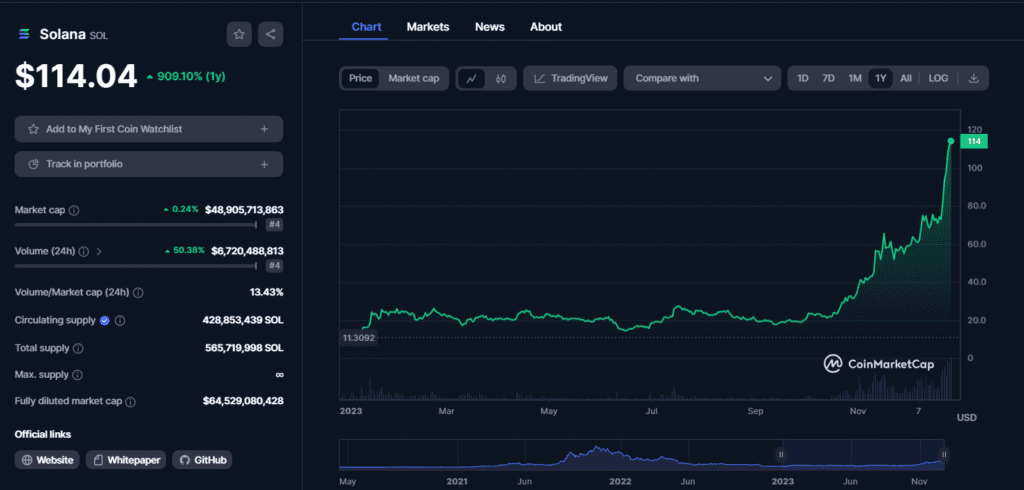

Solana (SOL) has defied all odds, surging over 50% in the past week and 906% year-to-date. However, a dark cloud looms as massive Solana whale movements stir speculation about a potential market sell-off. With 2 million SOL shifted in recent transactions, should investors brace for a price plunge?

Whales on the Move:

Blockchain tracker Whale Alert sent shivers down the spines of Solana bulls, flagging multiple large-scale token movements. An anonymous whale, holding a hefty 1.2 million SOL (~$150 million), mysteriously transferred their stash to an unknown wallet. Similar large transactions, totaling hundreds of millions of dollars worth of SOL, were directed towards platforms like Binance and Coinbase.

History Repeats?:

Past incidents have proven whale activity to be a potent market mover. Back in November, whale selling contributed to Solana’s dip below $55. With such substantial sums on the move, concerns regarding a potential dump and subsequent price crash are understandable.

Bullish Sentiment Persists:

Despite the whale movements, there are also positive indicators. The SOL price remains stable, showing a slight 1.6% increase in the past 24 hours. Bullish sentiment prevails on social media, with platforms like Santiment reporting increased hype and a positive weighted sentiment for SOL. Additionally, DEX volumes on Solana have seen a stunning 100-fold increase since the last quarter. This suggests strong demand and optimism from retail investors.

Also Read: Solana Slays the Doubts: 300% Surge Makes “Ethereum Killer” Title Ring True

Market Volatility: Proceed with Caution:

The crypto market remains notoriously volatile, and recent choppy trading across the broader digital asset space adds to the uncertainty. While Solana’s fundamentals paint a promising picture, investors should exercise caution and remain vigilant in the face of potential whale-driven market swings. Conducting thorough due diligence and maintaining a diversified portfolio is crucial in navigating the ever-changing crypto landscape.