Nearly all Bitcoin wallets are now in profit, according to data from market intelligence firm IntoTheBlock. This news comes as Bitcoin surges to a new yearly high of $60,000, marking a 17.85% rally in the last 7 Days.

This surge in profitability coincides with Bitcoin reclaiming its 2023 high, currently sitting just 20% shy of its all-time high of $69,000 reached in November 2021. Notably, long-term holders comprise the majority of profitable investors, with 69% holding Bitcoin for over a year.

Furthermore, Bitcoin futures open interest has reached an all-time high of $24.78 billion, surpassing the previous record set in 2021. This surge in open interest suggests increased institutional participation and potential for further price volatility.

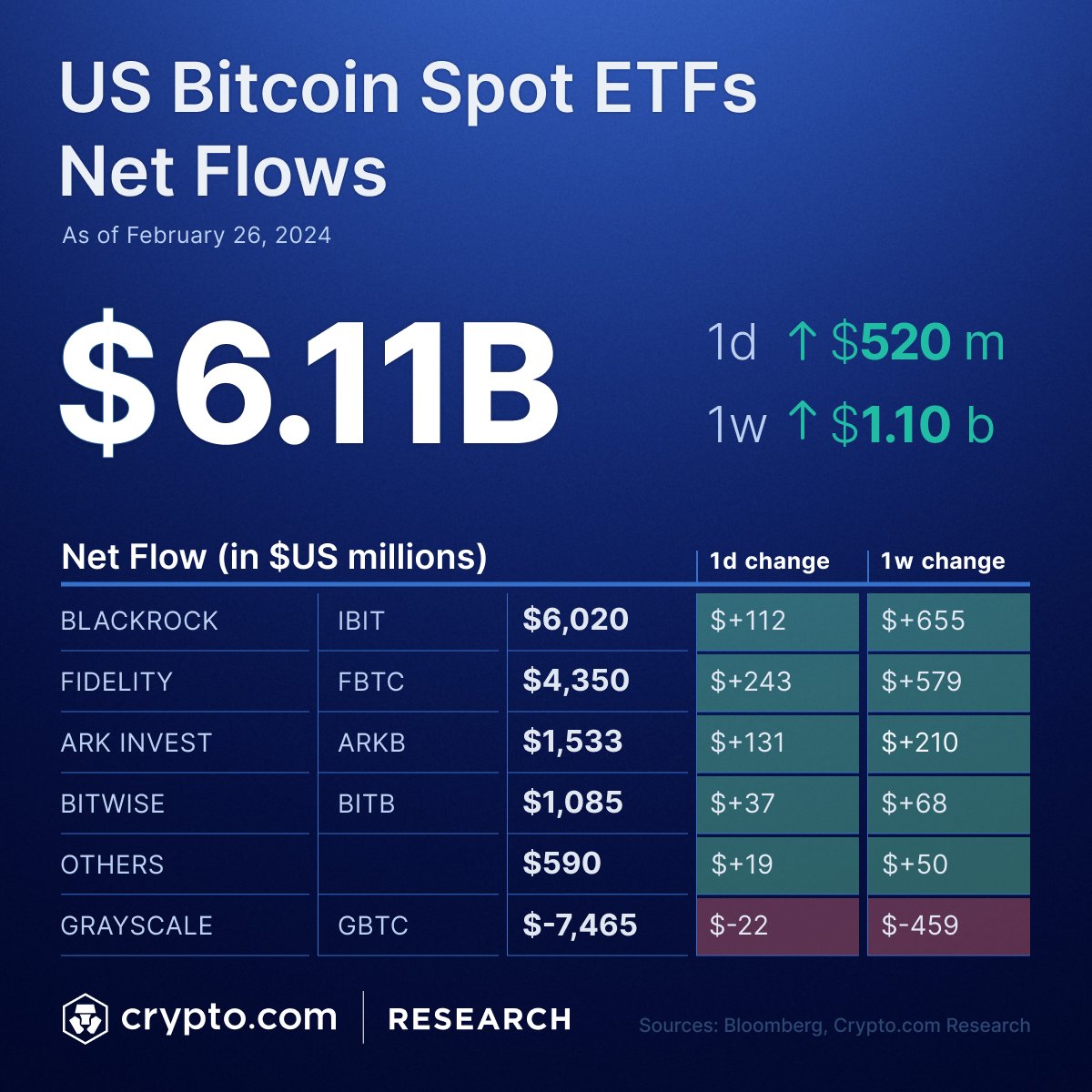

Analysts attribute the recent upswing to inflows into newly launched U.S. Bitcoin spot ETFs. Since their launch in January, these ETFs have witnessed over $6 billion in inflows, with BlackRock’s IBIT, Fidelity, Ark Invest, and Bitcwise leading the charge.

However, it’s important to note that Grayscale, the world’s largest Bitcoin fund manager, has experienced negative inflows during this period.

While Bitcoin’s future trajectory remains uncertain, the current profitability surge and record-breaking open interest paint a positive picture for the short-term, especially for long-term investors.

Bitcoin (BTC) Market Overview

As of February 28, 2024, the global cryptocurrency market is thriving, with a market capitalization of $1.18 trillion, reflecting a significant 4.91% increase in the last 24 hours. Bitcoin (BTC), the dominant cryptocurrency by market cap, is currently trading at $60,449.00, bolstered by a 5.82% surge in the past day. Its daily trading volume sits at $55.08 billion, showcasing active market participation. With a circulating supply of 19.64 million out of a maximum supply of 21 million, Bitcoin maintains its top position in the market.