|

Getting your Trinity Audio player ready...

|

Solana (SOL) has entered a critical phase as on-chain data and technical indicators suggest a potential price recovery. Despite its recent downturn, key metrics indicate that selling pressure may be fading, setting the stage for a possible rebound.

SOL Enters Oversold Territory

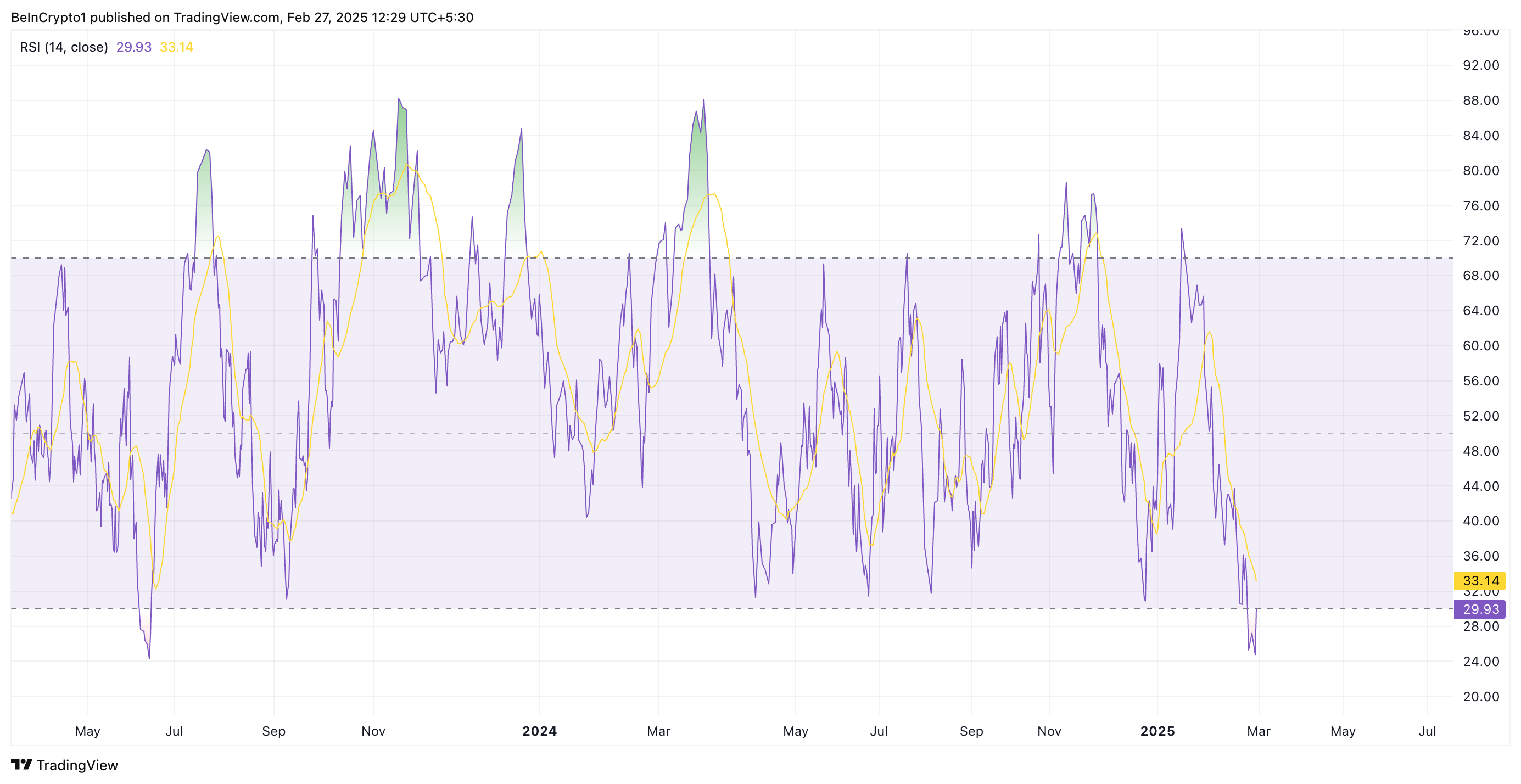

An analysis of the SOL/USD one-day chart reveals that the coin’s Relative Strength Index (RSI) has dropped below 30 for the first time since June 2023. This level signifies that SOL is now in oversold territory, a condition that often precedes a price reversal as traders look for buying opportunities at discounted levels.

Historically, when an asset’s RSI falls below 30, it signals exhaustion in selling momentum. If past trends hold, SOL may experience a rally as market participants start accumulating the token in anticipation of an upward move.

Market Sentiment and Capitulation Signals

Crypto analyst Miles Deutscher recently highlighted that Solana is undergoing its worst bearish sentiment in over a year. According to Deutscher, SOL is experiencing a “capitulation moment,” where weak-handed investors exit the market after extended losses. This phase often marks a market bottom, as selling pressure decreases and paves the way for a price rebound.

Capitulation events typically lead to a shift in market dynamics. Once short-term holders exit, long-term investors step in, potentially stabilizing the price and fueling an upward trajectory.

Key Support Levels and Potential Upside

At press time, SOL is trading at $141.67, holding slightly above its critical support level of $136.62. If buyers re-enter the market, this level could serve as a strong foundation for a move toward $182.31, a key resistance zone. A successful break above this level may propel SOL above $200, with a possible target of $222.14.

Conversely, if bearish pressure persists, SOL could dip to $120.72. However, with key technical indicators hinting at a potential recovery, the coming days could be crucial for SOL’s price action.

Also Read: Solana (SOL) Price Drops 50%: 3 Key Reasons Behind the Crash – Will It Recover?

With RSI levels signaling an oversold condition and market sentiment at extreme lows, Solana may be nearing a reversal. If bullish momentum returns, SOL could be poised for a significant recovery, potentially challenging the $200 mark once again. Traders should watch key support and resistance levels closely as Solana navigates this critical phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.