Echoes of the Past

Pseudonymous analyst Rekt Capital points to historical chart patterns, suggesting a pre-halving correction could be imminent. He highlights the 20% and 38% price drops experienced in 2020 and 2016, respectively, before the halving events. Rekt Capital anticipates a retracement lasting up to 77 days, though potentially milder than previous cycles due to the already observed 18% pullback in January and 14% dip in early March.

Breaking the Mold?

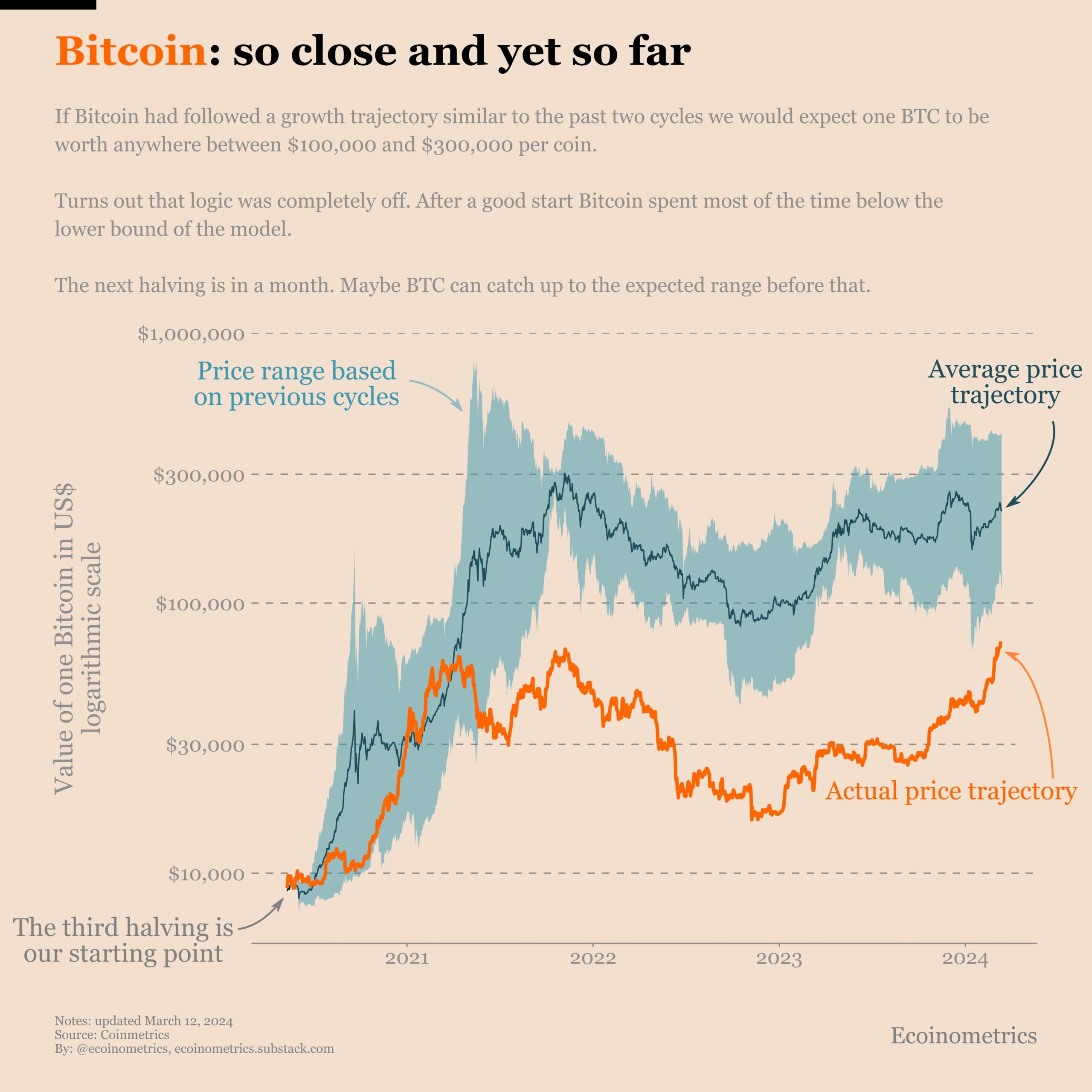

This bull run, however, presents unique factors. Unlike prior cycles, Bitcoin established a new all-time high before the halving. Additionally, Ecoinometrics data suggests the current price trajectory falls short of historical growth patterns.

If Bitcoin followed its past two cycles, it could be hovering between $100,000 and $300,000 per coin. This suggests room for further growth before the halving.

Post-Halving Boom or Bust?

Looking ahead, wealth management firm Bernstein offers a bullish outlook. Their analysts predict a post-halving surge, with Bitcoin potentially reaching $150,000 by mid-2025. This optimism stems from the surging demand for spot Bitcoin ETFs, exceeding initial projections. Bernstein expects continued inflows to propel the price.

Beyond the Halving

While Bernstein’s target is significant, Cathie Wood’s ARK Invest raises the bar even further. They’ve revised their long-term Bitcoin price target to a staggering $1 million.

With conflicting signals from historical trends and bullish projections, Bitcoin’s future remains uncertain. Investors should carefully consider the potential for a correction before the halving alongside the long-term growth prospects fueled by factors like ETF adoption. As always, thorough research and a well-defined investment strategy are crucial before diving into the volatile cryptocurrency market.