|

Getting your Trinity Audio player ready...

|

Pepe (PEPE), the well-known Ethereum-based memecoin, is grabbing attention from whales and institutions even amidst a broader market consolidation. While the overall market sentiment leans bullish, a recent correction follows a period of significant upward momentum.

Whales Accumulate PEPE as Sentiment Remains Positive

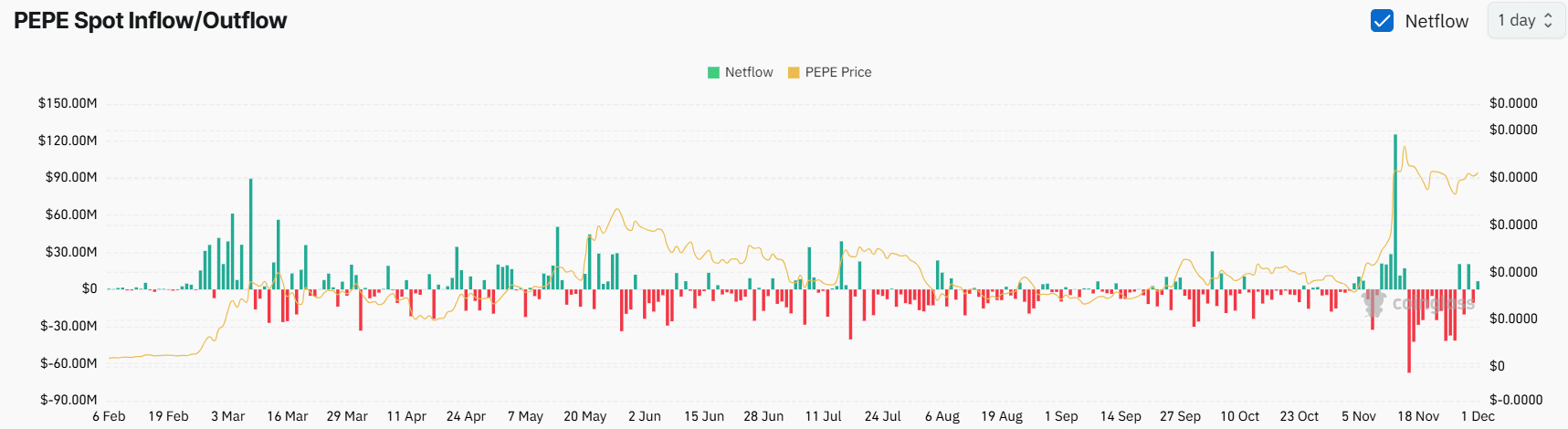

Data from Coinglass, analyzed by AMBCrypto, reveals a noteworthy trend: a massive $341 million outflow of PEPE from exchanges since November 13th. This substantial withdrawal suggests that tokens are being moved off exchanges and into private wallets, potentially signaling an ideal buying opportunity and foreshadowing future price increases.

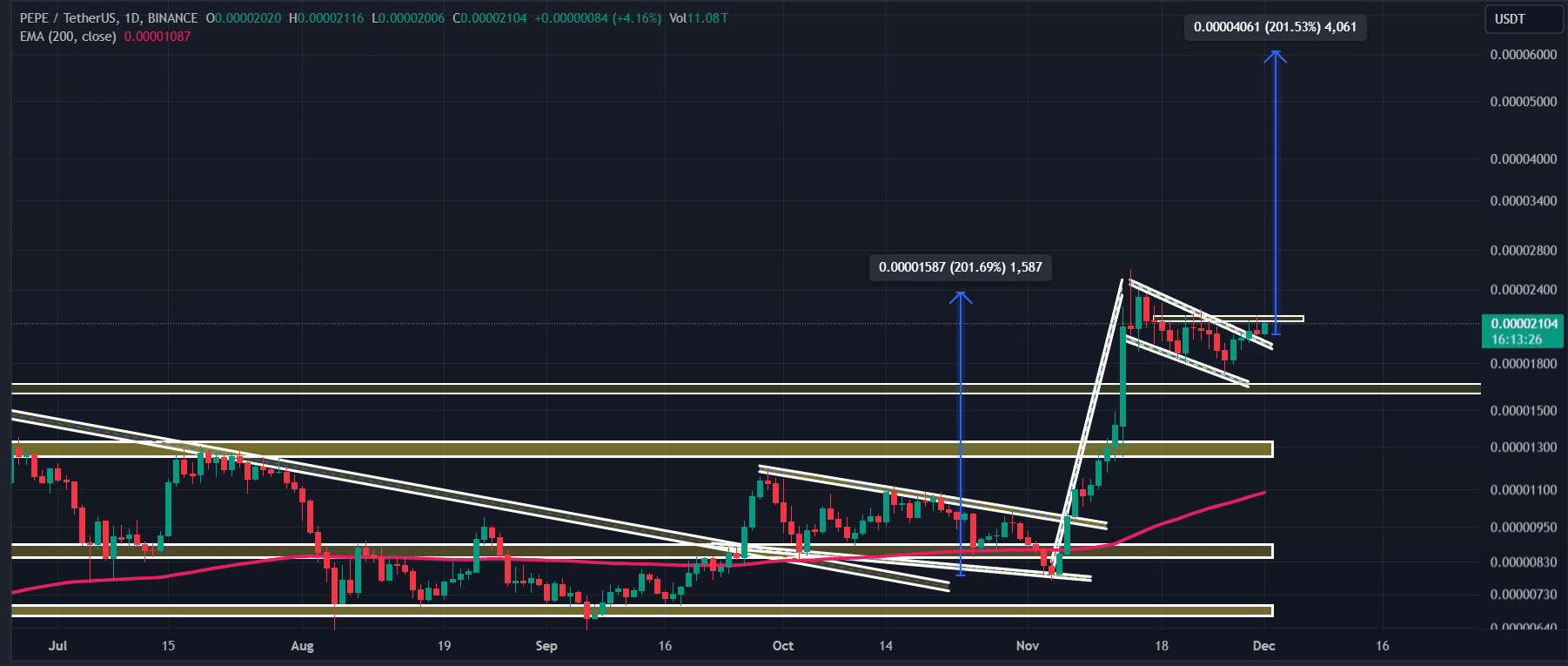

Analysts believe the primary driver behind this significant whale activity is the formation of a bullish price pattern on the daily timeframe. This pattern, coupled with the community’s trust in whale actions, fuels a positive outlook for PEPE.

Technical Analysis Hints at Potential Surge

AMBCrypto’s technical analysis paints a bullish picture for PEPE. The memecoin appears to have broken out of a bullish flag and pole pattern on the daily chart. Based on historical trends and recent price movements, a daily candle closing above $0.0000216 could trigger a significant rally, potentially pushing PEPE towards $0.000060, a 200% increase in the coming days.

Furthermore, the Relative Strength Index (RSI) sits at 62, indicating room for further upward movement before reaching the overbought zone. This adds another layer of optimism to the short-term outlook for PEPE.

Key Levels to Watch for Traders

Coinglass data, analyzed by AMBCrypto, also highlights substantial long positions taken by traders. Key liquidation levels to monitor include $0.0000199 on the downside, where $7.40 million in long positions are concentrated, and $0.00002143 on the upside, where $5.05 million in short positions reside. These points indicate potential areas of overleverage.

The combination of bullish on-chain metrics and technical analysis suggests that the bulls are currently in control and could propel PEPE towards a price surge.

Current Price Action

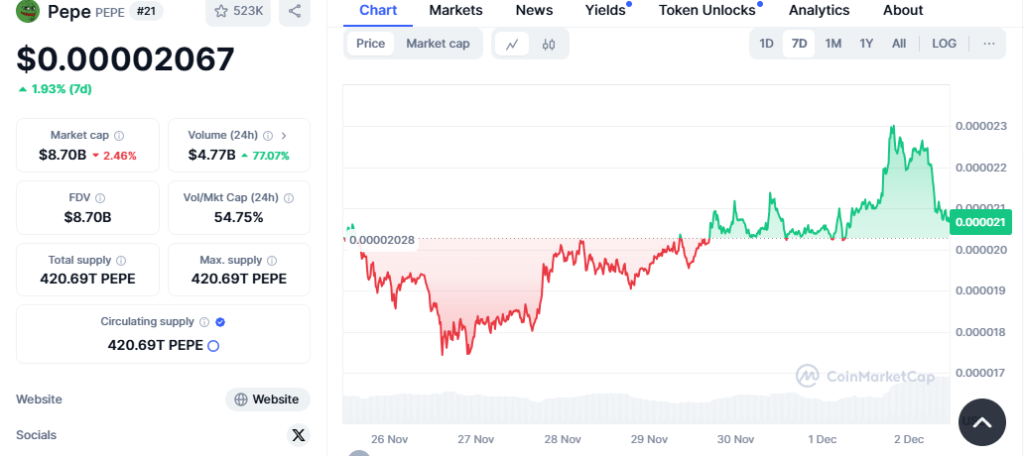

At the time of writing, PEPE is trading near $0.00002097, reflecting a 1.10% decline in the past 24 hours. During this period, trading volume also dropped by 15%, signifying potentially lower participation from short-term traders.

Also Read: PEPE Price Prediction: 75% Surge Expected as $341.5M Whale Outflow Signals Bullish Momentum

Despite the ongoing market correction, Pepe (PEPE) continues to attract whale and institutional interest. Bullish technical indicators and significant token withdrawals from exchanges paint a promising picture for the memecoin’s near future. As the market stabilizes, PEPE’s price action will be worth watching closely, particularly if it surpasses the key resistance level of $0.0000216.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.