|

Getting your Trinity Audio player ready...

|

XRP, the cryptocurrency associated with Ripple, is struggling to maintain its recent recovery. Despite bouncing back from a broader crypto market downturn, the digital asset is now facing increasing headwinds as investor sentiment turns sour.

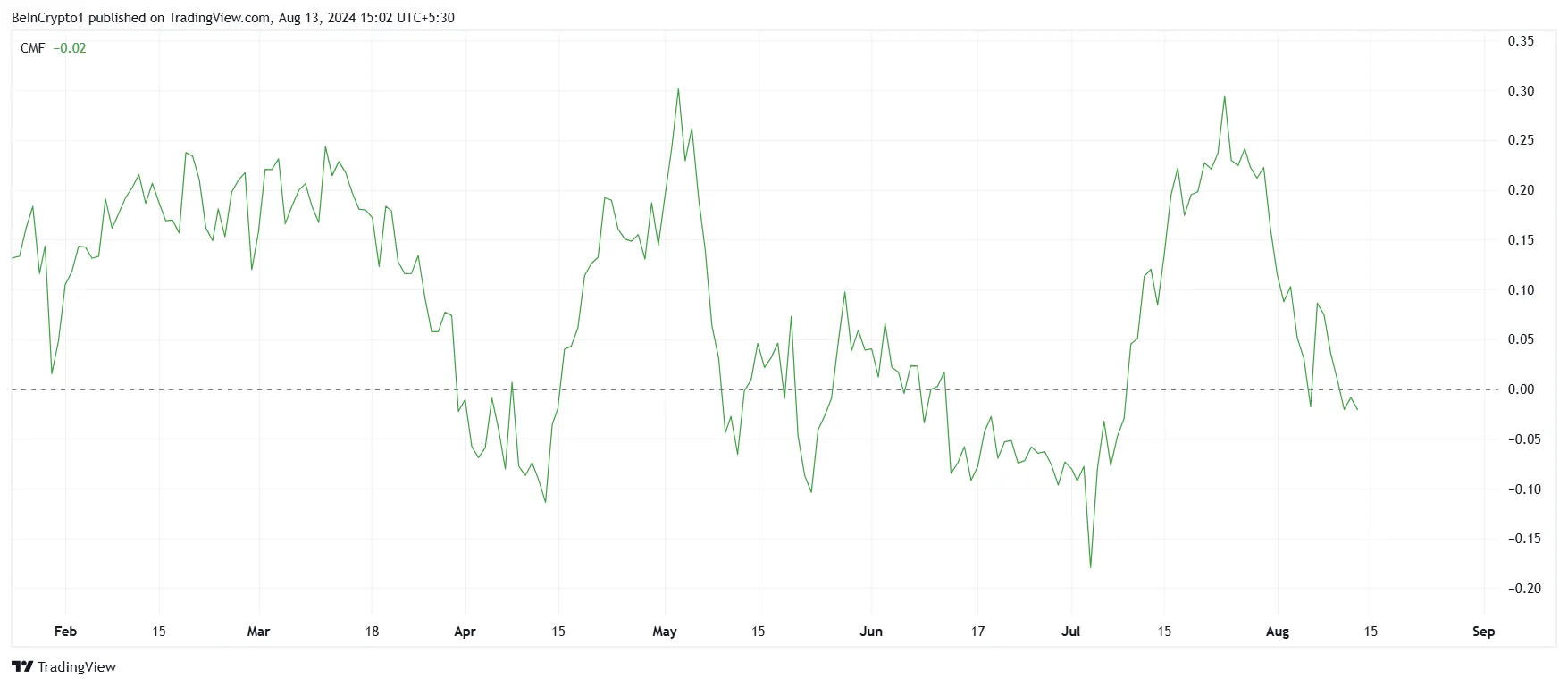

Technical indicators are painting a gloomy picture for XRP. The Chaikin Money Flow (CMF) metric, a measure of money flow into and out of a security, is signaling a significant outflow of funds. This suggests that investors are actively selling their XRP holdings, exerting downward pressure on the price.

Furthermore, a divergence between XRP’s price and its daily active addresses (DAA) is adding to the bearish outlook. This discrepancy indicates a decline in buying interest relative to selling pressure, a worrying sign for bulls. Historically, such divergences have often preceded price declines.

As a result of these factors, XRP’s price is under threat of falling below the critical support level of $0.52. This level corresponds to the 23.6% Fibonacci retracement of a recent price decline. However, a successful defense of the $0.58 level, which coincides with the 38.2% Fibonacci retracement, could signal a potential reversal and a retest of the resistance at $0.63.

It’s important to note that XRP has repeatedly failed to break through the $0.63 resistance, suggesting a lack of bullish conviction. If the bearish trend continues, the cryptocurrency could face a prolonged period of consolidation or further decline.

Also Read: XRP To $8 By 2024? Analyst Predicts Life-Changing Gains

Investors should closely monitor these technical indicators and market sentiment for clues about XRP’s future direction. While the cryptocurrency has shown resilience in the past, the current landscape is challenging for bulls.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!