|

Getting your Trinity Audio player ready...

|

Worldcoin (WLD) is experiencing a significant downturn, trading at $1.85 at press time, reflecting a -10.96% decline over the past 24 hours, according to Coingecko. Despite this, the cryptocurrency’s 24-hour trading volume reached $434,172,556, signaling active participation even amid the ongoing bearish trend.

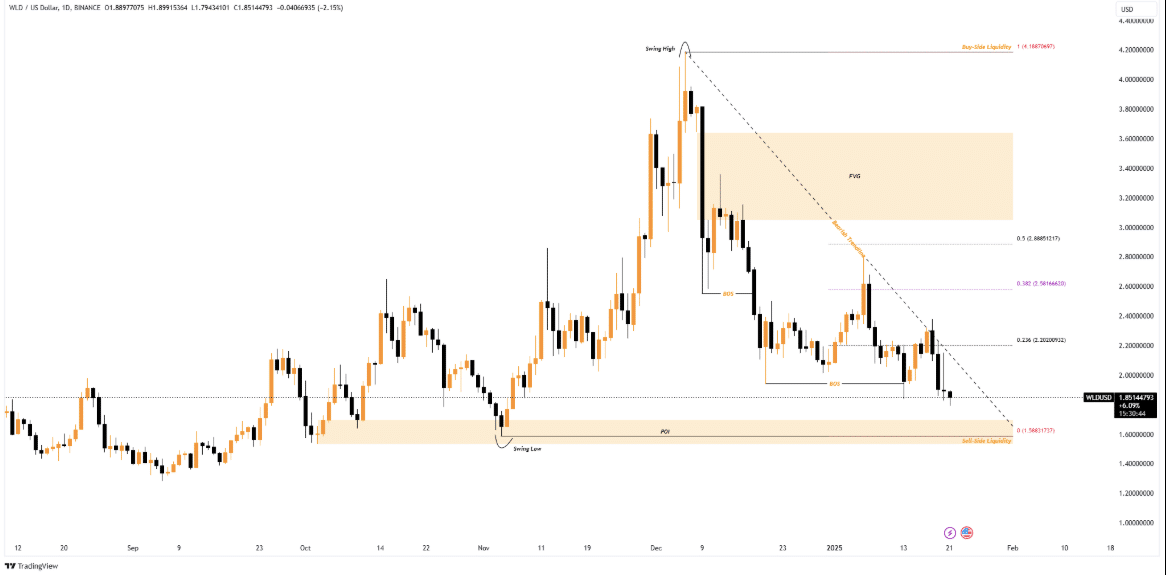

The price of Worldcoin has remained in a clear downtrend, marked by lower highs and lower lows, while staying below a descending trendline. The next crucial support level is at $1.54, where a concentration of sell-side liquidity exists, making it a key level to monitor. If this support breaks, further downside pressure could follow.

Technical indicators suggest several resistance levels that may pose obstacles for a potential recovery. Key Fibonacci retracement levels include $2.02 (0.236), $2.58 (0.382), and $2.88 (0.5), which traders should watch closely during any price rebounds. Meanwhile, the Fair Value Gap (FVG) between $3.00 and $3.50 seems distant, especially in the current bearish environment.

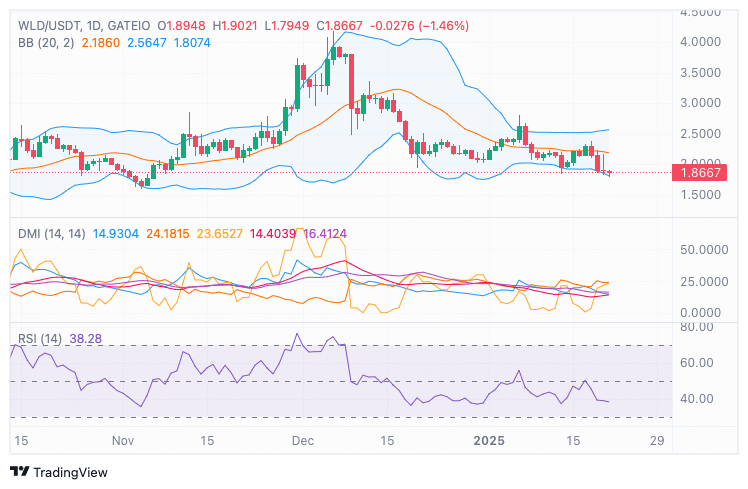

Bollinger Bands (20) indicate contracting volatility, with the price nearing the lower band at $1.8074, hinting at potential oversold conditions. The middle band at $2.1860 stands as a significant resistance point if the price attempts a recovery.

Market sentiment, as reflected in the Directional Movement Index (DMI), shows weakening bullish momentum. The +DI (14.93) is below the -DI (16.41), and the ADX value of 23.65 signals a mild bearish trend. Should the ADX rise above 25, it could suggest stronger selling pressure in the near term.

The Relative Strength Index (RSI) is currently at 38.28, indicating bearish sentiment. A further drop toward 30 could signal oversold conditions and present a potential rebound opportunity for buyers.

Also Read: Worldcoin [WLD] Faces Whale Sell-Off Amid Recovery – Key Levels to Watch for Price Surge

In terms of network activity, large transactions have fluctuated, with recent data revealing a renewed interest in WLD, evidenced by 79 transactions in the last 24 hours. Active addresses have maintained a steady trend, reflecting ongoing user engagement despite the price volatility.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.