|

Getting your Trinity Audio player ready...

|

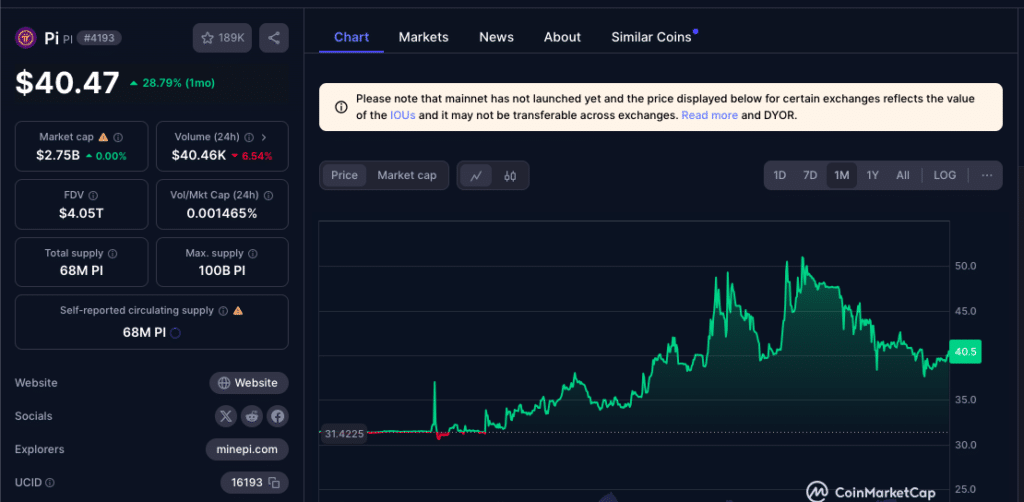

The Pi Network unofficial token, currently trading at $38.55 on HTX, has been steadily consolidating as traders anticipate the imminent launch of the mainnet. The developers have hinted at a potential launch before the year’s end, sparking increased interest in the project.

KYC Verification and Ecosystem Growth

One of the key prerequisites for the mainnet transition is the completion of Know Your Customer (KYC) verification for millions of pioneer members. This process is essential to ensure the authenticity of network participants and prevent bot infiltration.

Also Read: Pi Network Calls for More Validators to Speed Up KYC Process

In addition to KYC, the developers are focusing on expanding the Pi Network’s ecosystem. They aim to have at least 100 mainnet-ready applications before the launch of the Open Network, ensuring that the Pi token has immediate utility upon its release. E-commerce-focused applications are a prime target for the token’s adoption as a medium of exchange.

The timing of the mainnet launch will also depend on external market conditions. The developers are keen to capitalize on a strong cryptocurrency bull run to maximize the impact of the token’s introduction. However, historical precedent suggests that tap-to-earn tokens, such as Hamster Kombat, Catizen, and PixelVerse, often experience significant price declines after airdrops.

The value of the Pi token remains uncertain as it is not yet publicly traded. Details about its circulating supply and maximum limit have not been disclosed. Furthermore, the Pi/USDT token offered by HTX is merely an IoU and is not directly linked to the main Pi Network. Its low daily trading volume limits its effectiveness as an indicator of future price movements.

The recent rally in the Pi token, peaking at $40 earlier this month, coincided with a broader crypto market uptrend. However, technical indicators suggest that a potential correction may be in store. If the token fails to hold above the 50-day moving average, it could face further declines, with the next key support level at $29.57.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.