|

Getting your Trinity Audio player ready...

|

Shiba Inu’s meteoric rise in 2020-2021 captivated the crypto world, turning modest investments into fortunes. As the second-largest meme coin, SHIB continues to attract investor attention, with some analysts predicting audacious price targets.

A Look at the Lofty Goals

Market pundits have set their sights high for Shiba Inu. Some believe it could reach $0.001 or even $0.01, wiping out multiple zeros from its current price. While these targets might seem ambitious, the community’s unwavering belief in the project fuels such optimism.

The Roadblock: Supply Constraints

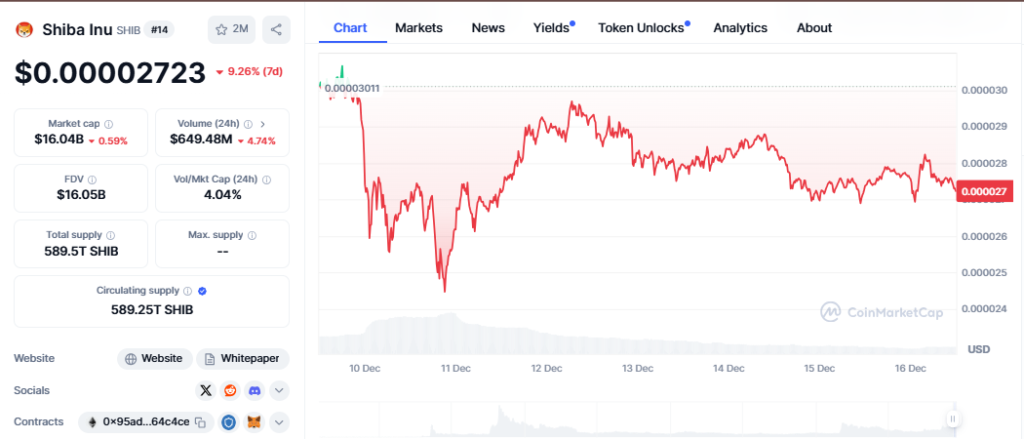

However, achieving such lofty goals faces significant hurdles. Shiba Inu’s massive circulating supply of 584 trillion tokens poses a major challenge. At a $0.01 price, the market cap would exceed the entire crypto market. A $1 price, on the other hand, would dwarf the market cap of gold and the combined value of the top 20 US companies.

The Only Way Forward: Token Burns

To realize these ambitious targets, a significant reduction in supply is necessary. One viable solution is token burning, where SHIB tokens are permanently removed from circulation. By buying back and burning tokens, the Shiba Inu team could gradually decrease the supply and potentially drive up the price.

A More Realistic Outlook

While the $0.01 and $1 targets might be unrealistic in the near future, more modest goals like $0.0001 and $0.0003 remain achievable. These targets would still deliver substantial returns for investors, especially those who bought early.

Also Read: Shiba Inu Price at Crossroads, Will SHIB Soar 163% or Drop 62%?

Shiba Inu’s potential for growth is undeniable. However, it’s crucial to maintain a realistic perspective. While the community’s enthusiasm is commendable, it’s essential to consider the underlying fundamentals and market dynamics. Token burning can play a pivotal role in reducing supply and increasing the value of each SHIB token. As the crypto market continues to evolve, Shiba Inu’s journey will be closely watched by investors and enthusiasts alike.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.