|

Getting your Trinity Audio player ready...

|

- ONDO fell 2% daily but remains 20% higher over the past week.

- A cup and handle pattern hints at upside targets of $1.40–$1.71.

- Analysts remain split, with 2025 forecasts ranging from $1.08 to $2.38.

ONDO is currently trading at $1.08, recording a 2.05% decline in the past 24 hours. The token’s trading volume dropped sharply by 44.83% to $210.56 million, indicating waning short-term activity from traders. This cooldown follows an impressive 20.39% rally over the last week, which outperformed many mid-cap cryptocurrencies and brought ONDO into the spotlight within the decentralized finance (DeFi) sector.

Analysts attribute the surge to growing use of ONDO in liquidity applications and a broader wave of DeFi market enthusiasm, which has sparked renewed interest among investors and traders alike.

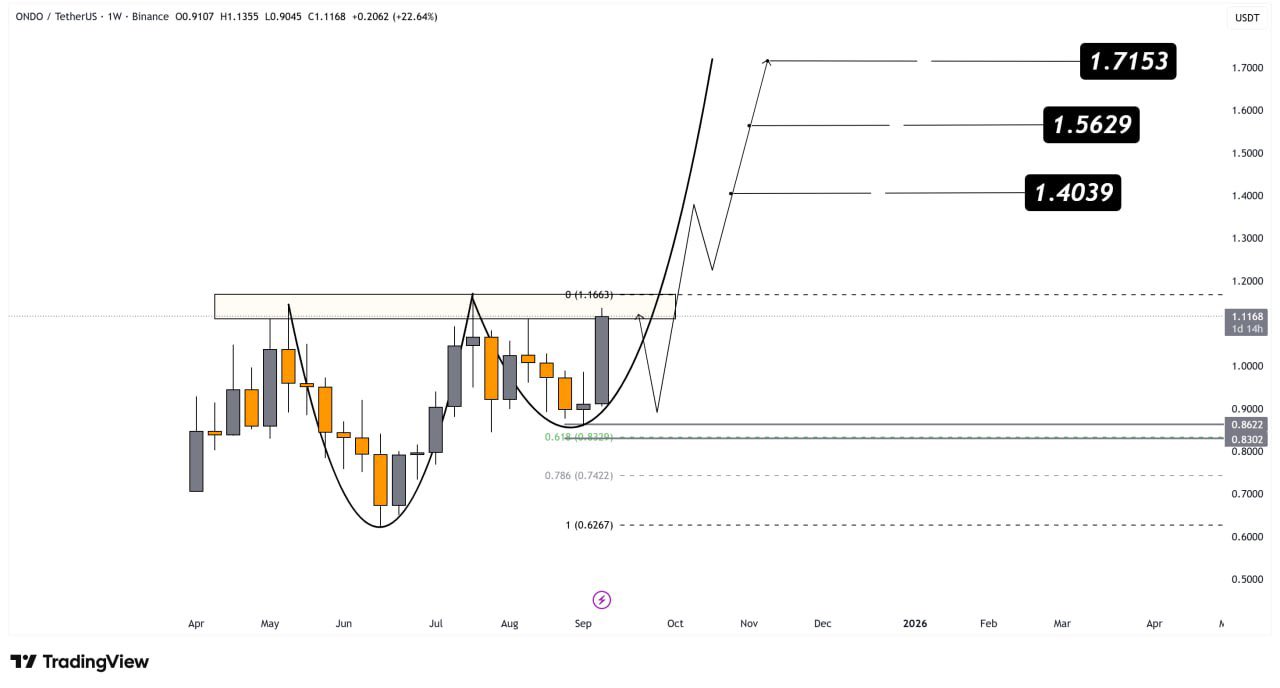

Cup and Handle Pattern Signals Bullish Outlook

Crypto analyst BitMonty highlighted a classic cup and handle pattern forming on ONDO’s weekly chart — a historically bullish technical setup. He noted that “momentum is building” as the token attempts to flip resistance into support.

BitMonty projects three possible upside targets:

- $1.40 (T1)

- $1.56 (T2)

- $1.71 (T3)

A decisive breakout above current levels could trigger a medium-term uptrend, drawing more buyers into the market.

Analysts Split on Future Price Trajectory

While optimism surrounds ONDO’s near-term chart, market opinions remain mixed on its longer-term prospects. DigitalCoinPrice predicts ONDO could cross $2.14 and approach $2.38 by year-end, marking a potential new all-time high.

By contrast, Changelly projects a more conservative 2025 range between $1.08 and $1.29, with an expected ROI of about 17.3%. This divergence highlights the importance of risk management as ONDO attempts to sustain its momentum.

Also Read: Is ONDO a Hidden Buy? Charts Flash Bearish, Metrics Show Opportunity

ONDO’s short-term pullback masks its recent strong rally, and technical indicators suggest a potential breakout ahead if resistance turns into support. While upside targets could drive prices significantly higher, investors should remain cautious and manage risk amid volatility.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!