|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Windtree Therapeutics’ $700 million crypto acquisition plan marks a pivotal moment for BNB, driving renewed bullish sentiment.

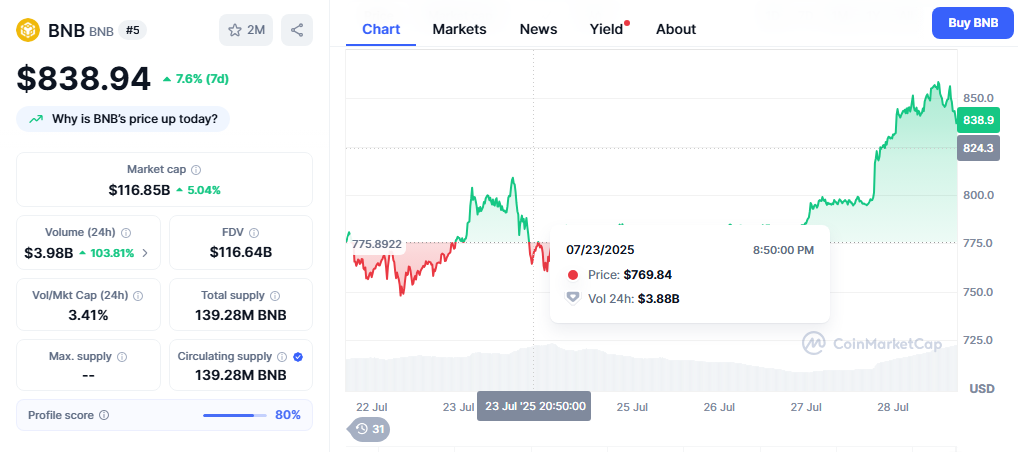

- Bollinger Bands and MACD confirm strong buying pressure with key resistance at $818 and potential upside to $850.

- Corporate treasury adoption helps not only BNB but also supports promising projects like Solaxy in the expanding DeFi landscape.

Binance Coin (BNB) is pushing toward a new all-time high following a significant corporate treasury announcement from Windtree Therapeutics, a Nasdaq-listed biotech firm. Windtree revealed plans for a $500 million equity line of credit and an additional $20 million stock agreement aimed at acquiring BNB. If approved by shareholders, nearly 99% of the funds raised will be allocated to accumulate Binance Coin, signaling a major institutional bet on the cryptocurrency.

This move reflects a growing trend among publicly traded companies adopting crypto assets to diversify their balance sheets. Windtree’s CEO Jed Latkin highlighted the strategy as a means to strengthen the firm’s digital asset position, while industry experts like Patrick Horsman from Build and Build Corp. praised the decision as a forward-looking step to create shareholder value.

Technical Analysis: BNB Nears Crucial $818 Resistance Level

BNB’s price initially retraced from the record $809 high on July 23 to dip near $742. However, Windtree’s announcement halted the decline, driving the price back up to $798 by July 27 — a 7% gain in just three days. Technical indicators suggest strong bullish momentum.

The daily Bollinger Bands on the BNBUSD chart show an upward slope, indicating rising volatility driven by buying pressure. Since early July, BNB has consistently closed above the 20-day moving average, a sign of sustained demand supporting the uptrend. The immediate target for bulls is the $818 resistance level at the upper Bollinger Band, with a breakout potentially pushing prices toward $850, a key psychological barrier.

Additionally, the MACD indicator confirms the bullish sentiment, with the MACD line well above the signal line and positive histogram bars, reinforcing the likelihood of continued upward movement.

Also Read: Binance Coin (BNB) Eyes Breakout as Transactions and TVL Spike

Corporate Crypto Adoption Fuels BNB and Benefits Emerging Projects Like Solaxy

Windtree Therapeutics’ commitment to inject $700 million into BNB accumulation is reviving interest in the coin and the broader crypto market. As institutional capital flows in, emerging projects stand to gain from the trickle-down effect. One such example is Solaxy, Solana’s first layer-2 protocol, currently running its $SLXY token presale.

Solaxy’s multichain DeFi platform offers high staking rewards, making it an attractive option for investors during the ongoing altcoin season. With BNB testing new highs and attracting major corporate investments, projects like Solaxy are well-positioned to capitalize on the growing investor appetite.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!