|

Getting your Trinity Audio player ready...

|

XRP’s recent surge has sparked a wave of excitement among investors, with some analysts drawing parallels to the token’s historic rally in 2017. Could XRP be poised to repeat its past performance and reach new highs? Let’s delve into the data to explore the odds.

A Look Back: XRP’s 2017 Bullish Pattern

CoinMarketCap data confirms XRP’s strong showing last week, with a price increase exceeding 25%. Currently trading at $0.538 with a market cap surpassing $30 billion, XRP holds the 7th position among cryptocurrencies.

Crypto analyst Milkybull ignited the history-repeating spark with a tweet highlighting a significant development: XRP’s chart appears to be mirroring the pattern observed in 2017. Back then, a bullish pennant formation followed by a breakout led XRP to reach its all-time high (ATH) in the subsequent year. A similar pennant is taking shape in 2024, suggesting the possibility of XRP reaching new heights in the coming months.

Examining the Bullish Potential

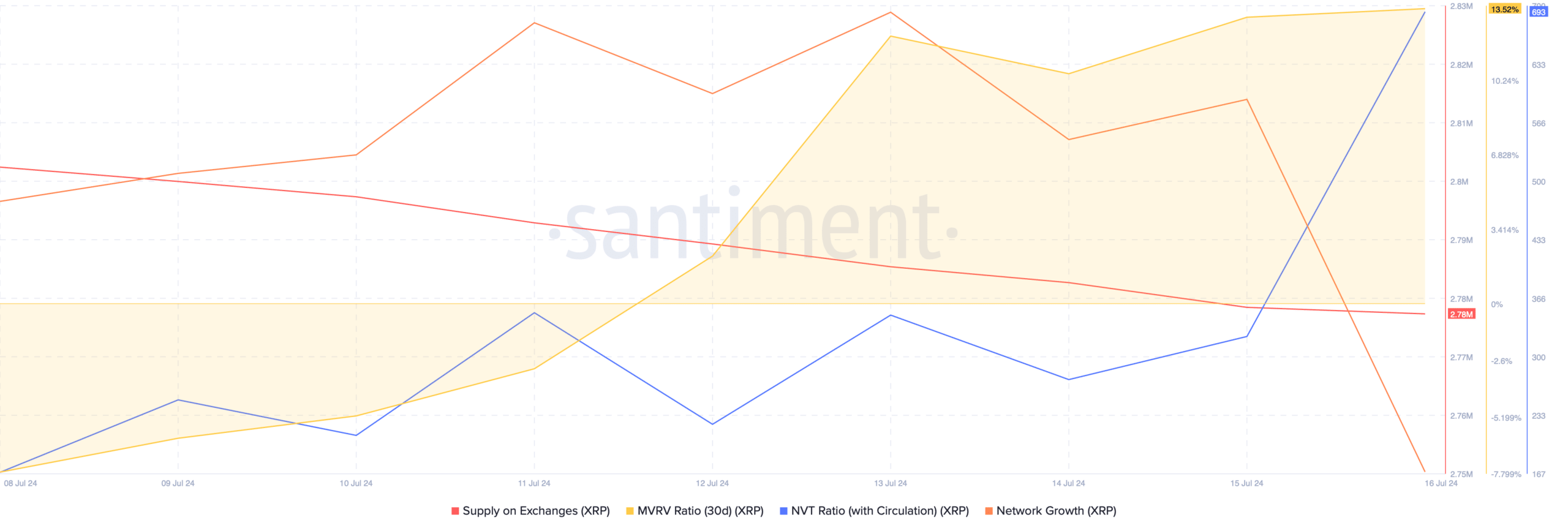

Given the potential for historical echoes, Analysts looked at Santiment’s data for supporting metrics. A sharp rise in XRP’s MVRV ratio signifies a bullish signal. Additionally, network activity remains strong, with an increase in new addresses interacting with the token. Furthermore, a decline in XRP supply on exchanges indicates growing buying pressure.

However, amidst the price rise, XRP’s NVT ratio also spiked, hinting at a potential overvaluation and possible short-term price correction. Technical indicators like XRP reaching the upper Bollinger Band and a sideways RSI suggest a period of consolidation or even a price dip. The bullish MACD reading remains a contrasting point, though.

Support and Resistance Levels

Hyblock Capital’s data sheds light on XRP’s immediate support and resistance levels. If the current bull run holds, XRP’s price could soon test $0.578. However, a trend reversal, as suggested by some indicators, might see XRP drop to $0.510.

Also Read: XRP Price Prediction: $57 Moon Shot Or Absurd Dream? Experts Weigh In

While XRP’s current trajectory echoes its 2017 performance, replicating that meteoric rise isn’t guaranteed. Several bullish signals are present, but technical indicators also hint at potential short-term volatility. Only time will tell if XRP can channel its past momentum and reach new highs in the coming months.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.