BlackRock, the world’s largest asset manager, is experiencing a gold rush thanks to its blockbuster iShares Bitcoin Trust (IBIT), launched in January 2024. This “fastest-growing ETF in history” has attracted a staggering $13.9 billion in net inflows, representing a remarkable 21% of BlackRock’s total ETF inflows in Q1 2024.

IBIT’s Meteoric Rise

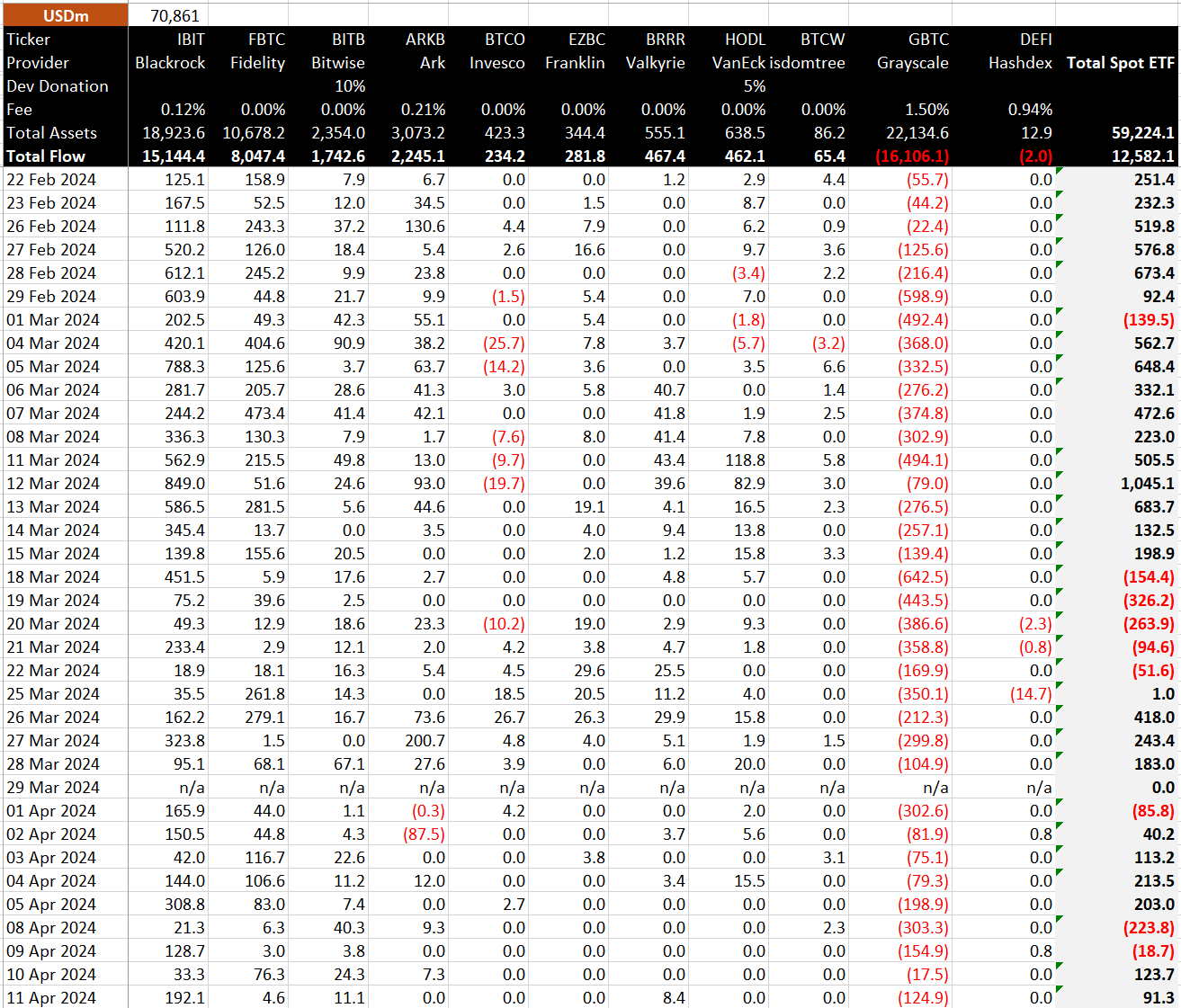

IBIT’s success story is evident in its unprecedented streak – net inflows on every trading day since its launch. This unparalleled demand has propelled IBIT’s assets under management (AUM) to nearly $19 billion in just three months. BlackRock CEO Larry Fink attributes this momentum to “surging demand” for Bitcoin exposure.

While IBIT takes center stage, BlackRock’s core business remains strong. Traditional asset classes like core equity and fixed income ETFs garnered a respectable $37 billion and $18 billion in net inflows, respectively, during Q1 2024. This demonstrates a balanced portfolio across various investment vehicles for BlackRock.

A Record-Breaking Quarter:

Fueled by IBIT’s success and continued strength in core offerings, BlackRock achieved a record-breaking $10.5 trillion in AUM in Q1 2024. This signifies a robust performance and solidifies BlackRock’s position as a dominant force in the financial landscape.

Also Read: Circle and BlackRock Join Forces: Streamlining BUIDL Share Redemption with Smart Contracts

Innovation Beyond Borders

BlackRock isn’t just chasing the Bitcoin wave; it’s also exploring the future of digital assets. The launch of their first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund, underscores this commitment. This offering provides qualified investors exposure to US dollar yields through a tokenized structure.

BlackRock CEO Larry Fink recognizes the potential of tokenization, calling it “the next generation for markets.” He envisions a future where tokenization streamlines capital markets, shortens value chains, and ultimately benefits investors with lower costs.

Looking Ahead:

BlackRock’s Q1 performance is a testament to its ability to adapt and innovate. With IBIT’s record-breaking pace and a focus on tokenization, BlackRock is well-positioned to capitalize on emerging trends in the ever-evolving financial landscape. Investors will be keenly watching BlackRock’s next moves as they continue to navigate the traditional and digital asset worlds.