Cathie Wood, CEO of ARK Invest, throws a wrench into traditional investment strategies, claiming Bitcoin is emerging as a preferred “flight to safety” asset, potentially dethroning gold. This bold statement comes amidst rising financial uncertainty and the recent launch of spot Bitcoin ETFs, making the cryptocurrency more accessible to mainstream investors.

Wood highlights Bitcoin’s impressive performance during the March 2023 regional bank crisis, where its value surged 40% as the traditional banking sector crumbled. This, she argues, demonstrates Bitcoin’s ability to thrive in volatile markets, unlike gold which remained stagnant during the same period.

Gold vs. Bitcoin: A Changing Landscape:

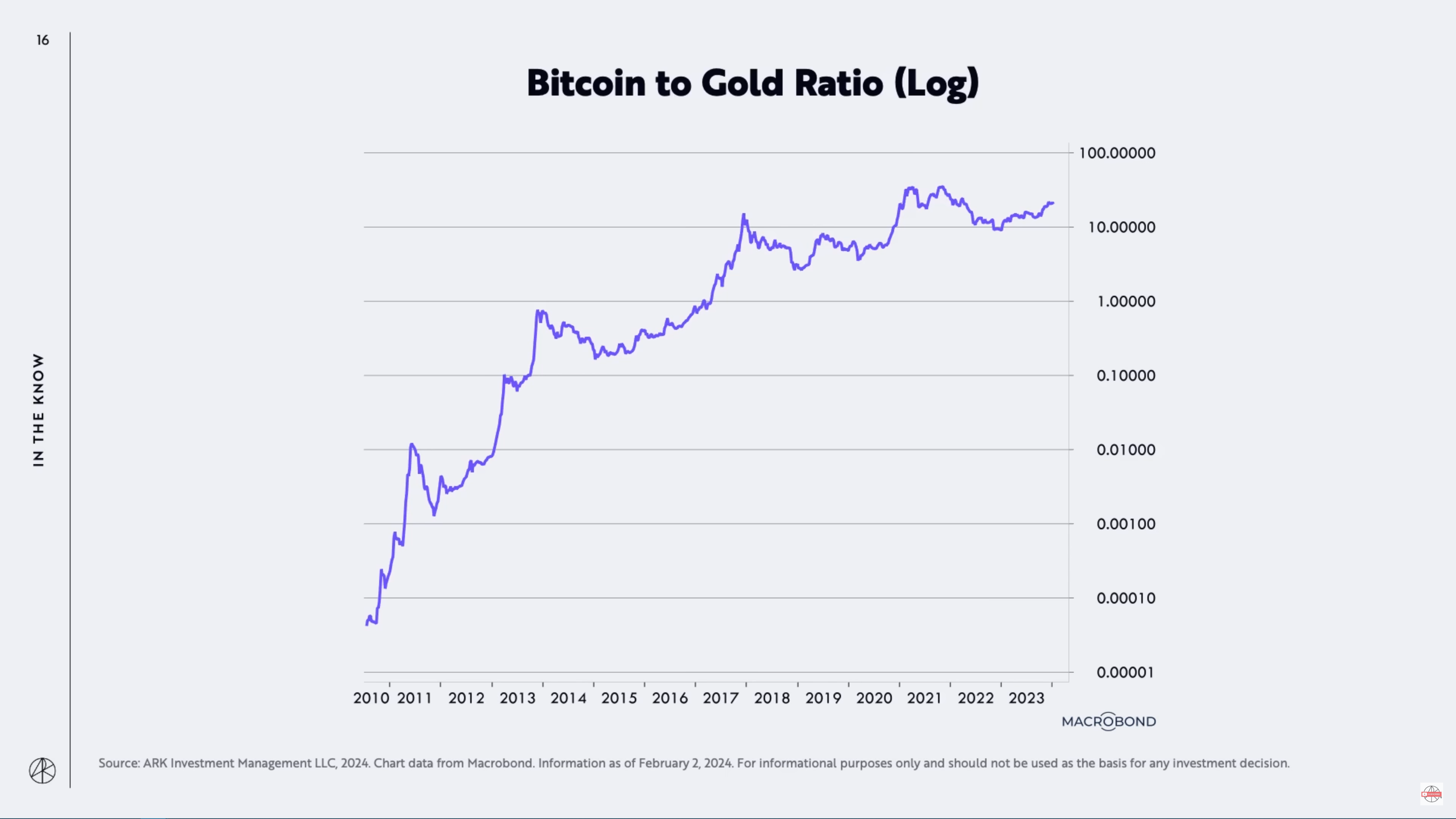

Wood’s conviction is further fueled by a chart showcasing Bitcoin’s steady rise in value relative to gold over the long term. “This chart just shows you that even relative to gold, Bitcoin has been rising,” she states, suggesting a gradual shift in investor preference towards the digital asset.

ETFs Fuel Adoption, But Volatility Persists:

The recent launch of spot Bitcoin ETFs has undoubtedly simplified access to the cryptocurrency, potentially accelerating its adoption by institutional investors. However, Wood acknowledges the subsequent price volatility, including a 20% drop after the ETF launch. Despite this, she remains optimistic, pointing to the strong holding pattern exhibited by a large portion of Bitcoin in circulation.

Related: Bitcoin to the Moon? Cathie Wood Predicts $1.5 Million by 2030 After ETF Approval

ARK’s Continued Crypto Conviction:

ARK Invest’s bullish stance on the crypto sector is further solidified by their significant investment in Coinbase stock, even after scaling back their holdings. This unwavering belief, despite market fluctuations, underscores their confidence in the long-term potential of cryptocurrencies.

Also Read: Bitcoin ETFs: A Golden Dawn or a Modest Glow? Comparing Crypto to Gold’s Historic Move

The Verdict:

While Wood’s prediction of Bitcoin overtaking gold as the ultimate safe haven asset might spark debate, it undeniably ignites an intriguing conversation about the evolving landscape of investments. With increased accessibility and its proven resilience in turbulent times, Bitcoin’s position as a viable alternative asset class is gaining traction. Only time will tell if it can truly dethrone the age-old reign of gold, but one thing is certain: the future of finance is becoming increasingly digital, and Bitcoin is at the forefront of this revolution.