|

Getting your Trinity Audio player ready...

|

As Solana (SOL) closed May with modest gains and limited volatility, investors remain cautiously optimistic heading into June. Despite low institutional interest, retail accumulation and technical indicators suggest that Solana’s price may soon break out—if market conditions align.

Institutional Support Wanes as SUI Steals the Spotlight

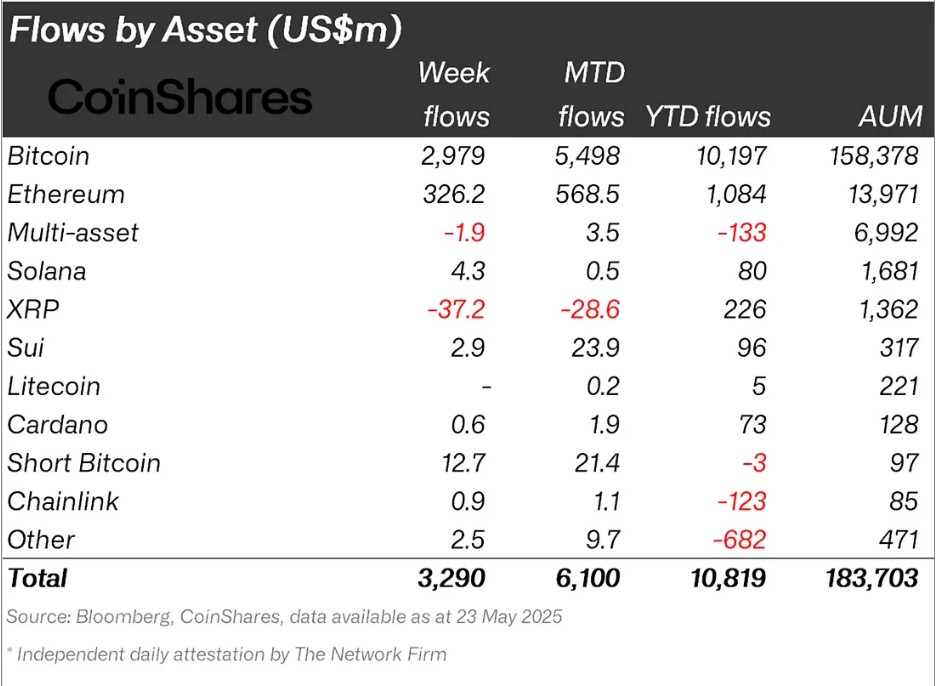

In May, Solana saw limited institutional inflows, raising concerns about long-term momentum. According to CoinShares, SOL attracted just $0.5 million in institutional capital, falling behind competitors like Cardano ($1.9 million) and Chainlink ($1.1 million). By contrast, SUI—a newer blockchain gaining popularity among developers—pulled in a significant $23.9 million.

This lack of institutional enthusiasm could pose a challenge for Solana’s growth, particularly as large-scale investors often drive sustained rallies. Without a revival in institutional interest, SOL may struggle to achieve the kind of price surges seen in previous bull cycles.

Retail Accumulation Signals Undervaluation

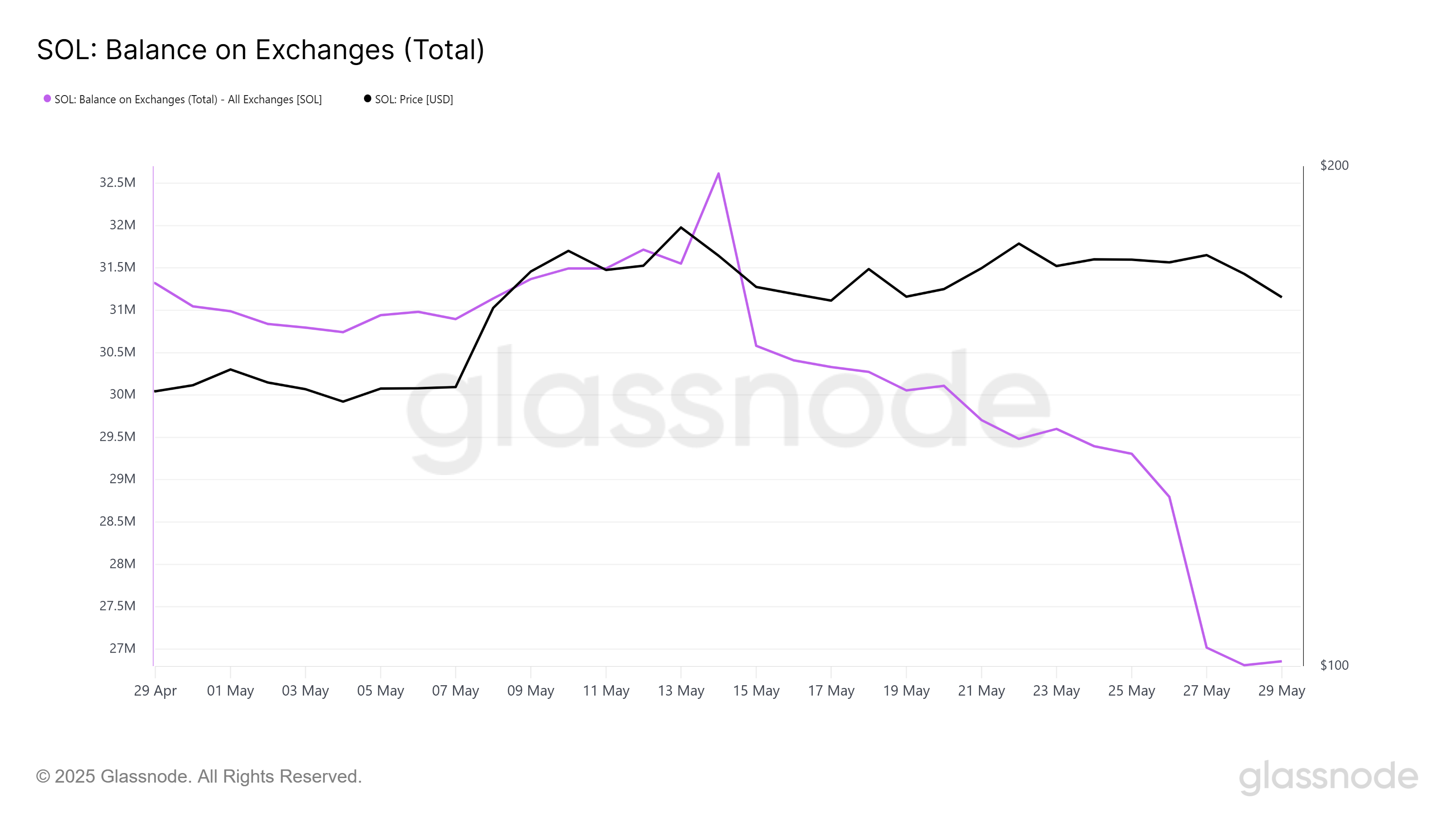

Despite the institutional pullback, retail investors and crypto whales are quietly accumulating SOL. Data from Glassnode shows a net reduction of over 4.13 million SOL from exchanges in May—equivalent to roughly $677 million. This trend highlights growing conviction among retail holders, who appear to view the current price as a buying opportunity.

The consistent outflow from exchanges suggests reduced sell pressure and potential resilience against broader market downturns. It also supports the theory that Solana may avoid steep corrections in June, even amid sector-wide volatility.

Also Read: Hyperliquid DEX Overtakes Ethereum and Solana in Revenue as HYPE Token Soars 75%

Range-Bound for Now, But a Golden Cross Could Spark Gains

Solana’s price currently stands at $164—up 11.5% since early May but still 12% below the monthly peak. Analysts expect SOL to remain range-bound between $161 and $178 in the short term. However, a breakout above the $178 resistance could push the price toward $188, especially if a Golden Cross—where the 50-day EMA crosses above the 200-day EMA—materializes.

Still, historical data warns of caution. According to Cryptorank, Solana’s average return in June over the past five years has been -8.97%. If profit-taking or negative market sentiment kicks in, a dip below $161 could send SOL to $150 or lower, invalidating the current bullish outlook.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.