|

Getting your Trinity Audio player ready...

|

- Solana (SOL) Breaks $200 Resistance, But Signs of a Potential Reversal Loom

Solana (SOL) has recently made headlines by surpassing its eight-month-old resistance level of $201, marking a significant price breakout. Known as an “Ethereum killer” for its high-speed, scalable blockchain, Solana’s growth trajectory has been nothing short of impressive. The altcoin now stands as the fourth cryptocurrency to reach a market cap of $100 billion, joining the ranks of Bitcoin, Ethereum, and Binance Coin. However, despite this achievement, several indicators suggest that the current rally may face challenges in sustaining these gains, raising questions about the near-term future of SOL.

Declining Active Addresses: A Warning Sign?

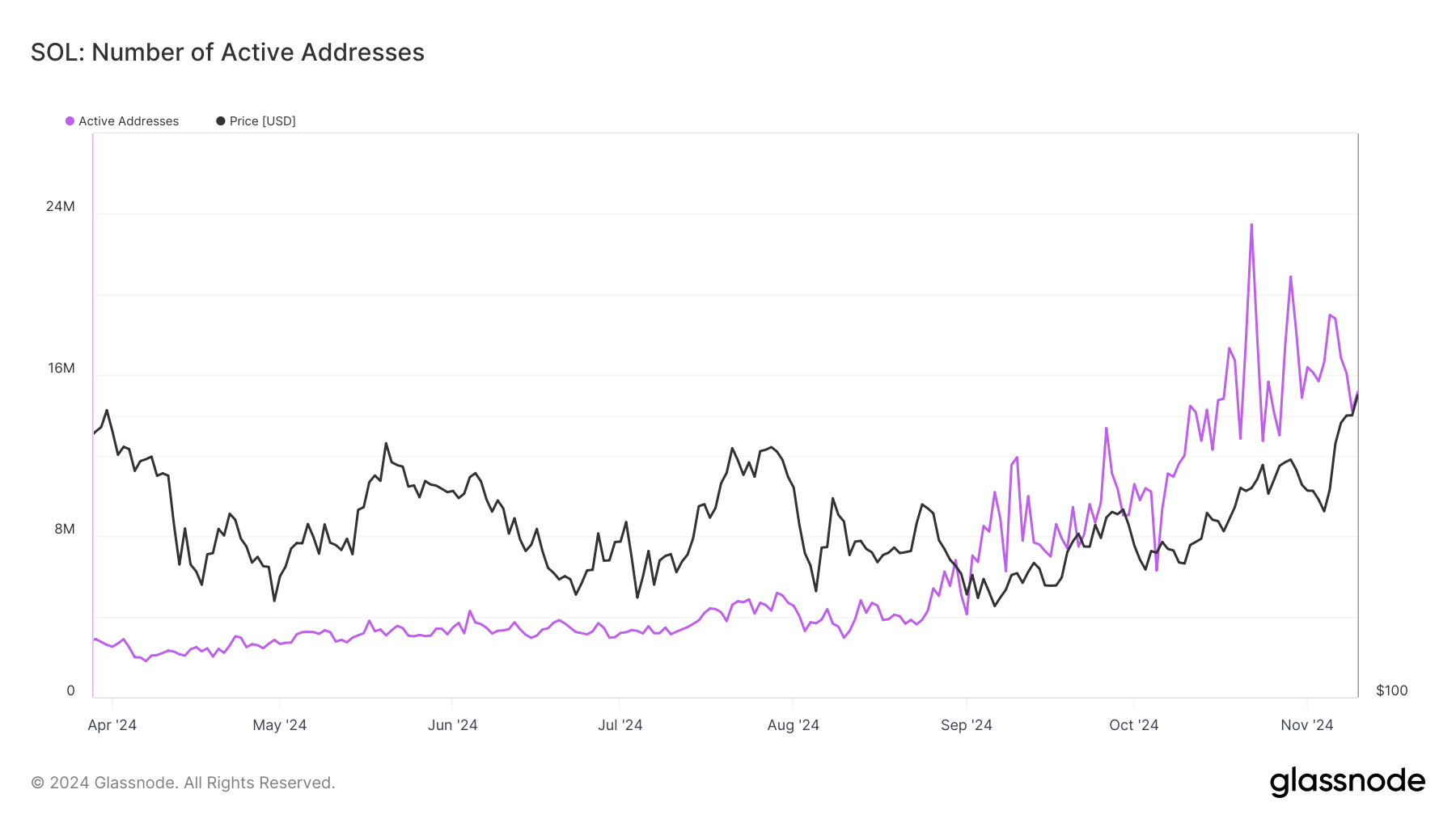

While Solana’s price has surged to new heights, a concerning trend is emerging: a decline in the number of active addresses on the network. The Daily Active Addresses (DAA) divergence is a key indicator of investor activity, and when it shows a drop despite rising prices, it often signals a potential pullback. Essentially, fewer users engaging with the network, while the price continues to rise, suggests that demand may not be as robust as the price action implies.

This divergence between Solana’s price and active addresses could act as a precursor to selling pressure. Investors may begin to lose confidence, leading to a wave of profit-taking and potentially cooling Solana’s current rally. If this trend continues, it could weigh heavily on SOL’s price, causing a correction in the near term.

Solana’s Overbought Condition – Is a Short-Term Reversal Imminent?

Further complicating Solana’s outlook is the current reading of the Relative Strength Index (RSI), a popular technical indicator used to gauge the overbought or oversold conditions of an asset. As of now, Solana is firmly in the overbought zone, with its RSI reflecting heightened investor enthusiasm. Historically, when an asset remains in the overbought region for too long, it is often followed by short-term corrections as prices become too inflated.

The overbought status of Solana suggests that its current rally may be running out of steam. If the RSI continues to stay elevated, it could prompt a price reversal as investors may look to cash in on their gains. In such cases, short-term pullbacks are common, and traders will need to be vigilant for signs of market sentiment cooling.

Solana Price Prediction Testing Key Support Levels

Solana’s recent rally propelled it to a three-year high of $215, with SOL currently trading around $205. However, with decreasing active addresses and an overbought RSI, the price is approaching a critical support level at $201. If SOL fails to hold this level, it may be vulnerable to further declines. A drop below $201 could lead Solana toward a stronger support floor at $186, a price level that has historically acted as a key line of defense.

The $186 support is critical for the health of the uptrend. A break below this level would likely signal a deeper correction, potentially taking SOL lower. Conversely, if Solana can maintain its position above $201 and successfully rebound, the next resistance target would be $221. A sustained break above $221 would likely push Solana’s market cap back above $100 billion, reinstating bullish momentum and counteracting the current bearish sentiment.

Solana’s recent surge to a $100 billion market cap and its breakout above $201 are notable milestones for the altcoin. However, the decline in active addresses and the overbought RSI signal that caution is warranted in the near term. While Solana’s bullish momentum remains strong, market participants should watch for signs of a reversal. If SOL can hold its critical support levels and maintain investor interest, the rally could continue. However, if selling pressure intensifies, a correction could be on the horizon, testing the resilience of Solana’s impressive rise.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.