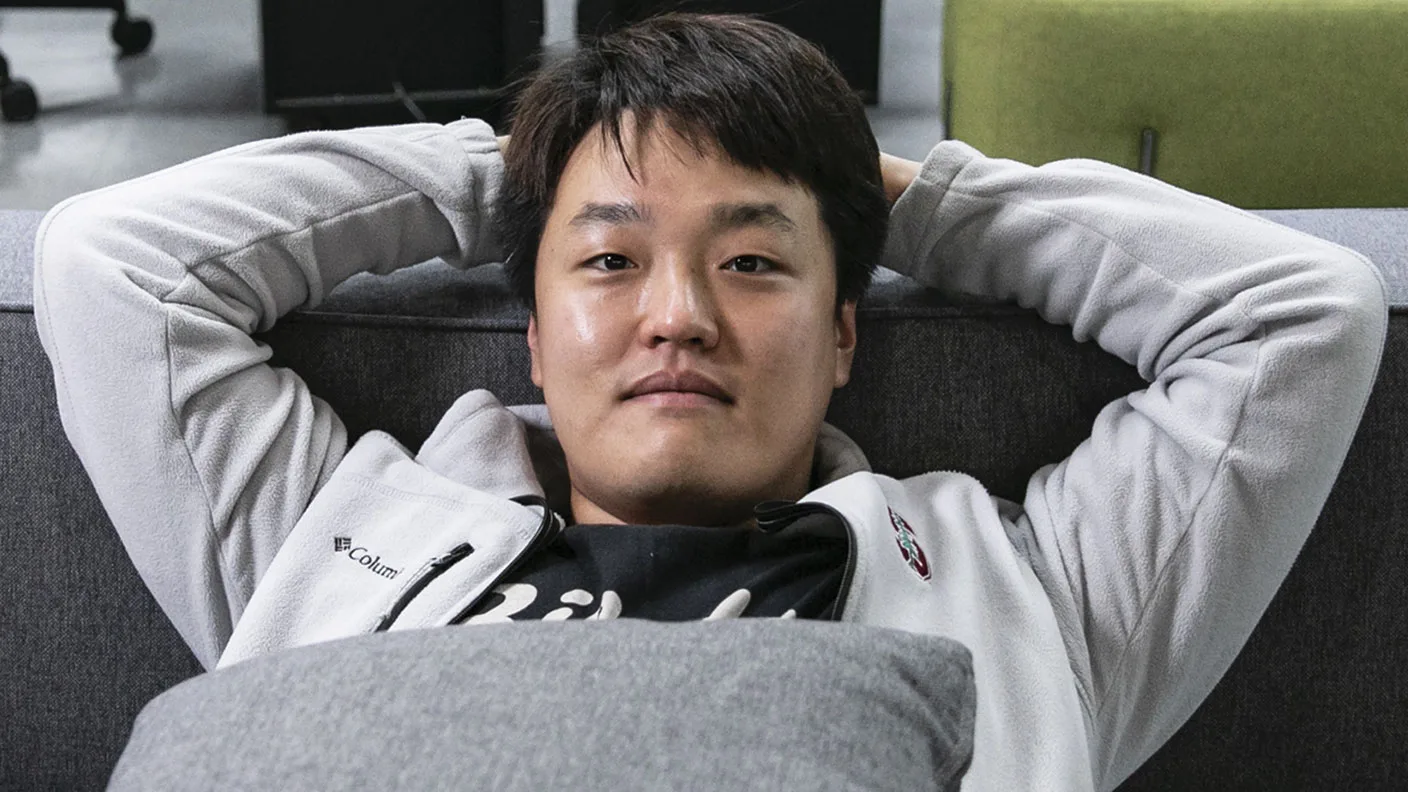

The fallout from the spectacular crash of the TerraUSD (UST) stablecoin and its connected Luna token in 2022 continues, with U.S. regulators seeking a hefty $5.3 billion fine from Terraform Labs and its co-founder Do Kwon.

This hefty fine request comes on the heels of a New York civil court jury finding Terraform Labs and Kwon liable for misleading investors about the safety of UST and the utility of the underlying Terra blockchain. According to court documents, investors poured over $2 billion into UST through exchanges and other platforms.

SEC Aims for “Unequivocal Message”

The U.S. Securities and Exchange Commission (SEC) argues that the proposed fine sends a clear message: such “brazen misconduct” will not be tolerated. In an April 19th court filing, the SEC detailed the breakdown of the requested fine. This includes roughly $4.7 billion in disgorgement and prejudgment interest, along with civil penalties of $420 million for Terraform Labs and $100 million for Kwon himself.

The SEC considers the proposed fine “conservative” considering the significant profits Kwon allegedly obtained from UST. However, Terraform Labs and Kwon are contesting the amount. Terraform argues for a maximum fine of only $3.5 million, while Kwon proposes a meager $800,000 penalty.

A Crypto Market Reckoning?

This legal battle has significant implications for the cryptocurrency market. The SEC’s pursuit of such a substantial fine highlights the growing regulatory scrutiny surrounding crypto assets, particularly stablecoins. The outcome of this case could set a precedent for future enforcement actions in the crypto space.

Whether the court agrees with the SEC’s proposed billion-dollar fine or sides with the significantly lower figures proposed by Terraform Labs and Do Kwon remains to be seen. The final ruling will be closely watched by investors and crypto businesses alike, potentially shaping the future landscape of cryptocurrency regulation.