|

Getting your Trinity Audio player ready...

|

Solana (SOL) is currently facing a challenging downtrend, and the outlook remains bearish in the short term. If the current selling pressure continues, SOL risks testing key support levels at $159 and $147. A deeper correction could even push the price down to $133, marking a significant 22.6% drop from its current levels. While this downturn is concerning, a recovery is not entirely out of the question.

Bearish Momentum: Ichimoku Cloud Signals Downtrend

The Ichimoku Cloud chart for Solana confirms the bearish sentiment. SOL is trading well below the cloud (Kumo), indicating strong downward momentum. The red, expanding cloud suggests increased resistance and a continuation of the bearish trend. Both the conversion line (blue) and baseline (red) are trending downwards, with the conversion line positioned below the baseline. This setup reinforces the selling pressure on SOL, with no immediate signs of reversal. Additionally, the lagging span (green) is positioned below both the price and the cloud, confirming the bearish bias.

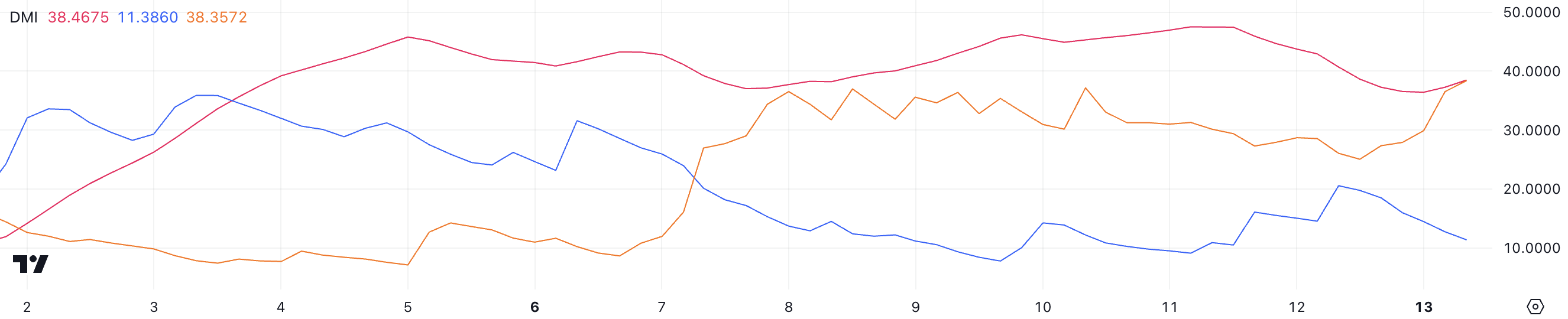

ADX and DMI: Strong Bearish Trend

The Average Directional Index (ADX) for SOL stands at 38.4, indicating a strong trend. ADX values above 25 signal a strong trend, and at over 40, the trend strength is particularly intense—whether bullish or bearish. In this case, the bearish trend dominates. The positive directional index (+DI) has dropped sharply from 20.5 to 11.3, signaling weakening bullish momentum, while the negative directional index (-DI) has surged from 26 to 38.3, highlighting increasing bearish pressure.

Can Solana Recover?

Despite the current downtrend, Solana could attempt a recovery if it manages to break resistance at $183. A successful breakout could push the price toward $203, offering hope for a bullish rebound. However, for the moment, the strong bearish indicators suggest that the downtrend will persist unless there’s a significant shift in momentum.

Also Read: JPMorgan Predicts $3B-$8B Inflow for Solana and XRP ETFs as Trump Administration Eyes Approval

Solana’s price could be heading toward its next key support level of $159, with further downside risk if current trends continue.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!