|

Getting your Trinity Audio player ready...

|

Investment management firm VanEck has made a bold prediction: Bitcoin could reach a staggering $2.9 million per coin by 2050. This bullish forecast is underpinned by the firm’s belief that the decentralized cryptocurrency will become a cornerstone of the global financial system.

According to VanEck’s report, Bitcoin’s ascent will be driven by a confluence of factors. Firstly, the cryptocurrency is poised to become a dominant force in international trade, potentially settling 10% of global transactions by 2050. Secondly, central banks are expected to embrace Bitcoin as a reserve asset, with a projected 2.5% of their holdings allocated to the digital currency.

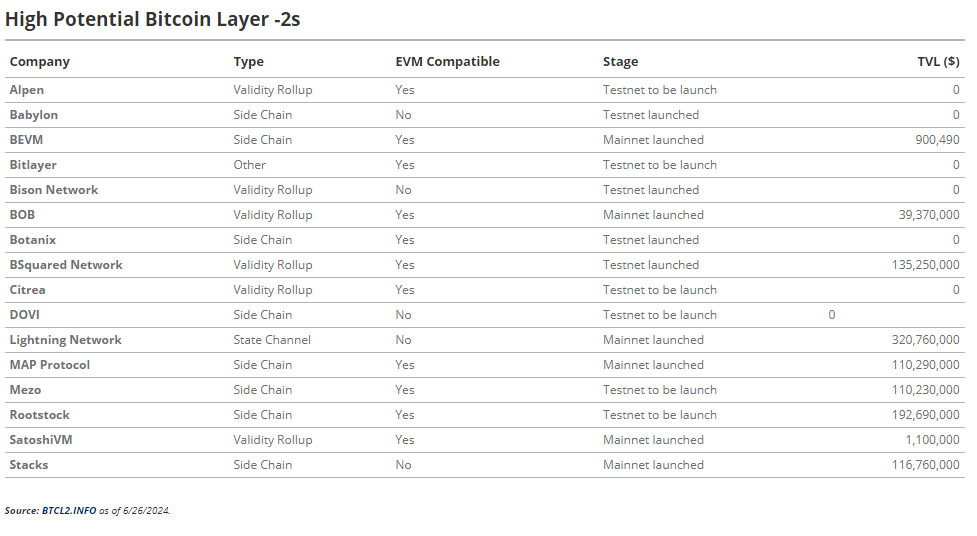

To accommodate the anticipated surge in Bitcoin usage, the report emphasizes the critical role of Bitcoin Layer-2 (L2) solutions. These scaling technologies are seen as essential to addressing the cryptocurrency’s current scalability limitations.

VanEck’s optimistic outlook is also tied to a forecast of economic decline in major economies like the US, EU, and Japan. The firm anticipates a loss of confidence in fiat currencies due to factors such as unconstrained deficit spending. This, coupled with the diminishing role of the euro and yen in international settlements, could accelerate the adoption of Bitcoin as a more stable and reliable store of value.

However, the report acknowledges potential hurdles to Bitcoin’s widespread adoption, including mining challenges, scalability issues, and regulatory uncertainties. While gold has historically served as a global reserve asset, VanEck believes its logistical and security limitations make it less suitable for the modern financial landscape.

The investment firm’s bullish stance on Bitcoin has sent ripples through the cryptocurrency market, with investors closely watching developments in the space. While the prediction of a $2.9 million Bitcoin price tag is undoubtedly ambitious, it highlights the growing recognition of the cryptocurrency’s potential to disrupt traditional finance.

As the world grapples with economic and geopolitical uncertainties, the appeal of a decentralized, immutable digital asset like Bitcoin is likely to continue to grow.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.