|

Getting your Trinity Audio player ready...

|

Hedera Hashgraph (HBAR) continues to struggle under bearish pressure as its six-week-long downtrend gains momentum. The altcoin has failed to break free from market-wide negative sentiment, with technical indicators suggesting further declines ahead.

HBAR Bears Take Control

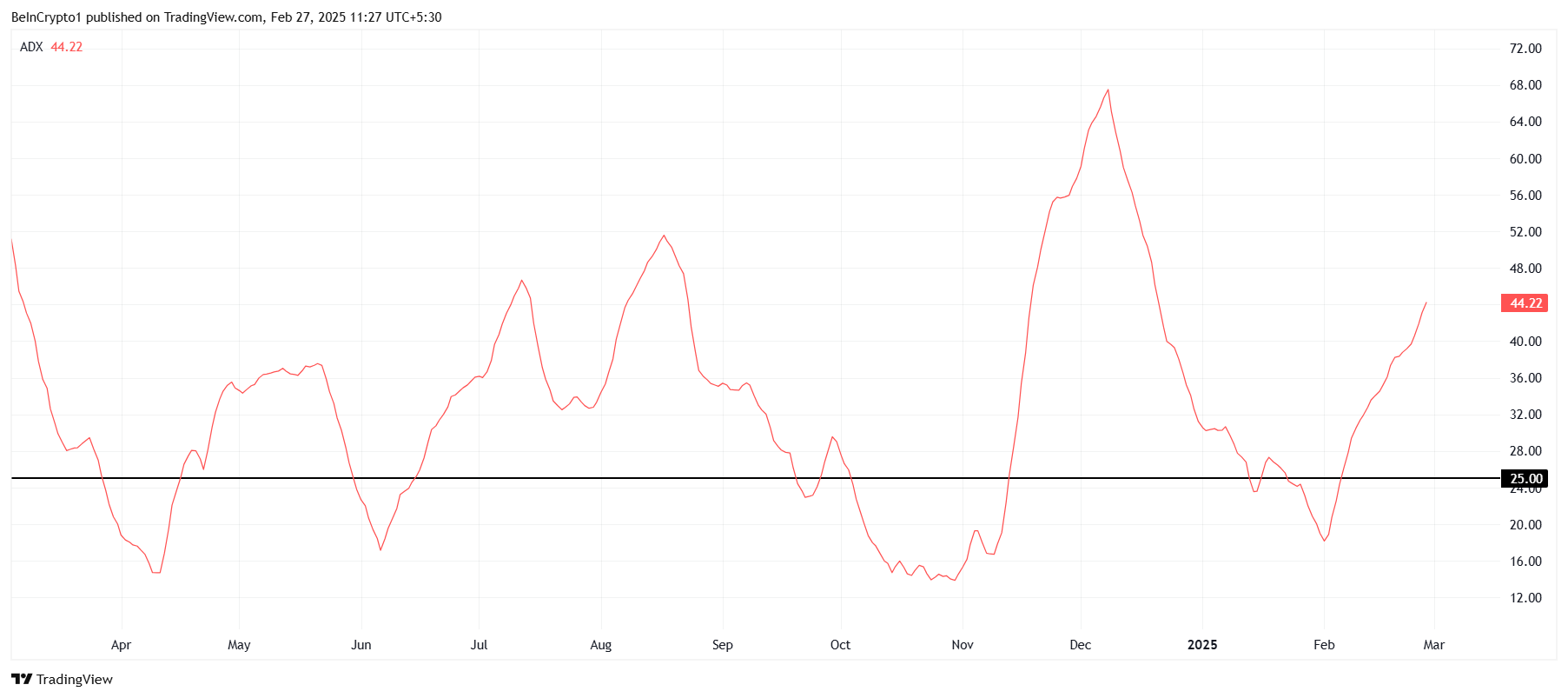

Since mid-January, HBAR has been on a steady decline, currently trading around $0.20. While the token has found temporary support at $0.19, its downward trajectory remains intact. The Average Directional Index (ADX) has surged to 44, well above the 25.0 threshold, indicating strong bearish momentum.

As selling pressure mounts, the likelihood of a price rebound appears slim. The Relative Strength Index (RSI) is hovering near oversold levels, yet historical trends suggest that an immediate recovery is uncertain. Although an RSI below 30.0 often signals potential reversals, previous price action reveals that such conditions do not always lead to a significant rebound.

Key Support and Resistance Levels

For HBAR to avoid deeper losses, it must hold the crucial $0.19 support level. A breach of this level could push prices lower, with the next major support lying at $0.17. If the downtrend continues unchecked, further declines could be in store, exacerbating investor losses.

Conversely, for any bullish momentum to return, HBAR must successfully break past the $0.22 resistance level. A decisive move above this threshold could indicate the start of a recovery, potentially shifting sentiment in favor of buyers.

Market Outlook Remains Cautious

Despite its sharp downturn, HBAR has yet to confirm a full trend reversal. The ADX’s rising strength suggests that bears still have the upper hand, and the lack of strong bullish catalysts limits upside potential in the near term.

Also Read: Hedera (HBAR) Price Signals Bullish Sentiment as Nasdaq Files for Spot HBAR ETF

Until market sentiment improves and HBAR reclaims key resistance levels, the altcoin remains vulnerable to further declines. Investors should keep a close watch on support zones and be cautious of potential volatility as the market navigates through uncertain conditions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.