|

Getting your Trinity Audio player ready...

|

Ripple’s XRP token is experiencing a resurgence, emerging as one of the strongest performers in the cryptocurrency market over the past week. This positive price trend is bolstered by a wave of bullish sentiment sweeping through the market.

XRP on an Upward Trajectory

XRP has exhibited impressive upward momentum for most of July, according to an onchain analysists. Since around July 8th, the token has surged by a remarkable 38%. This bullish trend continued in the past four days, with XRP experiencing consecutive gains that pushed its price close to $0.60.

While a slight retracement has occurred recently, with XRP currently trading around $0.59, technical indicators continue to paint a bullish picture. The Relative Strength Index (RSI) sits at 65, indicating a generally bullish zone without reaching overbought territory. This suggests ample room for further price appreciation.

The Moving Average Convergence Divergence (MACD) reinforces this optimism. Its lines and histogram bars positioned above zero point towards sustained positive momentum for XRP.

XRP Outperforms Over Multiple Timeframes

Despite the recent pullback, XRP has managed to remain among the gainers in the last 24 hours according to CoinMarketCap data. The data shows a modest 1% price increase within this timeframe.

Zooming out to the seven-day chart reveals an even more compelling picture. XRP boasts a notable increase of over 12% for the week. This sustained gain underscores a strong recent period for XRP, even considering the current dip.

The fact that XRP remains significantly up over the week highlights the overall positive sentiment surrounding Ripple.

Also Read: Ripple Pumps Brakes on IPO: $1.4 Billion Buyback Signals Confidence Despite SEC Lawsuit

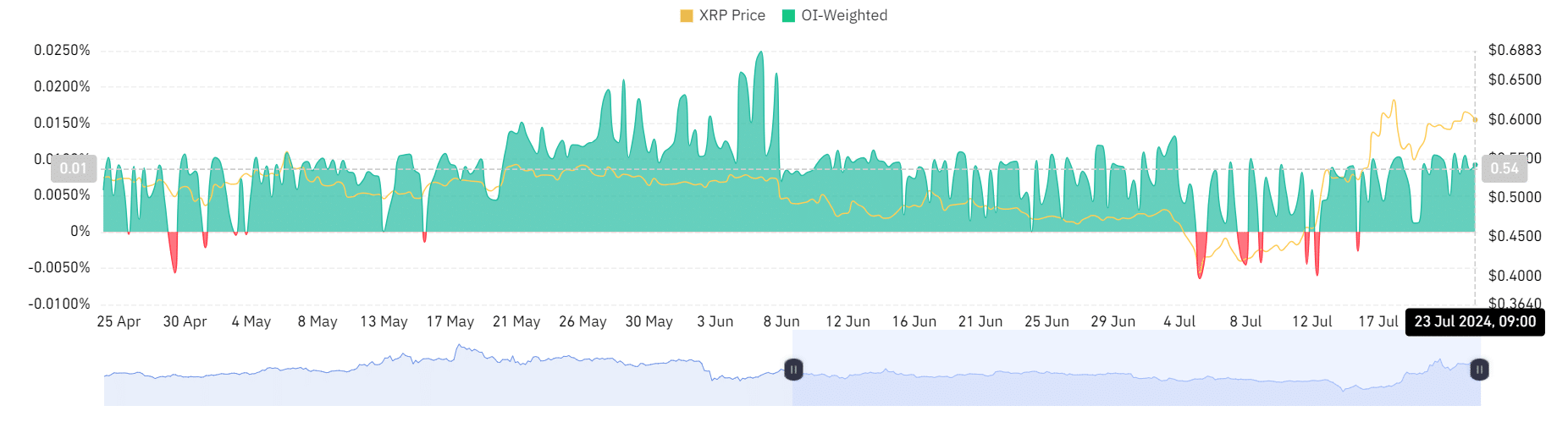

Futures Market Confirms Bullish Bias

An analysis of XRP’s funding rate on Coinglass adds further weight to the positive outlook. The current funding rate sits at approximately 0.09%, indicating a positive and rising trend.

A positive funding rate signifies that long positions (buyers) are compensating short positions (sellers). This typically reflects a market dominated by bullish sentiment.

Furthermore, open interest for XRP has jumped significantly, exceeding $800 million. This marks a substantial increase from $667 million just a week ago. A rise in open interest points towards new money flowing into the market and increased investor engagement with XRP futures contracts. This heightened level of activity suggests growing market interest in Ripple..

While a degree of caution is always warranted in the volatile cryptocurrency market, Ripple’s recent performance across various timeframes and positive technical indicators offer a promising outlook for XRP in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.