|

Getting your Trinity Audio player ready...

|

Shiba Inu (SHIB), the popular memecoin, is under bearish pressure after a 1.17% drop in its price over the past 24 hours. At the time of writing, SHIB was trading at $0.0000212, with a significant 25% decrease in trading volumes. Despite this underperformance, several on-chain metrics point to a potential trend reversal and a rally in the short term.

Reduced Selling Pressure Could Signal Recovery

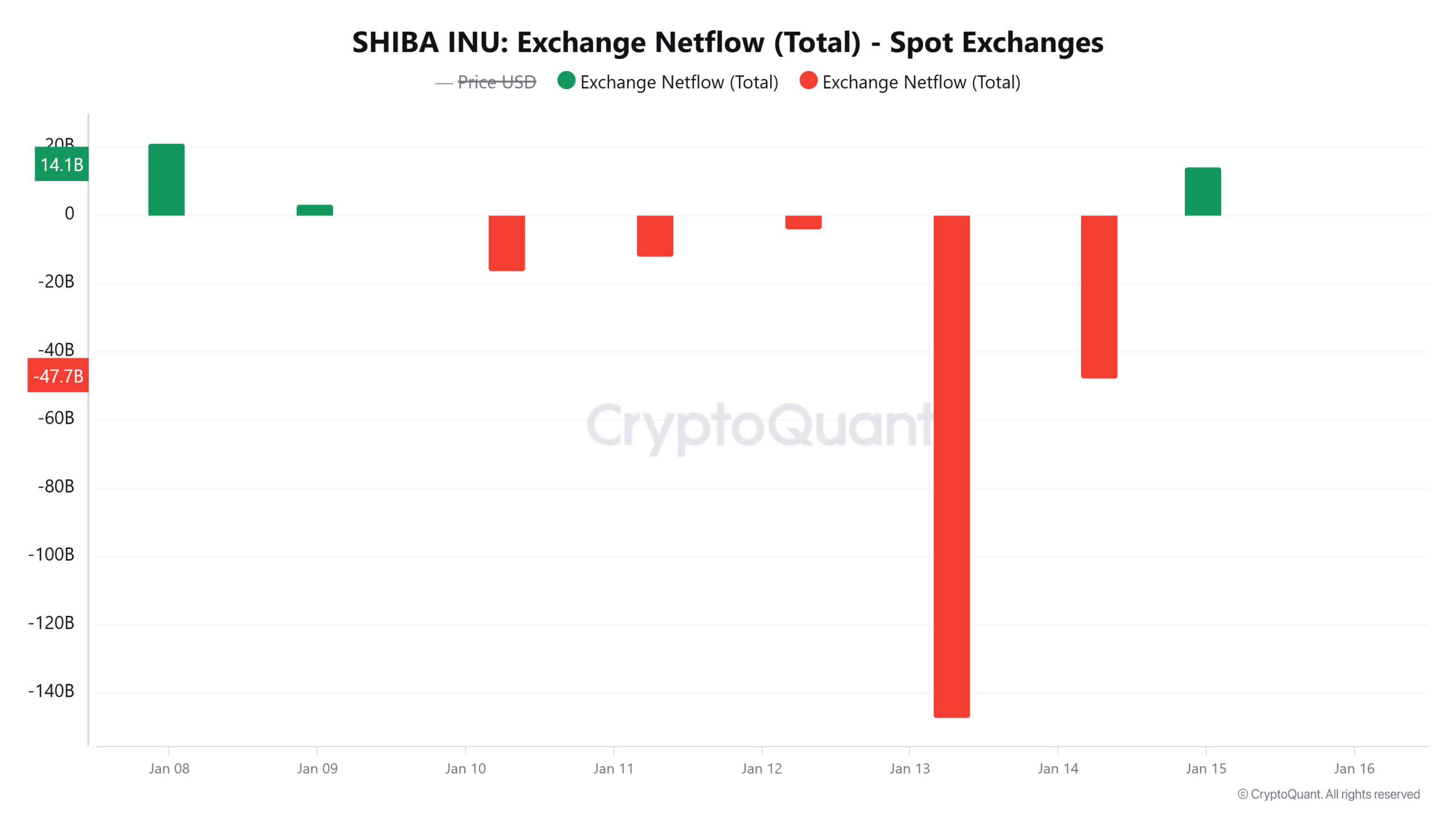

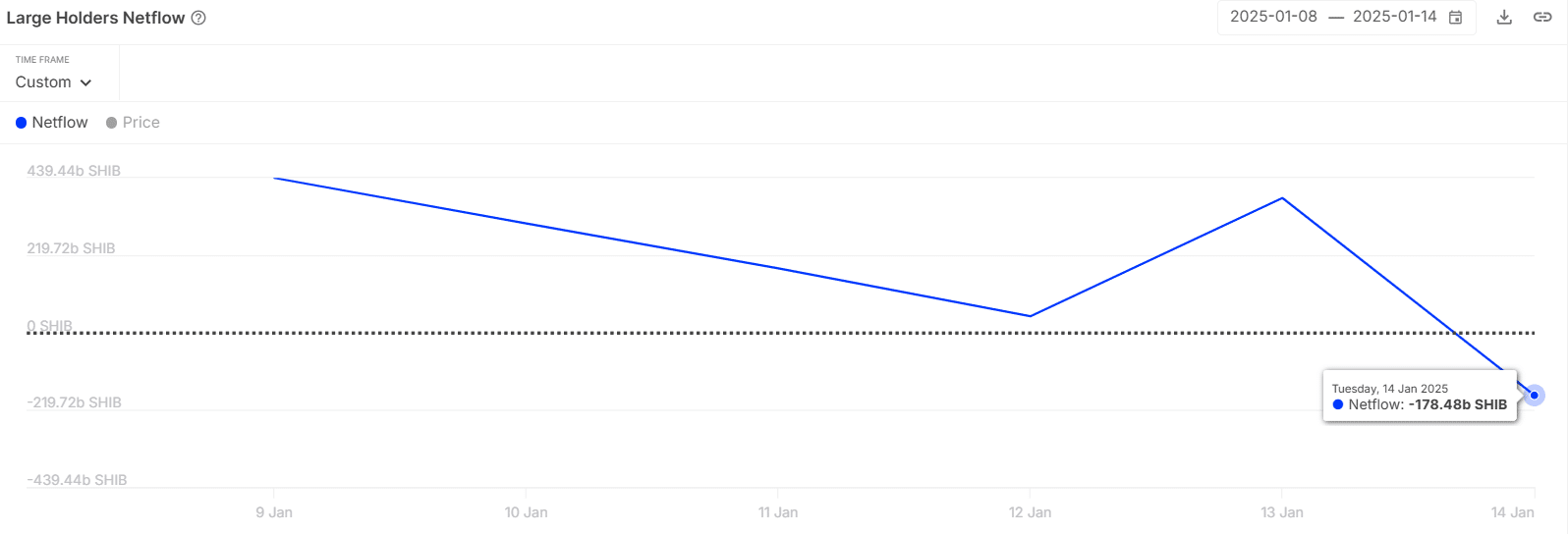

Data from CryptoQuant reveals that 194 billion SHIB tokens were withdrawn from spot exchanges between January 13th and 14th, suggesting that selling interest may be easing. Most of these withdrawals came from whale addresses, or large SHIB holders. IntoTheBlock data supports this, showing that netflows for large holders have turned negative, dropping from 382 billion SHIB to -178 billion SHIB. This shift signals that whales are accumulating SHIB tokens, which is typically a sign of a bottoming price.

Historically, whales tend to buy during price dips and sell when prices peak. The current accumulation phase, indicated by these large withdrawals, hints that SHIB may have reached its bottom and could soon experience upward momentum.

Bearish Technical Indicators Remain in Play

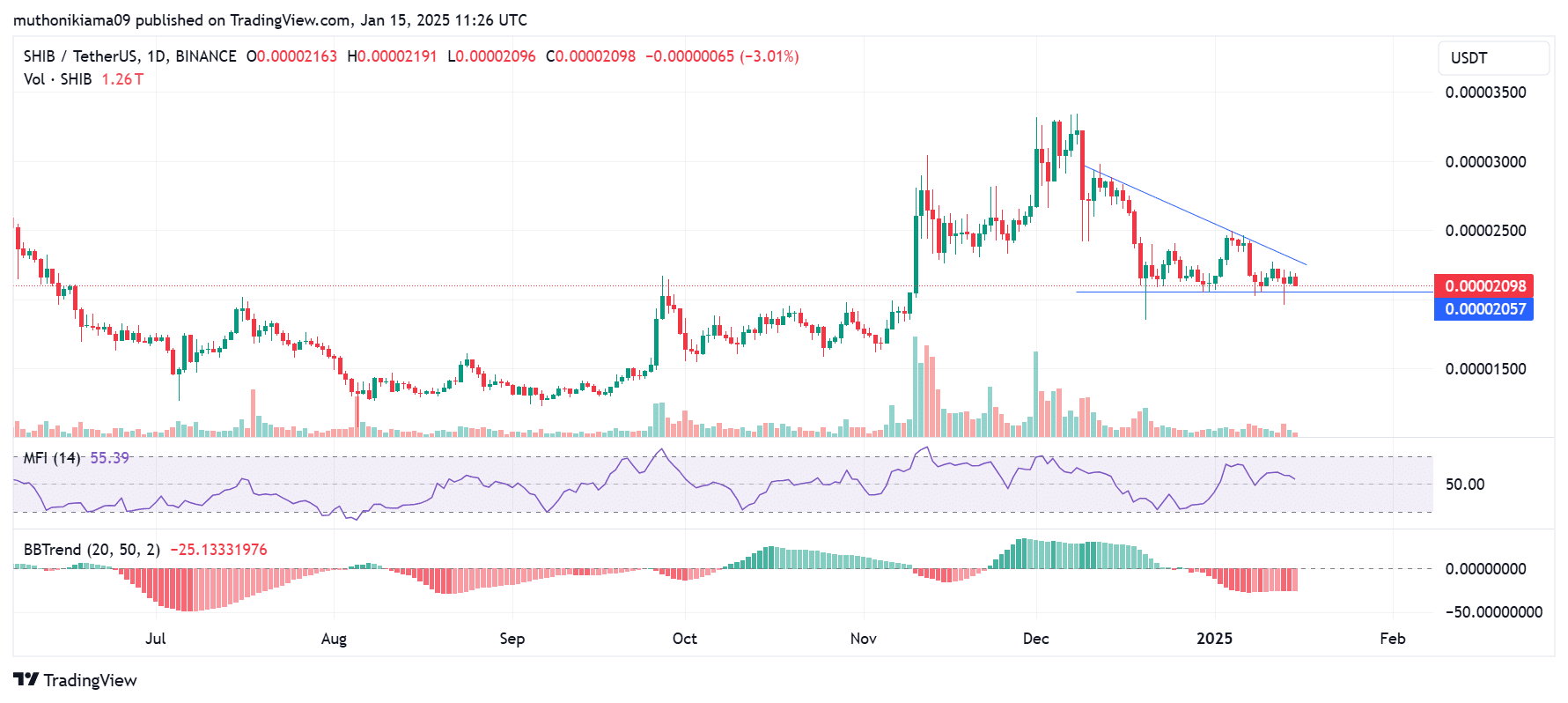

Despite the easing selling pressure, SHIB’s chart shows persistent bearish trends. The memecoin is currently trading within a descending triangle pattern, a formation typically associated with strong downtrends. The Money Flow Index (MFI) stands at 55 and is trending downward, suggesting that whale accumulation has yet to fully counterbalance the prevailing sell-side pressure.

The BBTrend indicator, which is red and negative, further confirms the prevailing bearish sentiment. These indicators suggest that, despite the signs of whale accumulation, SHIB still faces significant resistance.

Market Sentiment and Derivatives Data

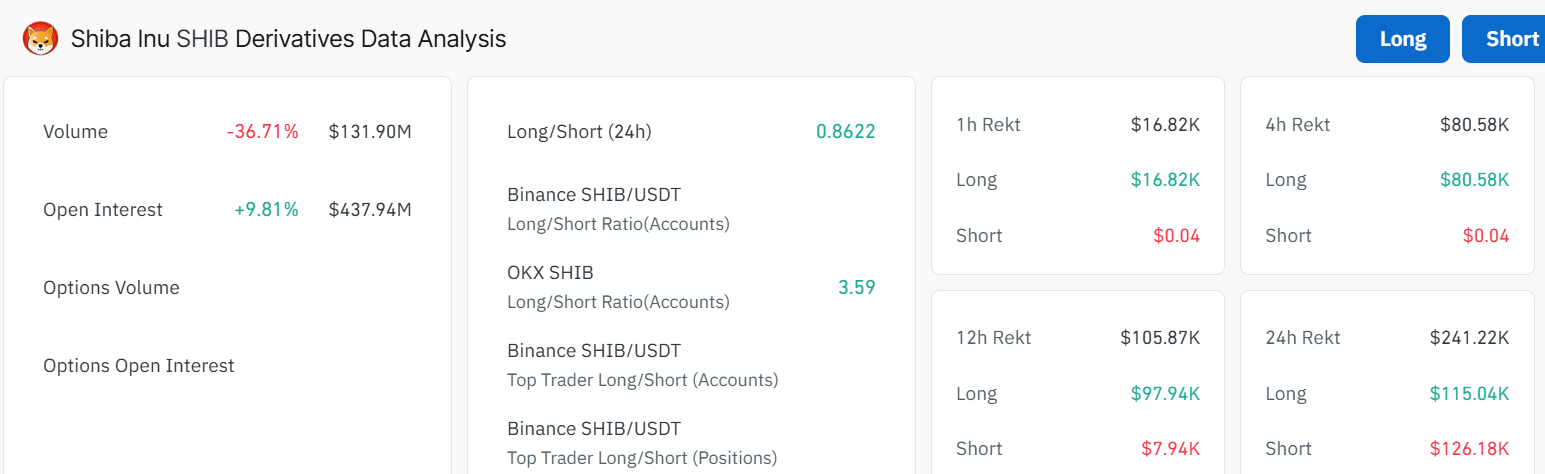

The derivatives market also paints a cautious picture. Data from Coinglass shows a slight uptick in Open Interest to $984 million, but the increase is largely driven by short sellers betting on further declines. The Long/Short Ratio has dropped to 0.86, reinforcing negative sentiment in the broader market.

In conclusion, while there are signs of accumulation and a potential trend reversal for Shiba Inu, the prevailing bearish outlook remains a significant factor. Investors should closely monitor market developments and technical indicators to gauge whether SHIB can break its current downtrend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Shiba Inu (SHIB) vs. Dogecoin (DOGE): Can SHIB Ride the Wave of DOGE’s Bullish Momentum?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.