|

Getting your Trinity Audio player ready...

|

The cryptocurrency market is facing a potential shakeup as Ether, the world’s second-largest cryptocurrency by market capitalization, teeters on the brink of a price drop that could trigger significant liquidations.

Ether Vulnerable to Liquidations

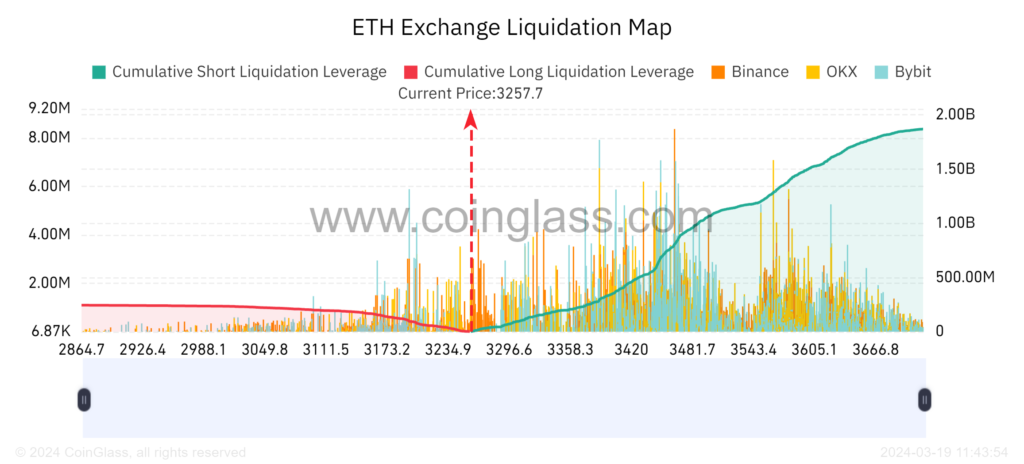

Data from Coinglass suggests that if Ether’s price falls below $3,100, over $212 million worth of leveraged long positions could be liquidated. This comes after a tumultuous 24 hours that saw the crypto market liquidate a total of $624.4 million, with a staggering 83% of those positions being long bets – essentially, investors who were hoping for a price increase.

Ether itself has borne the brunt of recent volatility, dropping a sharp 9.3% in the 24 hours leading up to March 19th, 2024 (UTC 10:40 AM). This adds to a weekly decline of over 18%, highlighting the precarious position Ether finds itself in. Should the price breach the $3,100 mark, the resulting liquidations could exacerbate the downward pressure on the market.

Market Recalibration on the Horizon

Analysts at Bitfinex believe that Bitcoin’s recent pullback, starting March 14th, could be a catalyst for a broader market recalibration. This period of adjustment would see investors find a new equilibrium after a surge in inflows towards Spot Bitcoin ETFs.

Divergent Paths: Bitcoin vs. Altcoins

However, the outlook isn’t entirely bearish. The resilience of the altcoin market, particularly Ethereum, offers a counterpoint. Bitfinex highlights the growing investment flows and record outflows of Ether from exchanges as signs of a bullish narrative for Ethereum and other Layer 1 blockchain projects. This selective outflow, reaching a new high of 154,000 Ether on March 11th, could potentially lead to a supply squeeze and a subsequent price increase for Ether.

The Road Ahead

While the short-term future of the crypto market remains uncertain, the coming weeks will likely be defined by the performance of large-cap altcoins like Ether. Their price movements could be instrumental in determining the overall trajectory of the market.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.