|

Getting your Trinity Audio player ready...

|

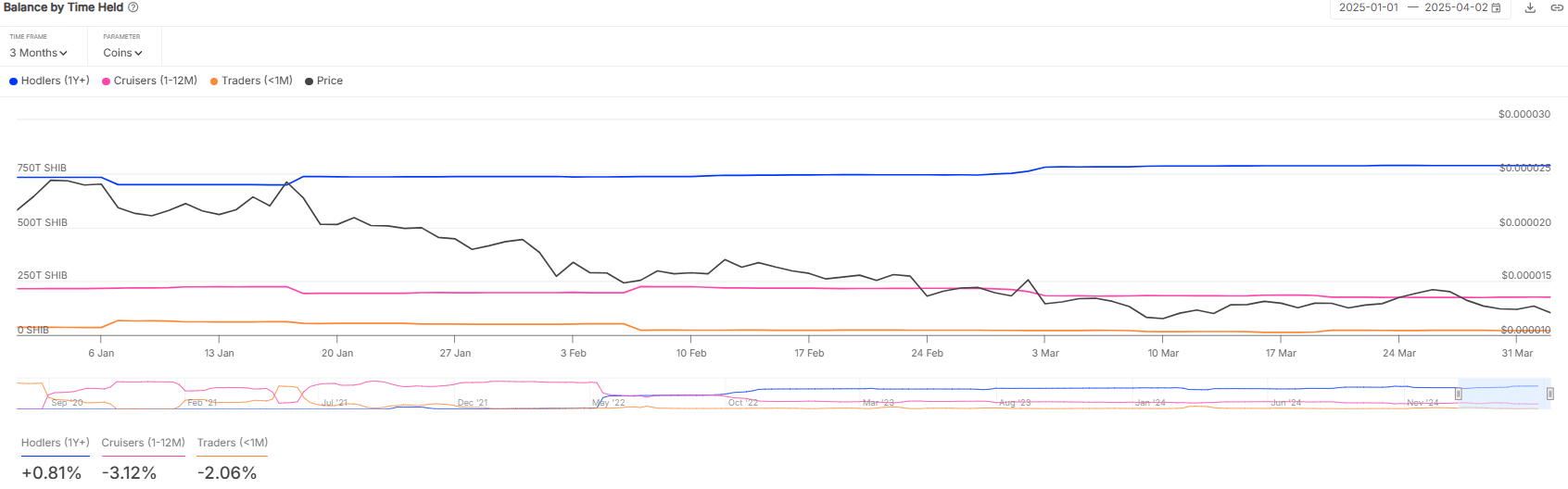

Shiba Inu’s (SHIB) investor landscape experienced a fundamental shift in Q1 2025, signaling a potential evolution from its speculative roots. According to IntoTheBlock, over 80% of SHIB’s total supply is now controlled by long-term holders—those who have held their assets for more than a year. This dramatic transition marks a stark departure from the memecoin’s history of short-term trading frenzies.

Long-term $SHIB holders collectively own more than 80% of the total supply.

— IntoTheBlock (@intotheblock) April 2, 2025

This indicates that even amid challenges in the memecoin market, many $SHIB holders remain optimistic. pic.twitter.com/JTnHS2TIjq

Diamond Hands Take Over

The latest wallet behavior analysis reveals that SHIB whales increased their holdings by 7.5% during the first quarter of 2025. Despite a steep 45% price decline, whale balances surged from 732 trillion to 787 trillion tokens.

Conversely, mid-term holders offloaded 18% of their positions, and short-term traders saw an even sharper decline, reducing their holdings by 43%—dropping from 36 trillion to just 21 trillion SHIB.

Where Did All the SHIB Go?

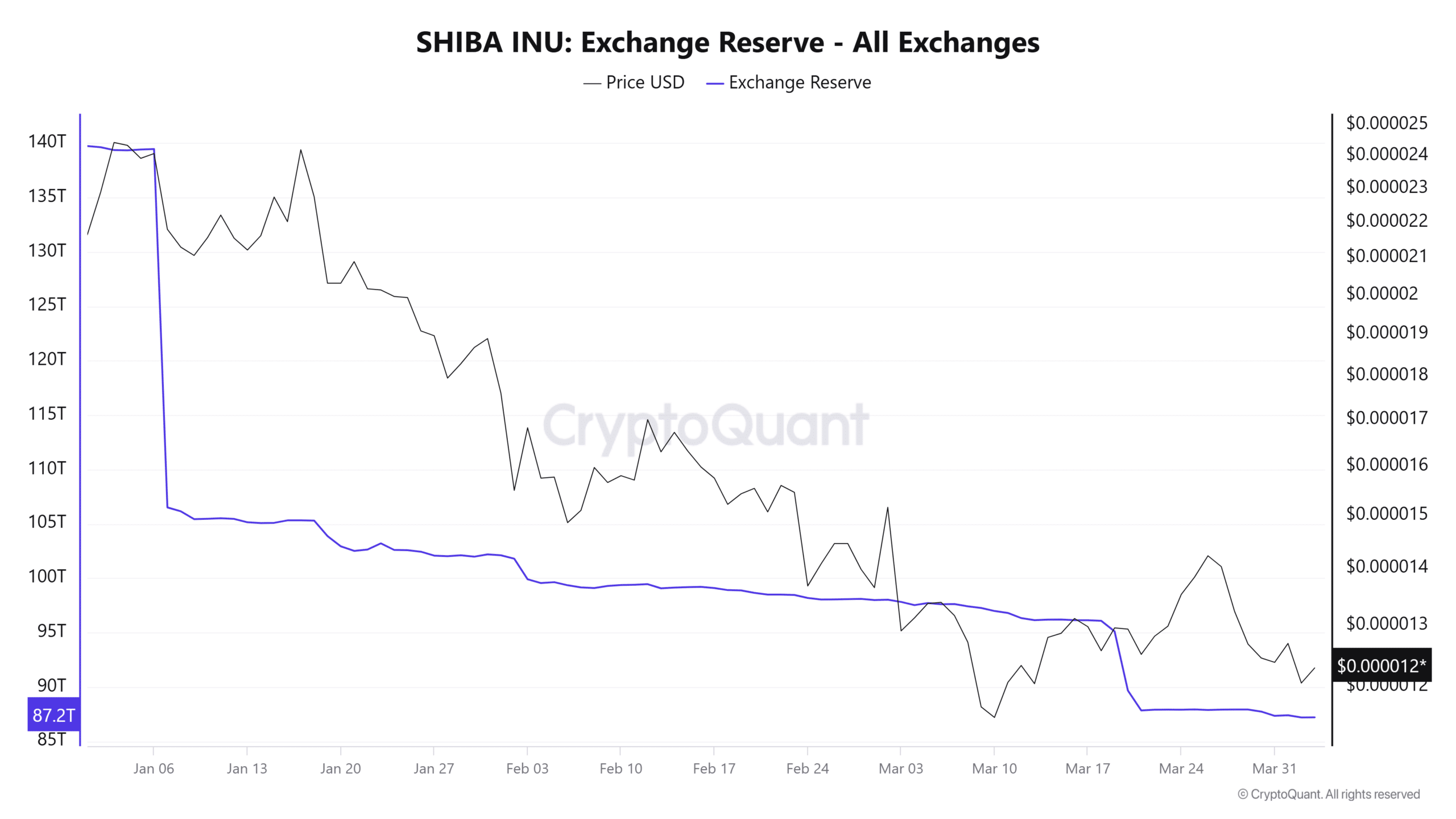

CryptoQuant data suggests a significant behavioral shift, with SHIB exchange reserves plummeting by 37.6%—from 139.7 trillion to 87.2 trillion tokens. Typically, such an outflow tightens sell-side liquidity, which is often a bullish signal. However, despite these encouraging trends, SHIB’s price continued to slide, hinting at broader market influences dampening its potential upside.

Whale Activity and Market Sentiment

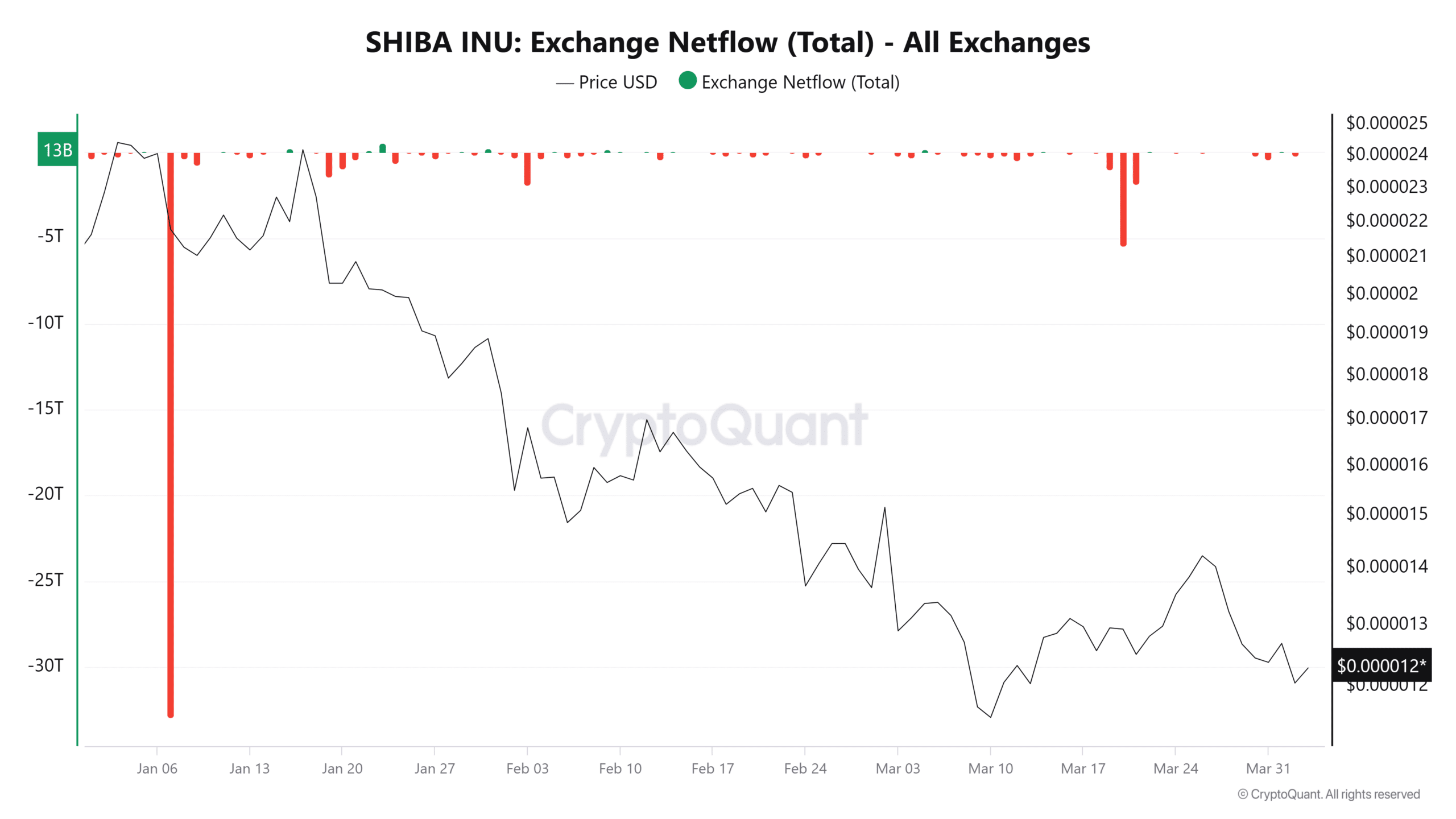

Adding complexity to the narrative, IntoTheBlock’s large holder netflow data revealed erratic whale behavior. On January 6th and 7th, over 33 trillion SHIB flooded exchanges, but by February and March, netflows reversed sharply, plummeting by 212%. Interestingly, despite these large swings, SHIB’s price remained relatively stable, suggesting that whale moves may no longer dictate market trends.

This decoupling could indicate a maturing market where retail sentiment and broader macroeconomic conditions exert a stronger influence than whale activity alone.

Two major netflow spikes in Q1—32.94 trillion SHIB on January 7th and 33.84 trillion SHIB on March 2nd—preceded significant price drops. Historically, such inflows signal large sell-offs, yet the continued decline in exchange reserves suggests that whale sales were absorbed by ongoing withdrawals, reinforcing the long-term accumulation trend.

With SHIB’s price stabilizing above key support levels and on-balance volume rising, long-term holders now dominate the supply. If accumulation continues and liquidity remains tight, Shiba Inu could see reduced volatility and a stronger foundation for future price movements.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Shiba Inu Price Fakeout? Analyst Predicts Further Correction as SHIB Struggles Below Key Resistance

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.