|

Getting your Trinity Audio player ready...

|

Solana (SOL), the fifth-largest cryptocurrency by market capitalization, continues to struggle amid ongoing market volatility, as recent developments point to increasing uncertainty.

A notable event was the massive dump of 246,064 SOL, worth approximately $45.7 million, by a crypto whale. The transaction, tracked by Whale Alert, saw the funds move to Binance, sparking concerns about a potential sell-off. The whale’s wallet address remains unknown, which has fueled speculation among investors about the possibility of further downward pressure on the price.

🚨 🚨 246,064 #SOL (45,761,912 USD) transferred from unknown wallet to #Binancehttps://t.co/xYzdg5gB7Y

— Whale Alert (@whale_alert) January 9, 2025

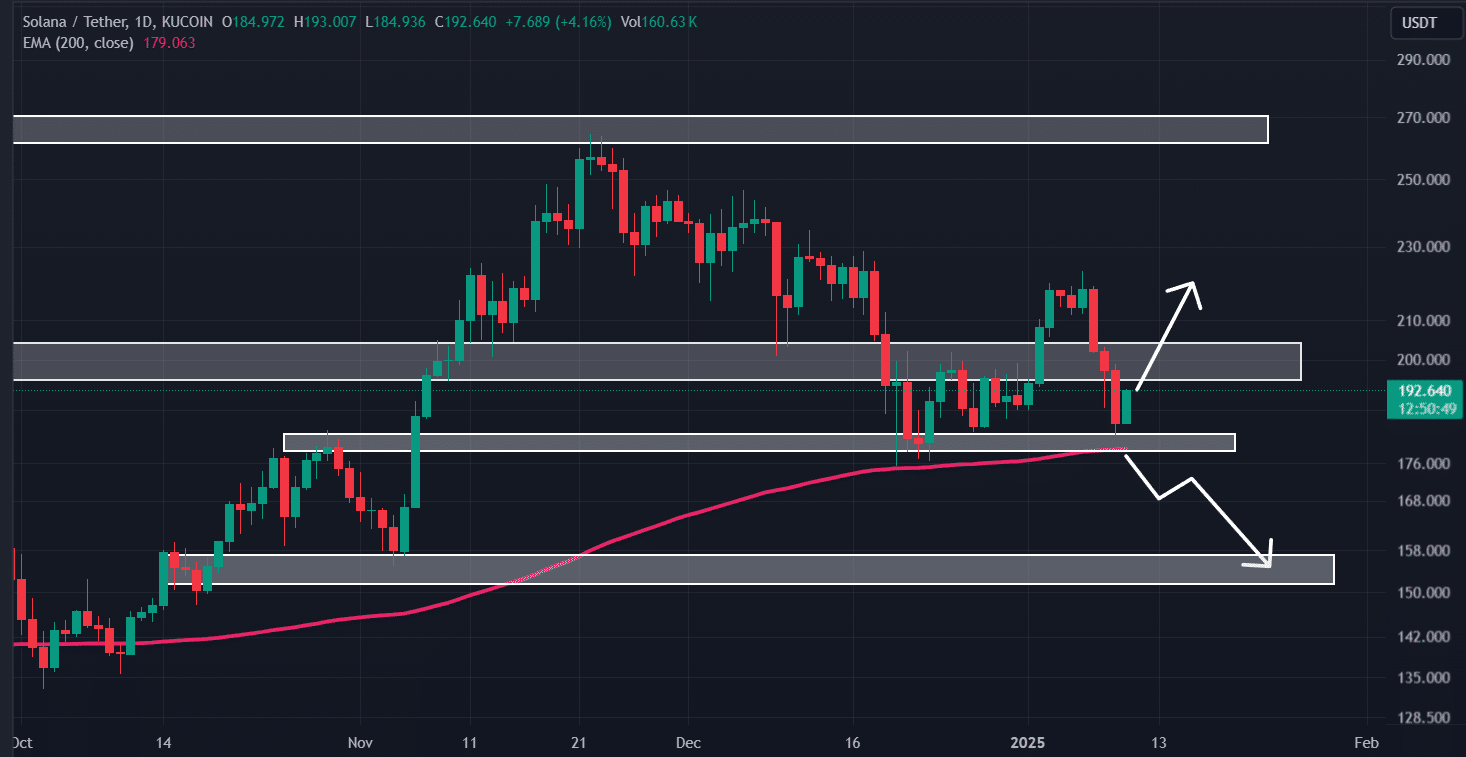

The timing of the dump coincided with Solana’s price testing a critical support level of $176 and the 200-day Exponential Moving Average (EMA). This point is now a pivotal area for the altcoin’s short-term price action. According to technical analysis, if SOL fails to hold above this level and closes a daily candle below $174.5, there is a strong possibility of an 11% drop, potentially pushing the price down to the $156 level.

However, there is a silver lining for bulls: If Solana manages to hold the $176 support level and stay above the 200 EMA, it could experience upward momentum, with a possible rally to the $220 mark.

On-chain data, however, paints a mixed picture. The latest Spot Inflow/Outflow metrics from Coinglass show that over the past 24 hours, exchanges saw a significant outflow of $61 million in SOL, indicating that many investors and long-term holders are looking to liquidate their positions. This could signal a further selling wave, potentially driving the price down.

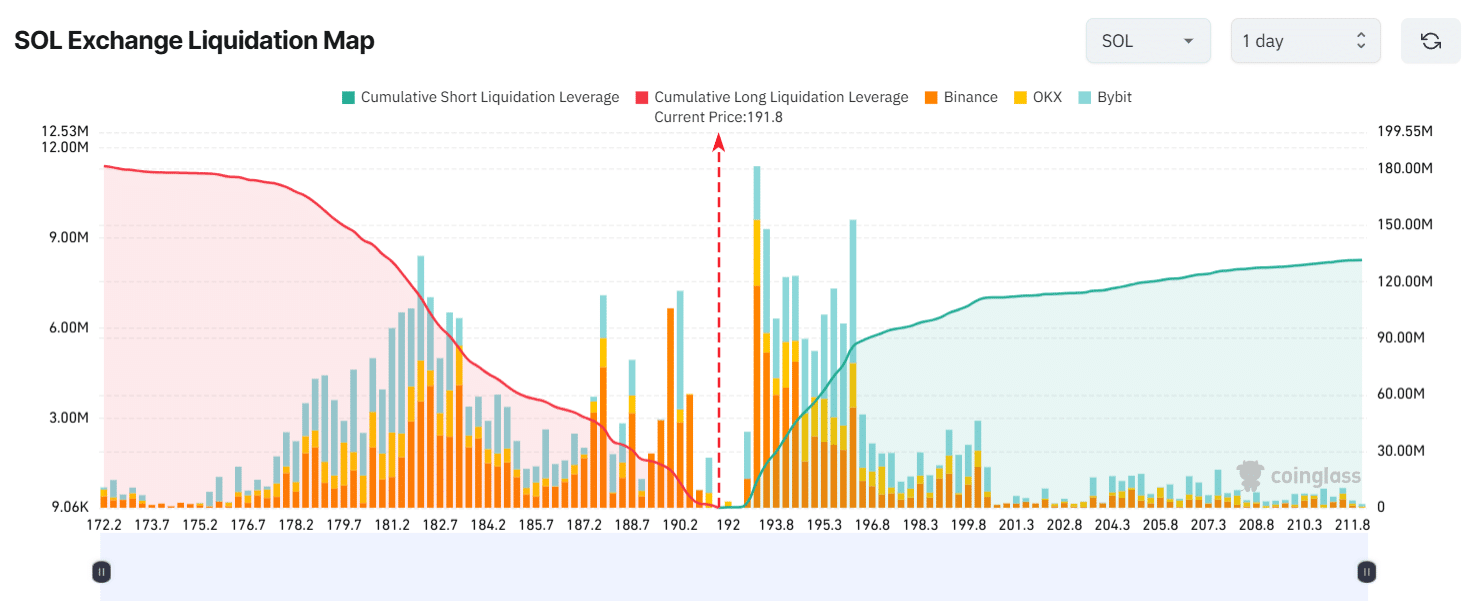

Current liquidation levels are crucial. If SOL drops to $182.1, over $111 million worth of long positions could be liquidated, intensifying selling pressure. On the other hand, if the price rises to $193.2, approximately $14 million in short positions could be wiped out.

At press time, SOL is trading at around $192, up 1.10% in the past 24 hours. However, a 5.5% drop in trading volume highlights the decreasing participation from traders, suggesting caution amid the prevailing market uncertainty.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Solana (SOL) Dips Below $200: Can It Regain Momentum and Overtake Binance (BNB) This Week?

Crypto and blockchain enthusiast.