|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- XRP is testing a major breakout zone and could rally 75% to $3.81 if the symmetrical triangle pattern plays out.

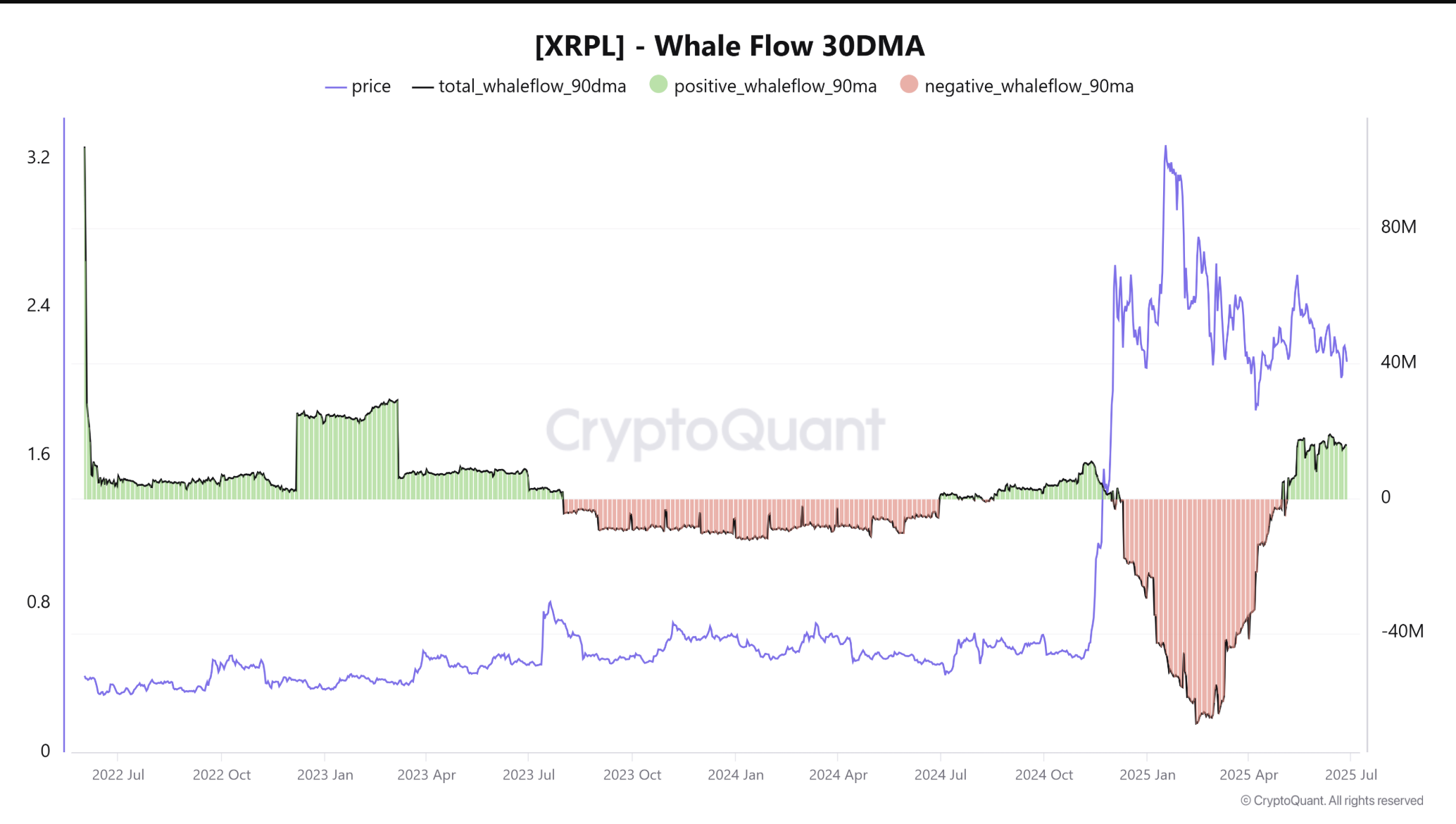

- Whale flows turned positive in May, signaling renewed accumulation and institutional interest.

XRP rose 6.5% in the past 24 hours to reach $2.20 on June 28, extending a bullish wave following Ripple Labs’ announcement to drop its cross-appeal in its long-running SEC case. The news capped a broader consolidation cycle after XRP’s explosive 575% rally since November.

The latest rally aligns with a strong technical pattern forming on XRP’s daily chart—a symmetrical triangle, which typically suggests a continuation of the prior bullish trend. XRP is currently testing the triangle’s upper boundary, with the 50-day exponential moving average (EMA) around $2.20 acting as additional resistance.

A confirmed breakout above this level could propel XRP toward a target of $3.81, representing a 75% gain from current levels. Analysts expect this move to unfold in the coming weeks if momentum sustains.

Whale Accumulation and Heatmap Zones Suggest More Upside

XRP’s technical setup is further supported by on-chain data showing that whale flows flipped positive in May for the first time in months, according to CryptoQuant. This marks the end of a long distribution phase, with inflows now exceeding levels seen in early 2024—just before XRP’s Q4 rally.

Large holders appear to be positioning for a sustained breakout, echoing similar accumulation patterns from past bull runs. If historical trends repeat, XRP could chart new highs by late 2025.

Meanwhile, Binance’s liquidation heatmap reveals the $2.34–$2.40 zone as a key short-term resistance level, with over $525 million in potential liquidations concentrated there. This cluster may act as a price magnet, and a move above $2.34 could spark a short squeeze, accelerating the breakout toward $2.40 and beyond.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!