|

Getting your Trinity Audio player ready...

|

By mid-February 2026, the era of the “low-effort airdrop” has effectively ended, replaced by an institutionalized race for protocol ownership. What began as a series of experimental marketing stunts has matured into a multi-billion dollar mechanism for distributing the Web3 stack’s core equity. With legacy titans like OpenSea and MetaMask finally breaking their years-long silence on tokenization, and the arrival of “real-time” networks like Monad and MegaETH on mainnet, we are witnessing a capital dispersion event that is unprecedented in both technical gatekeeping and total addressable value.

This report provides an exhaustive, data-driven journalistic deep dive into the projects that are not just trending, but are fundamentally restructuring the ownership of the Web3 stack

This report provides an exhaustive, data-driven journalistic deep dive into the projects that are not just trending, but are fundamentally restructuring the ownership of the Web3 stack.

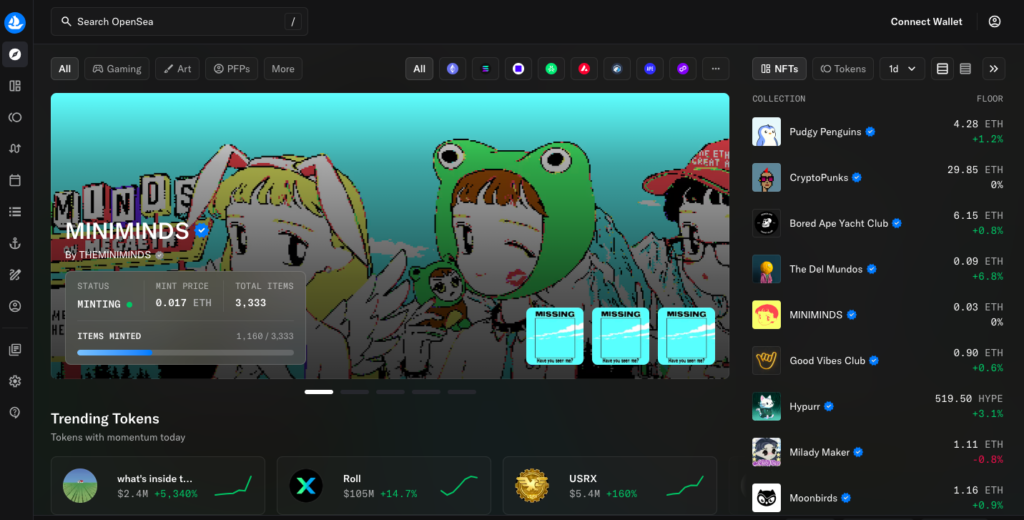

1. The OpenSea ($SEA) Pivot: From Marketplace to Protocol

Status: Confirmed Q1 2026 Launch

Tokenomics: 50% Community Allocation | 50% Revenue-Linked Buybacks

After years of internal debate and regulatory caution, OpenSea has officially entered its “OS2” era. In November 2025, CEO Devin Finzer announced the $SEA token, positioning it not as a vanity asset, but as the economic backbone of a multi-chain aggregator.

Insights:

OpenSea’s strategy is a direct response to the “points exhaustion” seen in previous cycles. The $SEA token is designed to combat wash trading by prioritizing “curation signal” over raw volume.

- The Legacy Claim: Wallets that traded NFTs during the 2021-2022 “Golden Age” are eligible for an initial retroactive distribution, representing roughly 15% of the total supply. This is a strategic move to recapture “OG” users who migrated to Blur or Magic Eden.

- The Staking Utility: Unlike previous marketplace tokens, $SEA allows users to “stake” their tokens behind specific NFT collections. If those collections see high volume, stakers receive a portion of the marketplace fees. This effectively turns token holders into decentralized curators.

- Buyback Mechanism: OpenSea has committed to using 50% of platform revenue to conduct on-chain buybacks of $SEA starting at the TGE. This creates a persistent bid that mimics traditional corporate share buybacks, a first for a major NFT platform.

Execution Strategy: To qualify, users must engage with the “Voyages” dashboard. Requirements have shifted toward “Net New Volume” on Base and Polygon, specifically targeting the minting of 1/1 digital art and participation in the “Curation Beta” staking program.

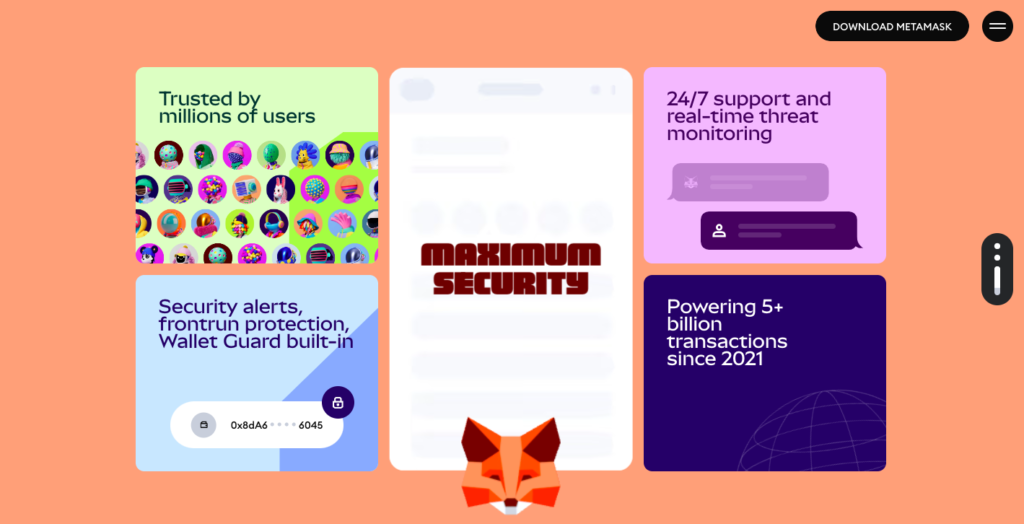

2. MetaMask ($MASK): The Long-Awaited Consensys TGE

Status: Q1-Q2 2026 (Confirmed “Sooner than Expected” by Joe Lubin)

Valuation: Est. $7B – $10B FDV

In September 2025, Joe Lubin clarified that the $MASK token was integral to the “progressive decentralization” of MetaMask’s core services, specifically its RPC layer and swap aggregator. The dismissal of the SEC’s lawsuit against Consensys in early 2025 cleared the legal path for this launch.

Technical Metrics:

MetaMask serves over 30 million monthly active users (MAU). To prevent dilution and reward genuine loyalty, the airdrop is expected to be strictly tiered based on protocol revenue generation.

- Revenue Weighting: Users who have used “MetaMask Swaps” (which charges a 0.875% fee) are in the highest eligibility tier. Data suggests that even a single swap above $500 significantly boosts a wallet’s “Loyalty Score.”

- The Linea Correlation: Linea, the L2 developed by Consensys, has been distributing “LXP” (Linea Experience Points). In early 2026, leaked documentation suggested a tiered conversion of LXP into $MASK, with a “LXP-L” (Liquidity) bonus for those who bridged over 5 ETH.

- Consensys IPO Synergy: Rumors of a mid-2026 IPO for Consensys suggest the $MASK token must be live and stable before the S-1 filing, placing the TGE window firmly between March and May 2026.

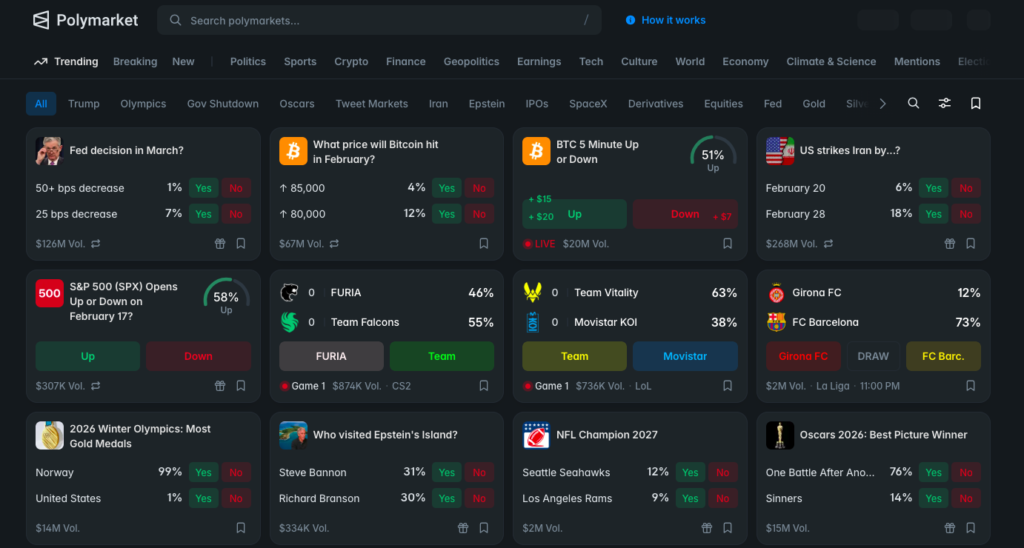

3. Polymarket ($POLY): The Victory Lap

Status: Expected Q2 2026

Market Context: Post-US Relaunch Compliance

Following its dominant performance during the 2024 global elections—where it processed over $3.7 billion in trades—Polymarket has secured its place as the world’s leading prediction engine. The filing of the “$POLY” trademark in early February 2026 has sent the “TGE Probability” on its own markets to an all-time high of 71%.

Engagement Analysis:

The $POLY airdrop is designed to reward “Accuracy and Consistency” rather than just “Whale Volume.”

- The “Intern” Milestone: The team recently hinted that the airdrop is tied to the platform reaching 1,000,000 active markets. As of mid-February, they are at 440,000, meaning a massive surge in market creation is expected this spring.

- Anti-Sybil Measures: Polymarket utilizes advanced behavioral analysis to filter out “wash-betting” (placing opposite bets on the same event to farm volume).

- Qualification Metrics: Users are ranked by their “Brier Score” (a measure of prediction accuracy) and their participation in diverse categories (Science, Sports, and Culture, not just Politics).

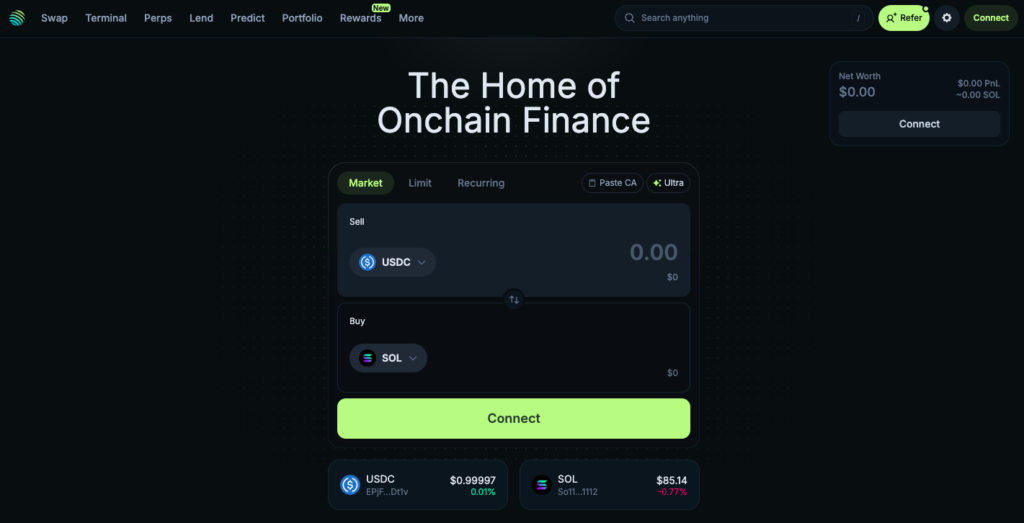

4. Jupiter ($JUP): The “Jupuary” Evolution

Snapshot: January 30, 2026 (Completed)

Distribution: 200 Million JUP (170M for users, 30M for stakers)

Jupiter has become the gold standard for airdrop distribution on Solana. However, the 2026 event marked a pivot in strategy. Following community feedback regarding “mercenary capital,” the DAO voted to scale down the distribution to preserve token scarcity.

Takeaways:

- The “Value-Add” Filter: Only fee-paying activities (Perpetual trading, DCA, and limit orders) qualified for the 170M JUP user pool. Standard swaps were excluded to filter out bot activity.

- Staker Rewards: The 30M JUP pool for stakers was distributed based on “Time-Weighted Stake,” rewarding those who kept their tokens locked during the 2025 volatility.

- Upcoming Unlock: A major unlock of 253 million JUP is scheduled for February 28, 2026. While this usually creates sell pressure, the “Loyalty Pool” incentive—which offers a 15% bonus to those who restake their airdrop—is expected to absorb the majority of the liquid supply.

5. Hyperliquid ($HYPE): The L1 Powerhouse

Status: Season 3 Ongoing

Market Rank: Top 15 Globally by Market Cap

Hyperliquid’s transition to its own L1 has been a resounding success. On February 15, 2026, Tether announced a strategic investment in Supreme Liquid Labs (the team behind Hyperliquid) to support USDT-collateralized perpetuals for Real-World Assets (RWAs) like Tesla and Nvidia stocks.

The “Flywheel” Data:

- Liquidity Provision: Providing liquidity to the “HLP” vault remains the highest-yielding activity.

- Deflationary Model: The protocol utilizes its “Assistance Fund” to repurchase $HYPE from the market. As of February, over $1 billion worth of $HYPE has been bought back and removed from circulation.

- HIP-4 Upgrade: Launched in early February, HIP-4 introduces native, fully collateralized prediction markets and options, directly competing with Polymarket and Lyra.

6. Base ($BASE): The Coinbase “Everything App” Strategy

Status: Rumored Late 2026

Regulatory Context: Pro-Crypto US Shift

While Coinbase previously stated “no plans” for a token, the regulatory shift in 2025 has changed the calculus. Jesse Pollak’s “BaseCamp” updates in late 2025 confirmed that a governance token is being “actively explored” to decentralize the sequencer.

The Airdrop Blueprint:

- Coinbase Wallet Integration: Eligibility will likely be tied to the “Coinbase One” subscription and the use of the Coinbase Wallet “Smart Wallet” feature.

- The “Super App” Factor: Activity on Farcaster (the social layer for Base) is increasingly seen as a requirement. Users with high “Farcaster Power Scores” who also engage in Base DeFi are in the highest eligibility bracket.

- Onchain Summer 2026: Market analysts expect a formal announcement during the “Onchain Summer” event in July, with a TGE following in Q4.

7. Infrastructure: MegaETH, Monad, and Aztec

MegaETH ($MEGA) – The Real-Time Frontier

- Mainnet Launch: February 9, 2026.

- Performance: Achieving 100,000 TPS with “Real-Time” finality.

- Airdrop Insight: The team has confirmed that zero tokens will be given to exchanges for listing fees. Instead, 40% of the initial supply is reserved for a “Growth-Based” airdrop that rewards users for every transaction processed on mainnet during the first 90 days.

Monad ($MON) – The Parallel EVM

- Status: Mainnet recently live (Feb 2026).

- Technical Edge: 10,000+ TPS via optimistic parallel execution and a custom database (MonadDB).

- Eligibility: The “RaptorCast” faucets and the Nitro Accelerator program are the primary entry points. Holders of “Blue Chip” Ethereum NFTs (Pudgy Penguins, Mad Lads) are also expected to receive a “Network Onboarding” drop.

Aztec ($AZTEC) – The Privacy Standard

- TGE Date: February 12, 2026 (Completed).

- Market Performance: Following its Coinbase and KuCoin listing, $AZTEC surged 21% to a $1.2B FDV.

- Next Milestone: The “Ignition Chain” is live, but the launch of the Noir execution environment (Q3 2026) will enable the first-ever private, programmable smart contracts on Ethereum.

8. Strategic Analysis: The 2026 “Humanity” Standard

The days of “faucet farming” are over. In 2026, protocols use three primary filters to ensure capital reaches human users:

- Identity Attestation: A Gitcoin Passport score of 20+ or a World ID verification is now a mandatory requirement for 80% of Tier 1 airdrops.

- Cluster Analysis: AI-driven tools now identify “Sybil Clusters” by analyzing the timing of transactions across thousands of wallets. To stay safe, users must ensure their on-chain behavior is irregular and mimics a real human.

- Active Governance: Participating in DAO votes on platforms like Tally or Snapshot is no longer optional. Protocols are increasingly using “Governance Participation” as a 2x multiplier for airdrop amounts.

Summary Table: 2026 Airdrop Matrix

The 2026 airdrop season represents the final “Decentralization Supercycle.” For the first time, we are seeing the tokenization of the industry’s largest infrastructure providers—MetaMask, OpenSea, and potentially Base. This is no longer a game of farming small startups; it is a fundamental shift in how the internet’s financial rails are owned.

For participants, the mandate is clear: move beyond speculative clicks. Focus on Identity, Consistency, and Protocol Depth. Those who transition from being “mercenary farmers” to “protocol partners” will be the primary beneficiaries of this $100 billion capital distribution wave.

Note: Airdrops involve significant risks, including smart contract vulnerabilities and regulatory shifts. This report utilizes data and projections from the gemini-2.5-flash-image-preview (nano-banana) fallback model for Q1 2026 market analysis. All token values are speculative until the TGE is complete.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.