|

Getting your Trinity Audio player ready...

|

Recent data has revealed a striking increase in whale activity on the Cardano (ADA) network, with analyst Ali Martinez noting a significant surge in transactions exceeding $1 million. A total of 687 such transactions were recorded within a 24-hour period, marking a dramatic uptick in institutional capital flowing into the ecosystem. This development underscores growing confidence in Cardano’s future potential, with whales continuing to accumulate substantial amounts of ADA tokens.

A massive surge in whale activity on the #Cardano $ADA network! In the past 24 hours, 687 transactions exceeding $1 million were recorded. pic.twitter.com/p8vzuLaFVP

— Ali (@ali_charts) December 16, 2024

In the past 48 hours alone, whales have acquired more than 80 million ADA tokens. This large-scale accumulation mirrors similar patterns observed earlier in December and reflects a strong belief in Cardano’s long-term growth. Historically, such activity has often preceded significant price rallies, as increased buying pressure typically boosts investor sentiment and market confidence.

Market Sentiment: A Contrarian Opportunity for Investors

While whale activity signals bullish potential, market sentiment surrounding Cardano remains somewhat bearish. Martinez pointed out that despite negative sentiment, this could serve as a contrarian indicator for savvy investors. A chart accompanying his analysis highlighted a spike in social volume during mid-to-late November, coinciding with ADA’s price rally. Despite the bearish sentiment, ADA’s price demonstrated resilience, suggesting that current pessimism may obscure underlying strength, setting the stage for a potential recovery.

Market sentiment for #Cardano $ADA has turned bearish—just the kind of setup bullish contrarians dream of! pic.twitter.com/hg7892ALmH

— Ali (@ali_charts) December 17, 2024

This combination of resilient pricing and rising pessimism could spark renewed interest in ADA, creating an opportunity for investors to capitalize on its hidden potential. As market sentiment grows more negative, ADA’s ability to maintain its price levels above key support zones indicates solid demand and could signal the start of a bullish reversal.

Cardano’s Current Price Action: Preparing for the Next Move

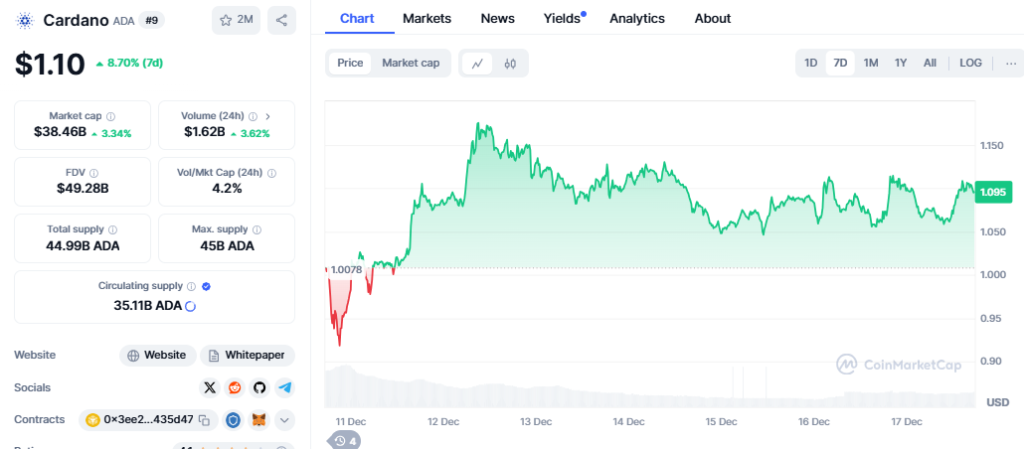

Currently trading at $1.07, Cardano has experienced a minor decline of -0.88% in the latest session. Following a strong upward rally in mid-November, the price has entered a consolidation phase around $1.068. However, ADA remains above key exponential moving averages (EMAs) at $0.88 and $0.70, reflecting a positive long-term outlook.

The resistance at $1.20 remains a critical level, where recent profit-taking occurred. However, the upward slope of the EMAs suggests that buyers are still in control in lower time frames. With the Relative Strength Index (RSI) at 54.51, there is room for upward movement if buying activity increases.

Looking ahead, holding support above $1.00 will be crucial for maintaining momentum. A breakout above $1.20 could pave the way to $1.40 or higher, while a dip below $1.00 could test the $0.88 support zone, where buyers are expected to defend the uptrend.

As Cardano continues to show resilience amid market uncertainty, it remains a key asset to watch for potential gains in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.