|

Getting your Trinity Audio player ready...

|

As the global economy teeters on uncertain ground, investors are flocking to hard assets, and the spotlight has turned decisively toward Gold and Bitcoin. With inflation still lingering and stock markets showing early signs of stress, traditional financial instruments are starting to lose their luster. In contrast, Gold has soared to an all-time high of $3,300, and Bitcoin continues to hold firm above $80,000 — signaling a strong shift in investor sentiment.

This synchronized movement between the two assets is more than coincidence. Amid growing geopolitical tensions and wavering economic policies, both institutional and retail investors are actively seeking safety. While Gold has long served as a traditional hedge, Bitcoin is quickly positioning itself as a modern counterpart — often dubbed “digital gold.”

Recent data backs up this trend. According to IntoTheBlock, Bitcoin’s exchange netflows are currently at 52%, suggesting more BTC is being withdrawn from exchanges than deposited. This indicates a strong holder mentality, where investors prefer to store their assets long-term rather than liquidate in the short term.

Moreover, 77% of all Bitcoin addresses are in profit, further bolstering investor confidence. Historically, such profitability has often led to market stability and, at times, bullish rallies — much like those that followed the 2021 and 2022 downturns.

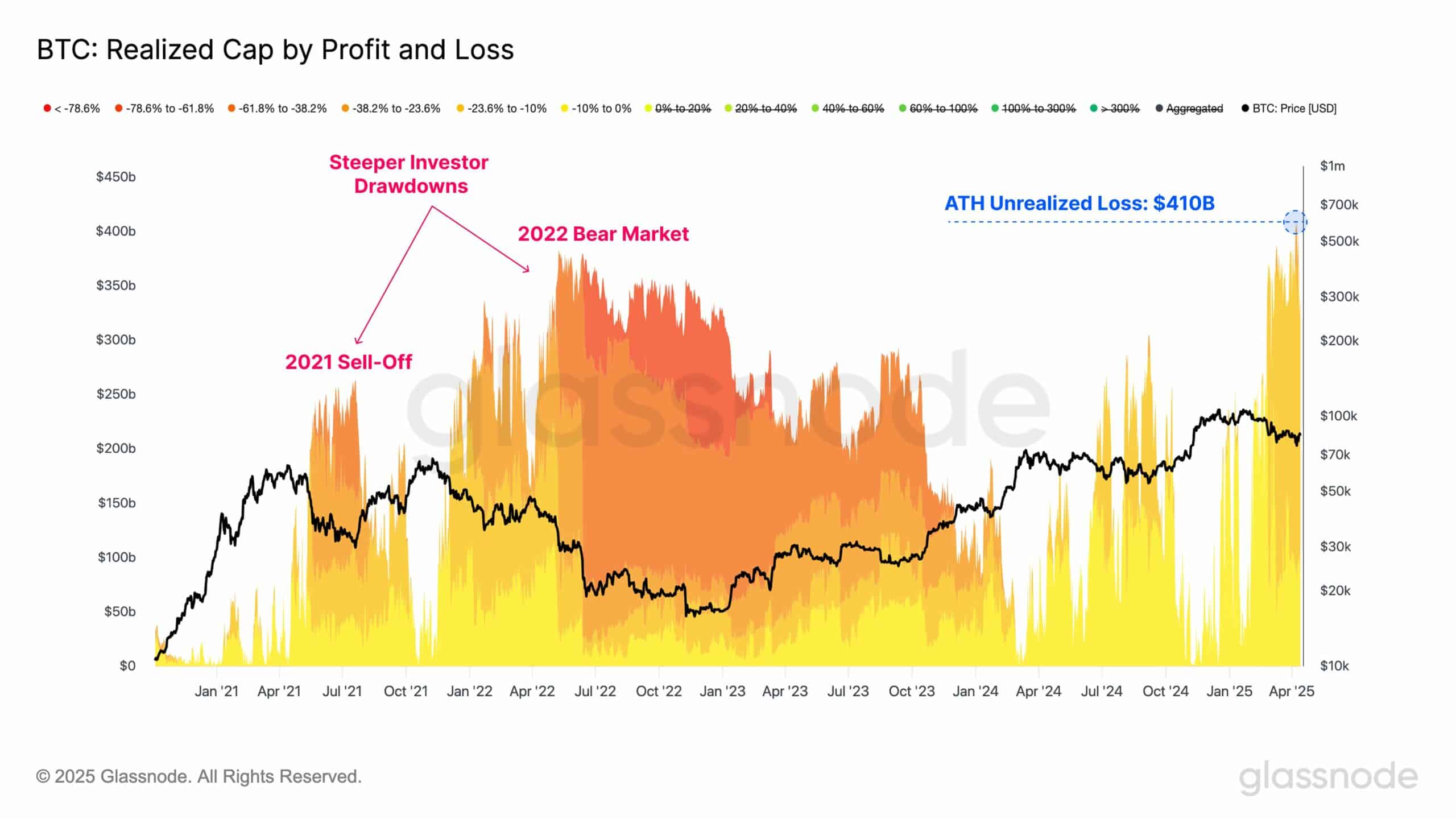

Glassnode data also reflects a decline in unrealized losses, indicating reduced selling pressure and growing belief in Bitcoin’s resilience as a store of value. This sentiment may pave the way for upward momentum, especially as equities remain volatile.

Also Read: Bitcoin at $85K Sparks Bullish Chatter on Social Media, Santiment Reports

In a world where monetary policy shifts and geopolitical risks remain high, Bitcoin’s appeal as a decentralized, globally accessible asset continues to rise. As long as economic uncertainty persists and trust in traditional markets falters, Bitcoin could see further inflows — and possibly, new record highs.

With Gold and Bitcoin both turning heads, the safe-haven narrative has never been stronger. Bitcoin isn’t just riding the wave — it’s helping shape it.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!