|

Getting your Trinity Audio player ready...

|

- Ondo Finance now holds SEC-approved broker-dealer, ATS, and TA licenses.

- ONDO’s growth depends on Oasis Pro integration, inflows, and whale stability.

- The acquisition positions Ondo as a compliant Real World Asset infrastructure leader.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Ondo Finance (ONDO) is making waves in the crypto world after acquiring Oasis Pro, a firm holding key SEC-approved licenses. This bold move positions Ondo at the intersection of DeFi and traditional finance, giving institutional investors a compliant gateway to tokenized assets.

1/ Ondo Finance has completed its purchase of Oasis Pro, including its SEC-registered digital assets broker-dealer, alternative trading system (ATS), and transfer agent (TA) licenses.

— Ondo Finance (@OndoFinance) October 6, 2025

This provides the Ondo Finance group with the most comprehensive set of SEC registrations for… pic.twitter.com/vaLjJZ5QAv

From DeFi to TradFi: Bridging the Gap

Ondo Finance’s acquisition of Oasis Pro brings broker-dealer, Alternative Trading System (ATS), and Transfer Agent (TA) licenses under its umbrella — all approved by the U.S. Securities and Exchange Commission (SEC).

This milestone allows Ondo to expand into the fast-growing Real World Assets (RWA) sector, which could exceed $18 trillion by 2033. By moving beyond a pure DeFi protocol issuing tokenized assets, Ondo now operates within a regulated U.S. framework, offering institutional investors legally compliant exposure to on-chain securities.

On-Chain Growth and Investor Appetite

Ondo’s ecosystem has demonstrated impressive growth. Its Total Value Locked (TVL) recently hit $1.74 billion, with Q3 revenue around $13.7 million. Meanwhile, Ondo Global Markets surpassed $300 million in tokenized treasuries, stocks, and stablecoins, reflecting strong institutional and retail inflows.

The surge in RWA adoption highlights investor demand for yield-bearing digital assets, particularly amid rising real interest rates. Ondo’s ability to merge TradFi credibility with DeFi efficiency is a key factor attracting this capital.

Technical Signals and Market Outlook

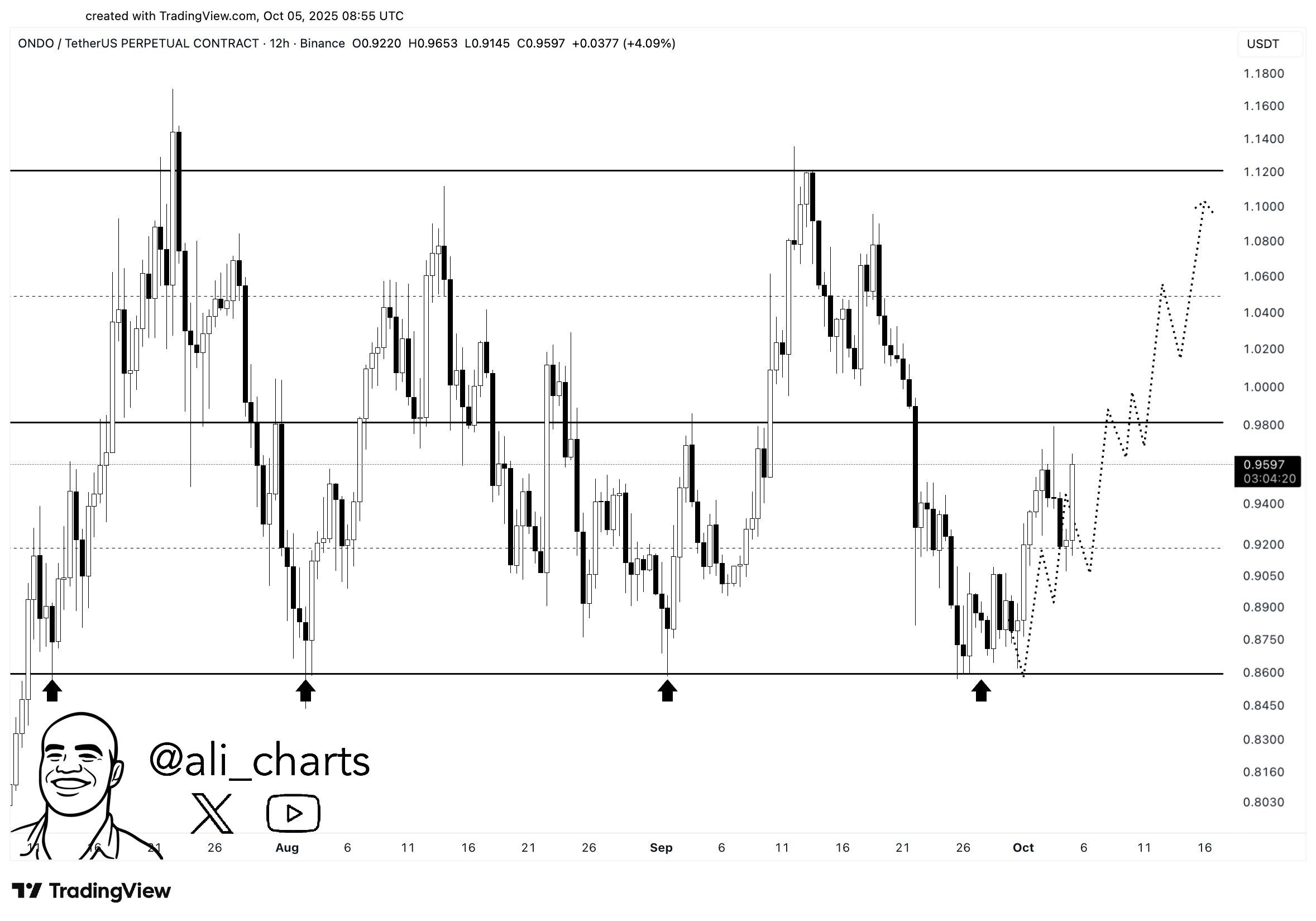

ONDO trades near $0.94, with resistance at $1.12 if bullish momentum persists. On-chain metrics, including the Short Term Bubble Risk (STBR) indicator, suggest that the market has stabilized after completing a full cycle from bubble to capitulation.

Also Read: Ondo Finance Under Pressure as $24M Whale Deposits Threaten ONDO Price Support

Analysts emphasize that Ondo’s breakout potential depends on three critical factors: smooth integration of Oasis Pro’s infrastructure, consistent inflows into tokenized products, and stable behavior among whales to avoid sudden sell-offs.

Ondo Finance’s acquisition of Oasis Pro is more than a corporate move — it’s a strategic leap toward bridging DeFi and TradFi. With SEC approval, strong on-chain growth, and rising institutional demand, ONDO is well-positioned to shape the regulated RWA landscape. However, market discipline and successful integration remain crucial for sustaining momentum.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.