|

Getting your Trinity Audio player ready...

|

Former U.S. President Donald Trump revealed plans for an official U.S. Crypto Reserve via Truth Social, signaling a major shift in the country’s stance on digital assets. The initiative aims to integrate leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA) into a national reserve framework, potentially redefining the role of crypto in the U.S. financial system.

XRP’s Inclusion: A Surprising Turn of Events

Among the proposed assets, Ripple (XRP) stands out as a surprising addition. Given its prolonged legal battle with the U.S. Securities and Exchange Commission (SEC), its inclusion may indicate a changing regulatory outlook. This move could signal government recognition of XRP’s utility in cross-border payments, a long-contested argument in the crypto space.

Could These Altcoins Be Next?

Speculation is mounting over which altcoins might be next in line for inclusion. CryptoRank suggests that several assets with pending ETF approvals could soon join Trump’s Crypto Reserve.

Which tokens could be next in Trump’s crypto reserves?$BTC and $ETH ETFs are already live, with $SOL, $XRP, and $ADA —highlighted by Trump—also expected to launch soon.

— CryptoRank.io (@CryptoRank_io) March 3, 2025

The next potential additions to the U.S. Сrypto Reserves could be among the altcoins awaiting ETF launches,… pic.twitter.com/ZSBwNKb9BJ

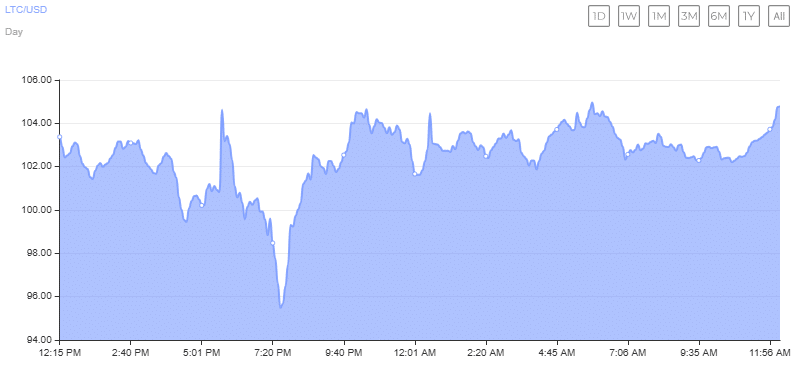

One frontrunner is Litecoin (LTC), a Bitcoin alternative known for faster transactions. Bloomberg analysts James Seyffart and Eric Balchunas estimate a 90% chance of approval for a Litecoin ETF this year, with CoinShares and Canary Capital already filing applications.

Polkadot (DOT), renowned for its blockchain interoperability, is another strong contender. Nasdaq has submitted a Form 19b-4 for a Grayscale spot Polkadot ETF, while 21Shares has filed for a similar product. Despite increasing institutional interest, DOT has seen a 16.36% price drop in the past 24 hours, currently trading at $4.17.

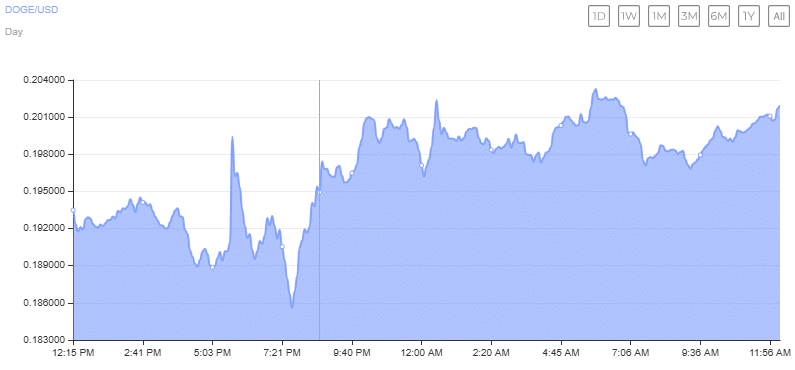

Dogecoin (DOGE), once a meme-driven asset, has matured into a serious financial instrument with a market capitalization of $28 billion. The SEC’s acceptance of Grayscale’s 19b-4 filing for a Dogecoin ETF underscores its growing mainstream appeal.

Expanding the Crypto Reserve

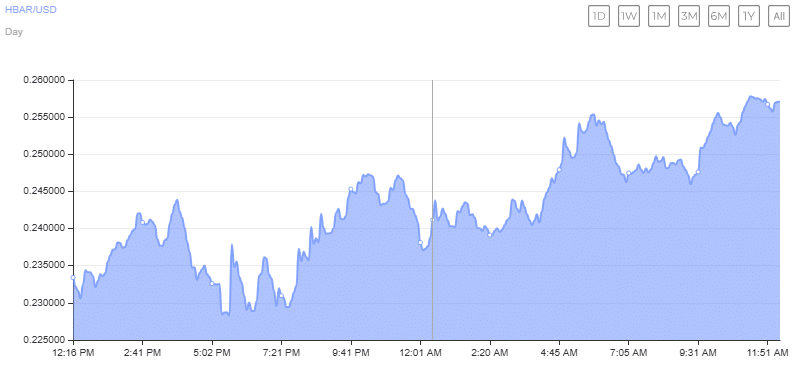

Additional altcoins gaining traction include Hedera (HBAR) and Chainlink (LINK). Grayscale has officially filed for a Hedera ETF, though market volatility has driven HBAR’s price down 9.52% in the last 24 hours. Meanwhile, Chainlink remains a strong candidate for future ETF filings, given its dominance in decentralized oracles.

Rounding out the discussion, Avalanche (AVAX) and Aptos (APT) are emerging as significant players. AVAX, ranked #16 by market cap at $8.14 billion, offers high-speed transactions and scalability, making it attractive for developers. Aptos, with a market cap of $3.13 billion, is carving out a niche as a next-generation blockchain solution.

Also Read: Michael Saylor’s Surprising Take on XRP: ‘Bullish’ Outlook as U.S. Crypto Reserve Adds Altcoins

With ETF approvals on the rise, assets like LTC, DOT, DOGE, and LINK could see substantial price surges, reinforcing crypto’s role in mainstream finance. As Trump’s Crypto Reserve concept gains momentum, the digital asset landscape in the U.S. could undergo a seismic transformation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.