|

Getting your Trinity Audio player ready...

|

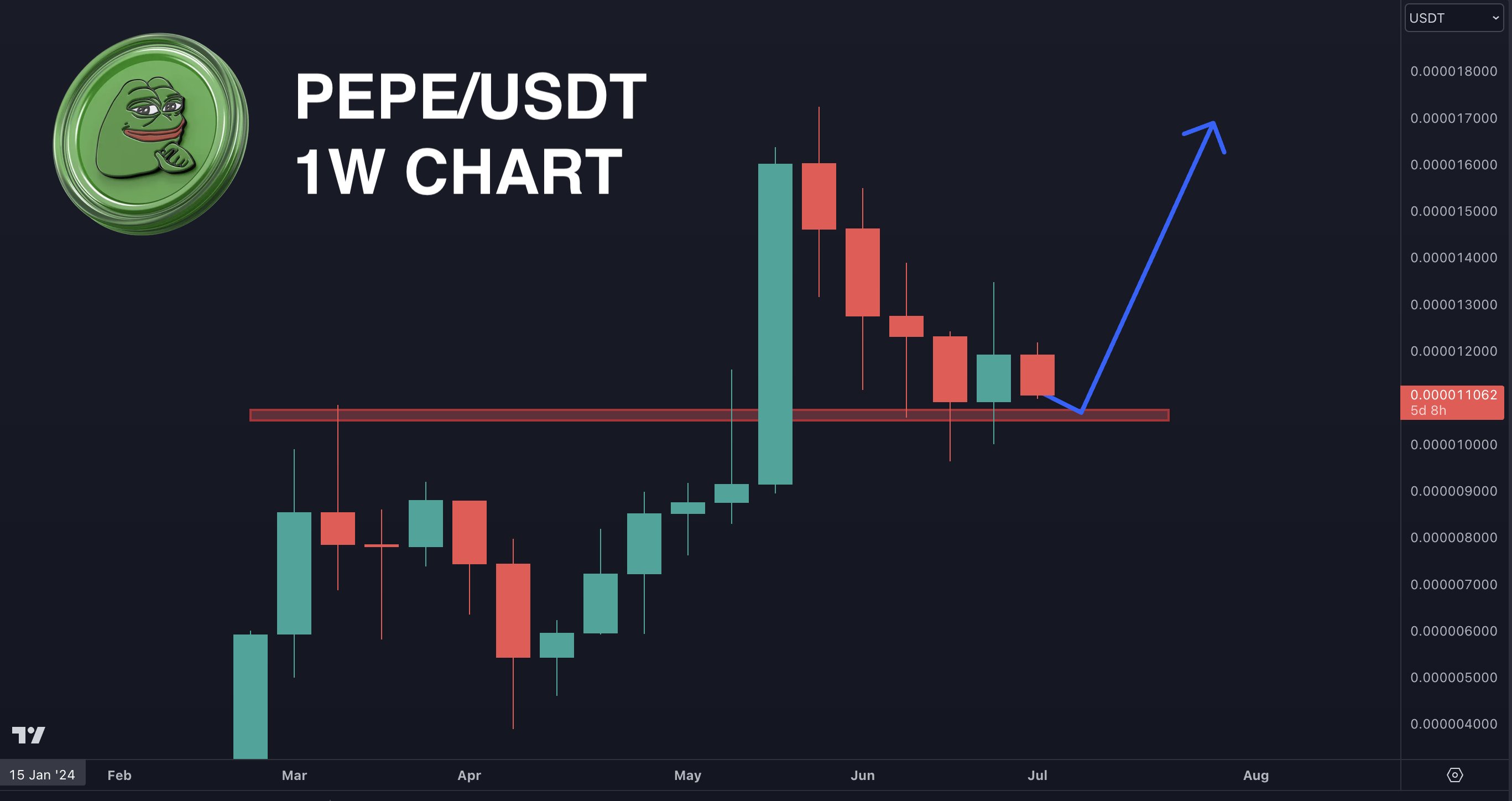

Popular meme coin PEPE finds itself in the analyst spotlight, with Crypto Jack on social media platform X expressing a bullish outlook based on the weekly chart.

Jack believes PEPE is retesting a crucial resistance level that could now act as support, suggesting potential price increases.

However, Crypto Jack’s optimism clashes with broader market sentiment surrounding PEPE. The coin recently struggled to break through a key resistance point, the 50% Fibonacci retracement level at $0.000013. This suggests a lack of buying pressure and potential downward movement.

Technical Indicators Flash Caution

Technical indicators also paint a mixed picture. The daily Relative Strength Index (RSI) sits near 50, indicating neither strong buying nor selling pressure. The Chaikin Money Flow (CMF) dips below 0.05, signifying capital flight from PEPE, further hinting at a bearish trend.

Dominant short positions, evidenced by recent liquidations, reveal a market lacking confidence in PEPE’s immediate price recovery. This short-term pessimism contrasts with Jack’s long-term perspective.

Price Action: Stalemate or Stepping Stone?

From a technical standpoint, PEPE found support at the 78.6% Fibonacci retracement level of $0.0000107, halting a potential decline. However, resistance at $0.000013 continues to impede price increases.

Interestingly, Coinglass liquidation data shows a cluster of activity around $0.00001164 and $0.00001180 within the last day. This concentrated trading zone suggests market players are strategically positioning themselves for potential trend shifts.

Also Read: PEPE Price On The Brink: 19.79% Trading Volume Drop Ignites Breakout Rumors

The Wait and See Game

Despite minimal price movement, the high volume of concentrated liquidations points to underlying market tension. Investors, both long and short, are adjusting their leveraged bets at these critical levels, waiting for a clear directional signal.

While Crypto Jack’s bullishness offers a counterpoint, PEPE’s current market performance leans towards a wait-and-see approach for most investors. Only time will tell if the clustered liquidations foreshadow a breakout or a breakdown for the popular meme coin.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.