|

Getting your Trinity Audio player ready...

|

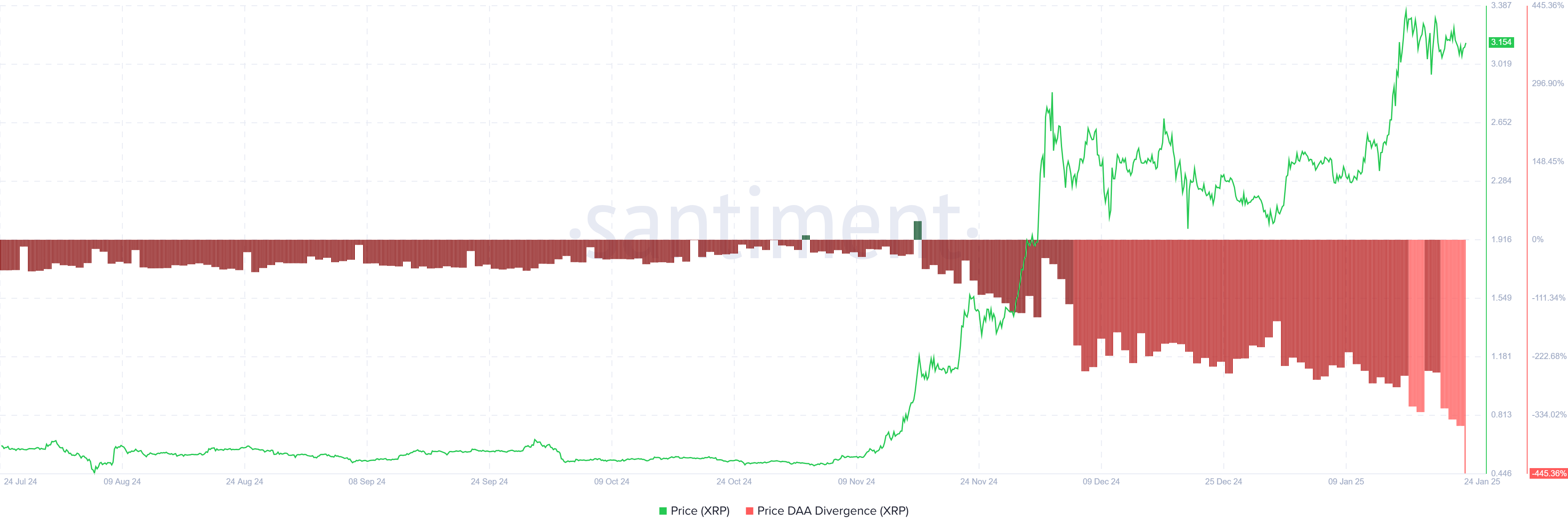

XRP’s price trajectory is under intense scrutiny as bearish signals dominate the market. Investor participation on the XRP network has dwindled, exacerbating the altcoin’s challenges. The Price Daily Active Addresses (DAA) Divergence indicator is flashing clear red bars, signaling strong sell pressure. This decline in network activity reflects waning confidence among participants, leading to reduced transaction volumes—a troubling trend for the altcoin’s performance.

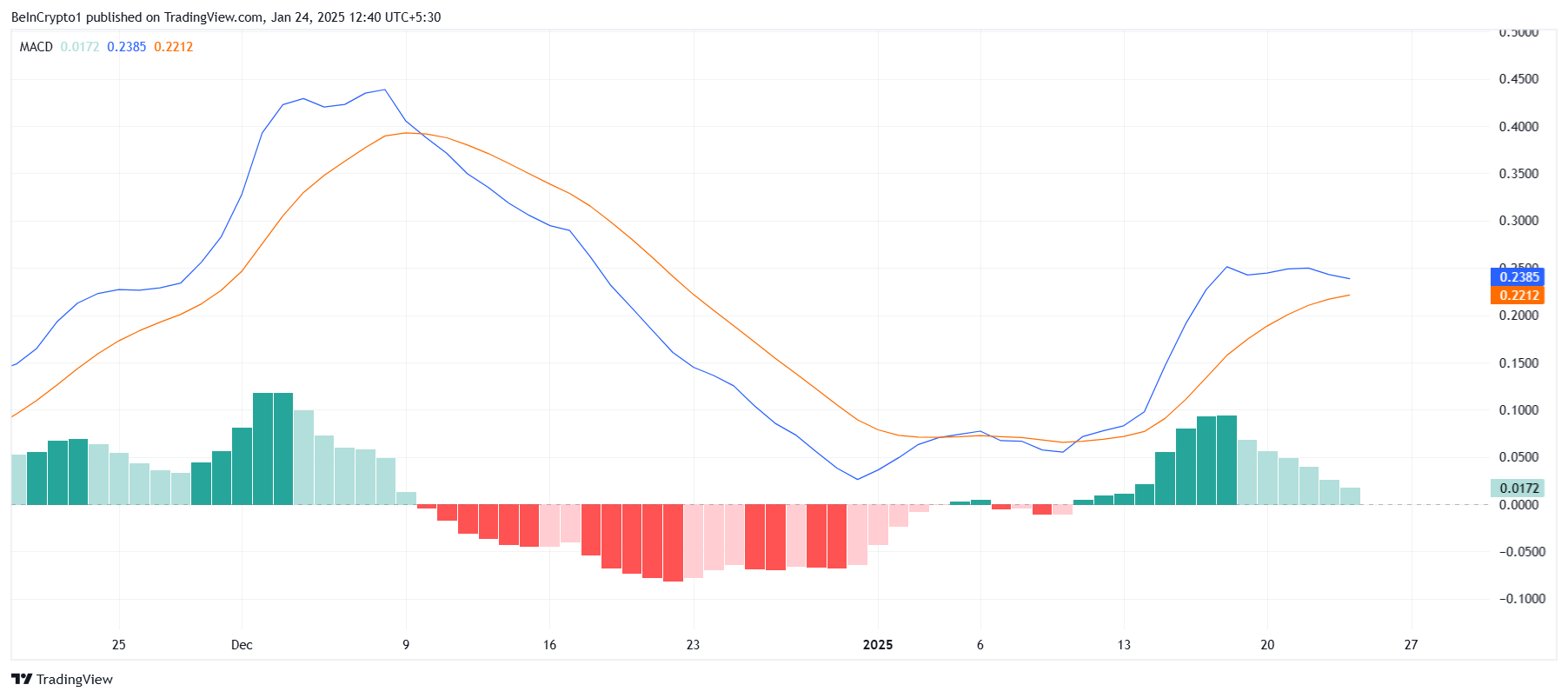

The lack of robust investor engagement is weakening support levels, leaving XRP vulnerable to sharp corrections. If transactional activity does not rebound, XRP’s price could face further downward pressure. The Moving Average Convergence Divergence (MACD) indicator adds to these concerns, hovering on the edge of a bearish crossover. With receding histogram bars nearing the zero line, bearish momentum appears to be overtaking buying pressure, echoing broader market uncertainties.

Currently trading at $3.15, XRP is struggling to sustain the rally that propelled it to its all-time high (ATH) of $3.40 earlier this month. If bearish sentiment persists, XRP could slide to a critical support level of $2.73, representing a 13% correction. Breaching this support could trigger further losses, with the next key level at $2.18—a move that would erase recent gains and deepen the bearish outlook.

However, a glimmer of hope remains. If XRP secures $2.73 as a strong support, it may regain its footing. A bounce from this level could enable the altcoin to challenge its $3.40 ATH once more. Breaking this barrier would invalidate the bearish scenario, potentially reigniting investor confidence and driving renewed momentum.

Also Read: Ripple (XRP) Soars: Bullish Patterns and U.S. Treasury Involvement Ignite Investor Optimism

The coming days will be pivotal for XRP, as network activity and technical indicators determine whether it can overcome mounting pressures or succumb to further declines. Investors will be closely monitoring these developments, making participation and sentiment critical factors in shaping XRP’s near-term future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.