|

Getting your Trinity Audio player ready...

|

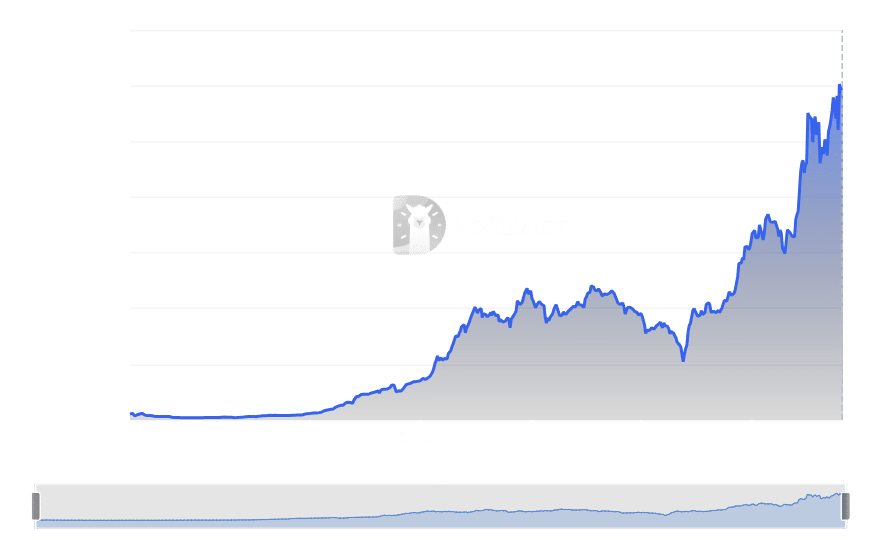

The Sui Network [SUI] has recently made significant strides in its decentralized finance (DeFi) ecosystem, as evidenced by a substantial surge in its total value locked (TVL). This growth underscores the increasing adoption and investment in SUI’s burgeoning DeFi landscape, with lending platforms like Suilend and NAVI Lending emerging as key drivers.

TVL Skyrockets, Led by Lending Platforms

A closer look at the TVL chart reveals a remarkable upward trajectory for SUI over the past year. As of press time, the TVL stands at a robust $1.79 billion, having reached an all-time high of $1.8 billion on December 12th. This surge is primarily attributed to the popularity of lending platforms Suilend and NAVI Lending, which collectively account for a significant 58% of the network’s total locked assets. Suilend currently boasts a TVL of $552.5 million, while NAVI Lending holds $491.23 million.

Volume Spike Confirms Increased Activity

The correlation between SUI’s TVL and trading volume is evident. As of this writing, the network’s daily volume is approximately $168 million. However, it’s worth noting that the volume reached a peak of over $551 million on December 12th, coinciding with the TVL’s all-time high. This surge in trading activity reinforces the growing interest and participation within the SUI ecosystem.

Bullish Momentum Faces Potential Consolidation

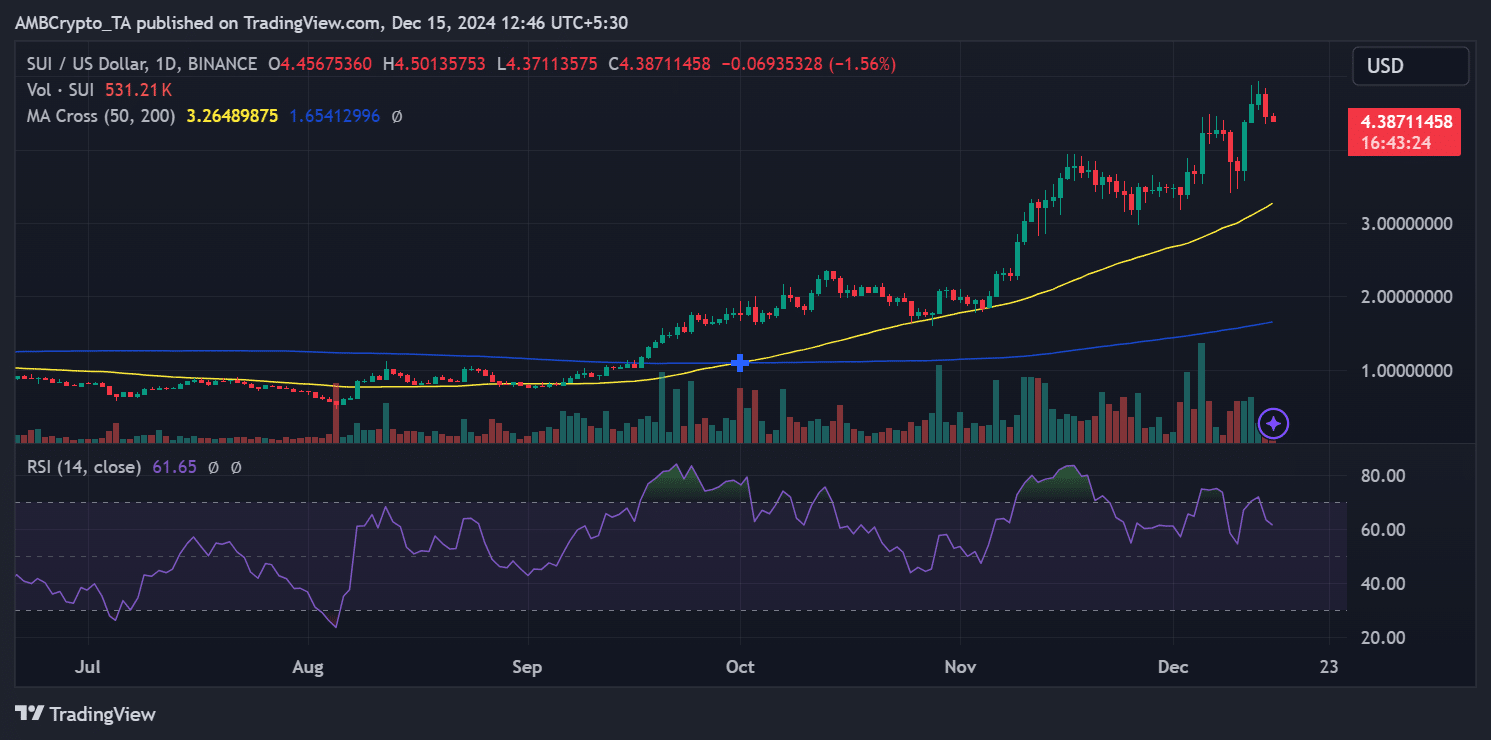

SUI’s price trajectory has closely mirrored the growth of its DeFi ecosystem, experiencing a notable rally in recent months. Currently trading at $4.38, SUI remains above its crucial 50-day moving average, indicating sustained bullish sentiment. The Relative Strength Index (RSI) at 61.65 suggests that the asset is approaching overbought territory but still has room for further upside.

While the steady increase in trading volume supports the upward price trend, the recent pullback from the $4.50 range hints at potential consolidation. If SUI manages to hold above the $4.20 support level, it could pave the way for another rally, with the next psychological resistance level at $5.

Also Read: XRP Lawsuit Insights: Elon Musk vs. SEC Sparks Industry Backlash as Ripple Leaders Weigh In

The $1.7 billion TVL milestone, primarily driven by the success of Suilend and NAVI Lending, underscores SUI’s growing potential as a significant player in the DeFi space. Coupled with its steady price performance and the rapidly evolving DeFi landscape, SUI appears well-positioned for continued growth and innovation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.