|

Getting your Trinity Audio player ready...

|

- Metaplanet borrows $100M against a fraction of 30,823 BTC holdings.

- Loan allows BTC accumulation, options trading, and share buybacks.

- Strategy reflects growing corporate trend of using BTC as strategic reserve.

Metaplanet Inc., the Tokyo-listed company building one of the largest corporate Bitcoin treasuries, has secured a $100 million loan using a portion of its Bitcoin holdings as collateral. Drawing from a credit facility on October 31, the company pledged a fraction of its 30,823 BTC stash, valued at roughly $3.5 billion at the time.

Borrowing to Expand, Not Liquidate

Rather than sell Bitcoin to free up cash, Metaplanet opted to borrow against its holdings. The loan, featuring a floating interest rate linked to U.S. dollar benchmarks, allows the company flexibility to repay whenever it chooses. By leveraging collateralized debt, Metaplanet can continue buying Bitcoin, fund its options business, and even execute a ¥75 billion ($500 million) share repurchase plan aimed at boosting its market-to-net-asset ratio.

The move reflects a deliberate strategy to preserve its long-term BTC holdings while accessing capital for growth. The company reaffirmed its goal of reaching 210,000 BTC by 2027—a target that would make it one of the largest public Bitcoin treasuries globally.

Strategic Finance and Corporate Bitcoin Trends

Metaplanet’s approach highlights a growing trend among corporations using Bitcoin as a strategic reserve. By borrowing instead of selling, firms can expand their exposure without triggering taxable events or diluting their core holdings. The Tokyo-based firm’s method illustrates how modern treasury management combines financial engineering with digital assets to fuel growth while mitigating risks.

The $100 million loan supports both its accumulation strategy and its income-generating options business, which earns premiums on Bitcoin positions. This dual-purpose financing enables the company to grow sustainably without compromising its primary asset base.

Also Read: MetaPlanet Resumes Bitcoin Buying After $100M Boost

Managing Risk in a Volatile Market

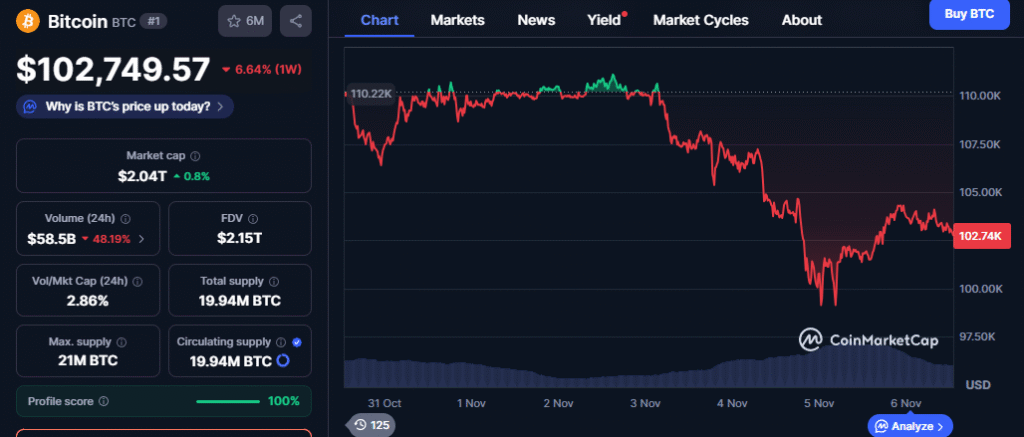

While borrowing against Bitcoin offers flexibility, it comes with inherent risks. Sudden price drops can tighten collateral margins and place pressure on reserves. Metaplanet maintains its leverage is conservative, but market volatility will ultimately test the resilience of this strategy.

Metaplanet’s $100 million Bitcoin-backed loan underscores a shift in corporate crypto strategies, where accumulation and financial engineering are prioritized over liquidation. By leveraging its holdings, the company balances growth, operational funding, and long-term exposure to Bitcoin, setting a blueprint for future corporate treasury management.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!