The long-awaited US spot Bitcoin ETFs have landed, but the party may just be getting started. While the initial market reaction was lukewarm, JPMorgan is predicting a significant capital shift within the crypto landscape, with up to $36 billion potentially flowing into these new players.

While fresh capital entering the crypto market might be slow to materialize, JPMorgan sees a more compelling story: a mass migration from existing crypto products towards the convenience and potentially lower fees offered by spot ETFs. The Grayscale Bitcoin Trust (GBTC) stands to be the prime source of this influx.

Leaving Grayscale Behind?

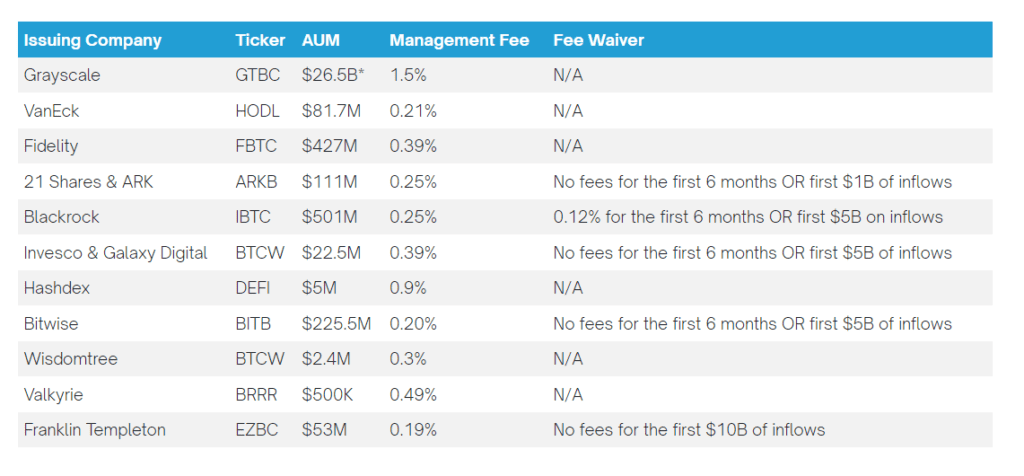

Investors who snapped up discounted GBTC shares last year might be eyeing the exit now. With spot ETFs offering direct Bitcoin exposure and potentially lower fees, up to $3 billion could be leaving GBTC, JPMorgan estimates. This sentiment is further fueled by Grayscale’s hefty 1.5% annual management fee compared to competitors like BlackRock‘s 0.25% offering.

Beyond GBTC: A Broader Shift

Retail investors holding their crypto in exchange wallets could also join the migration, contributing up to $20 billion to the ETF pool. The ease of access and traditional investment tools offered by ETFs might be too enticing to resist.

Related: Can Bitcoin Crack $200,000? Standard Chartered Predicts $100 Billion ETF Flood

Will Grayscale Adapt or Fade?

The future of GBTC largely hinges on its fee structure. JPMorgan predicts an additional $5-10 billion exodus if Grayscale doesn’t adjust its fees to match the competition. Institutional investors currently holding crypto in GBTC or futures-based ETFs could also be swayed by cheaper spot options, further exacerbating the outflow.

The Bottom Line:

The arrival of spot Bitcoin ETFs isn’t just about attracting new money; it’s about shaking up the existing crypto ecosystem. If they play their cards right, spot ETFs could become the preferred avenue for institutional and retail investors alike, leaving legacy products like GBTC in their dust. The question remains: will Grayscale adapt, or become a relic of a bygone era? Only time will tell how this crypto game of musical chairs unfolds.