|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) is trading cautiously around the $60,000 mark as conflicting signals emerge from the market. While some analysts predict a further decline, a key on-chain metric suggests a potential local bottom has been reached.

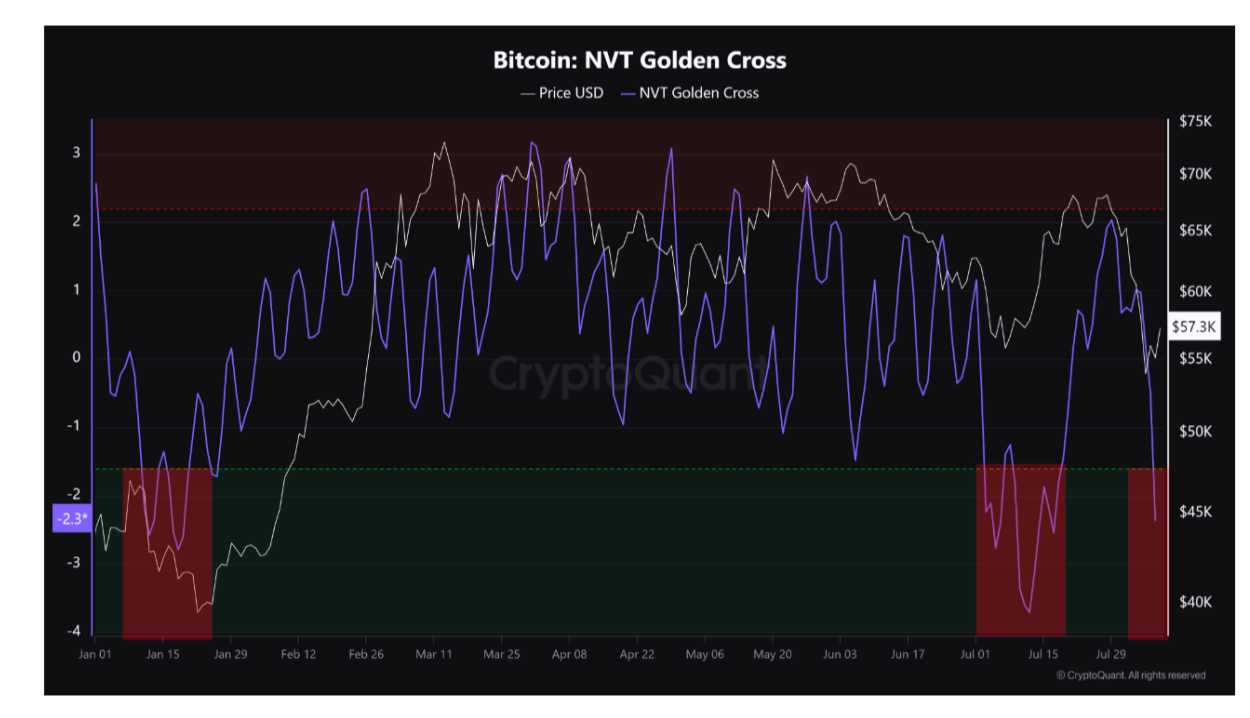

Fresh data from CryptoQuant indicates that the Network Value to Transaction Golden Cross (NVT-GC) tool has flashed a third “local bottom” signal in 2024. This metric, designed to gauge market overbought or oversold conditions, has historically preceded significant price rallies.

“If the NVT GC falls below -1.6 points (green zone), it indicates that the price is cooling down excessively and we are in a local bottom area,” CryptoQuant analyst Burakkesmeci explained.

Previous bottom signals in January and July were followed by 78% and 23% price increases, respectively. While the possibility of a deeper price correction remains, the current NVT-GC reading suggests a potential short-term bullish reversal.

However, the broader market sentiment remains cautious. Bitcoin has faced resistance around the $60,000 level, with some traders predicting a retest of lower support levels. The formation of a “death cross” in technical indicators has added to the bearish sentiment.

Also Read: $242B Bitcoin Buy – Hoskinson Flags Centralization Dangers for US Reserve Asset

As the market navigates this period of uncertainty, investors are closely monitoring both on-chain metrics and traditional technical analysis tools. The outcome of this battle between bulls and bears will likely determine Bitcoin’s short-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.