|

Getting your Trinity Audio player ready...

|

Solana (SOL) experienced a brief surge to $130 in early trading, sparking speculation of a potential return to $200. However, the altcoin has since retreated to $129.02, raising doubts about the sustainability of the rally.

While some traders remain optimistic, this analysis suggests that several factors may hinder Solana’s ability to reach $200 in the near term.

Low Inflow and Negative Sentiment

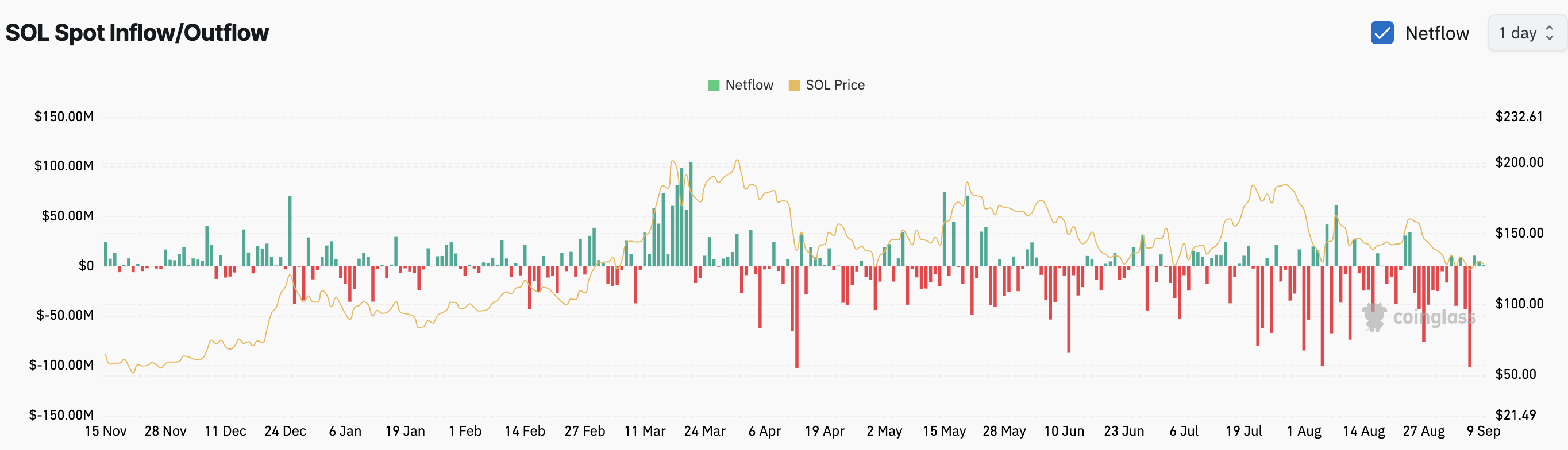

An assessment of Solana’s market conditions reveals a significant outflow of $100 million on September 6, indicating distribution before the price drop to $125. Although the inflow has since increased to $1 million, it remains far below the levels seen during previous rallies.

Comparing the current inflow to the conditions that led to Solana surpassing $200 in March, it becomes evident that a much larger influx of capital is required. The lackluster inflow into the spot market significantly diminishes Solana’s chances of approaching the $200 zone.

Furthermore, market sentiment surrounding Solana has turned negative. According to Santiment, Solana’s Weighted Sentiment is currently in the negative, suggesting an increase in pessimistic commentary. This negative sentiment could weaken demand for SOL, potentially leading to a price decline.

Technical Analysis Indicates Bearish Outlook

From a technical perspective, Solana is trading within a descending triangle, a bearish pattern. The upper trendline has been falling, with multiple fakeouts starting at $138.20. While there is support around $126.88, breaking through the $130 resistance seems unlikely given the low liquidity inflow.

Also Read: Solana (SOL) Set For 25% Surge – Bullish Divergence & On-Chain Metrics Point To Breakout

If Solana fails to break through the $130 resistance, the price could drop to $125.15, with additional resistance at $135.35. For SOL to invalidate this bearish outlook, significant capital inflow is needed. Only then can Solana break out of the descending triangle and reverse the ongoing downtrend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.