|

Getting your Trinity Audio player ready...

|

The Reserve Bank of Australia (RBA) has announced a strategic shift in its digital currency plans, opting to focus on the development of a wholesale central bank digital currency (CBDC) rather than a retail CBDC.

In a speech delivered at the Intersekt Fintech Conference, RBA Assistant Governor Brad Jones outlined the central bank’s three-year roadmap, which prioritizes the development of a wholesale CBDC. Jones explained that while a retail CBDC offered limited benefits for the Australian public, a wholesale CBDC could provide significant advantages for commercial and central banks.

Key benefits of a wholesale CBDC include reducing counterparty and operational risks, increasing transparency and auditability, enhancing liquidity and transaction capabilities, and reducing intermediary and compliance costs.

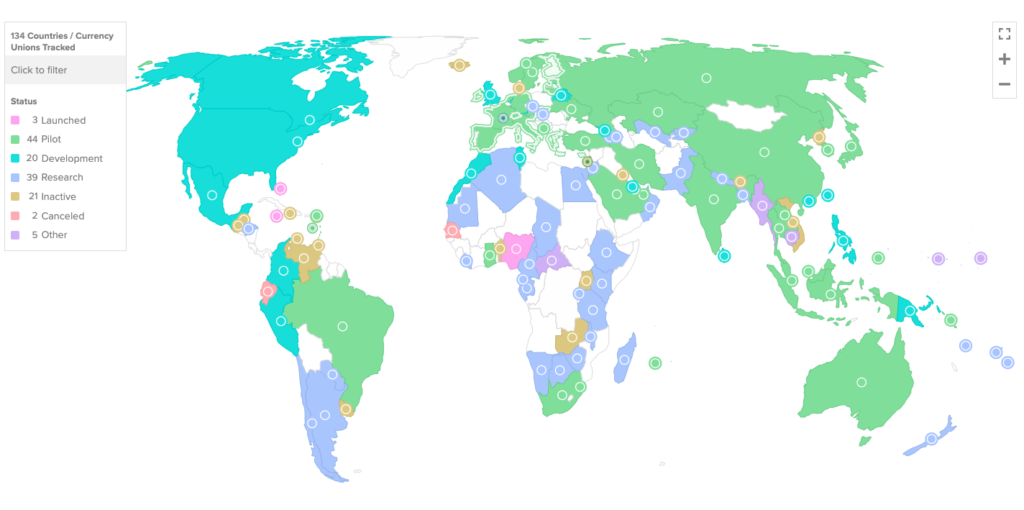

The RBA’s decision comes as a growing number of countries explore the potential of CBDCs. According to the Atlantic Council, 134 countries, representing 98% of global GDP, are investigating central bank digital currencies. Of these, 66 countries are in advanced stages of development, pilot, or launch.

The RBA’s focus on a wholesale CBDC aligns with the growing interest in this type of digital currency among central banks worldwide. Wholesale CBDCs are designed for use by commercial banks and other financial institutions, rather than individuals. They can be used to settle transactions between banks and other financial institutions, as well as to conduct monetary policy operations.

Despite its decision to prioritize a wholesale CBDC, the RBA has not ruled out the possibility of developing a retail CBDC in the future. However, Jones noted that the potential benefits of a retail CBDC for the Australian public appear to be “modest or uncertain” at present.

The RBA’s three-year roadmap includes plans to launch the public phase of Project Acacia, which will explore wholesale CBDC and tokenized commercial bank deposits. The project aims to build on the RBA’s previous research into CBDCs and explore potential cross-border applications with regional central banks.

In addition to Project Acacia, the RBA plans to establish industry and academic CBDC advisory forums, support reforms to regulatory sandboxes for financial innovation, and conduct public engagement on a retail 1 CBDC. The central bank is also undertaking further research into the potential benefits of asset tokenization and the role of blockchain and smart contract technology in its financial operations.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.