|

Getting your Trinity Audio player ready...

|

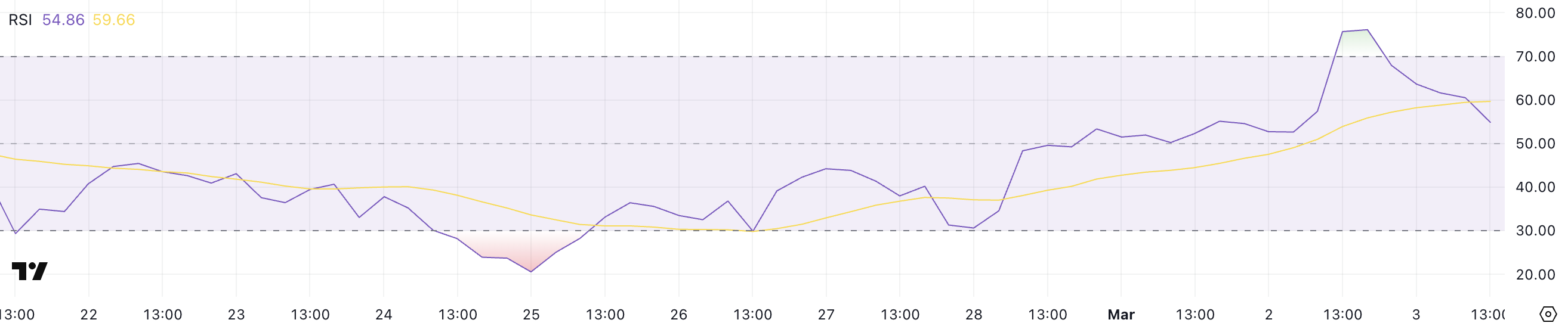

ONDO’s recent surge in price saw its Relative Strength Index (RSI) reach its highest level in three months, hitting 76.1 before cooling off to 54.8. This retracement suggests that buying pressure is easing, potentially setting the stage for further corrections if momentum continues to weaken.

ONDO RSI Declines After Overbought Territory

The RSI, a key momentum indicator, measures the speed and magnitude of price changes on a scale from 0 to 100. Readings above 70 indicate overbought conditions, often preceding a pullback, while readings below 30 signal oversold conditions that may lead to a rebound. ONDO briefly crossed the 70 mark for the first time in three months before dropping back to neutral territory at 54.8.

If RSI stabilizes above 50, ONDO could maintain its bullish structure and attempt another push higher. However, a further decline toward 40 or lower would suggest weakening momentum, increasing the likelihood of additional downside pressure.

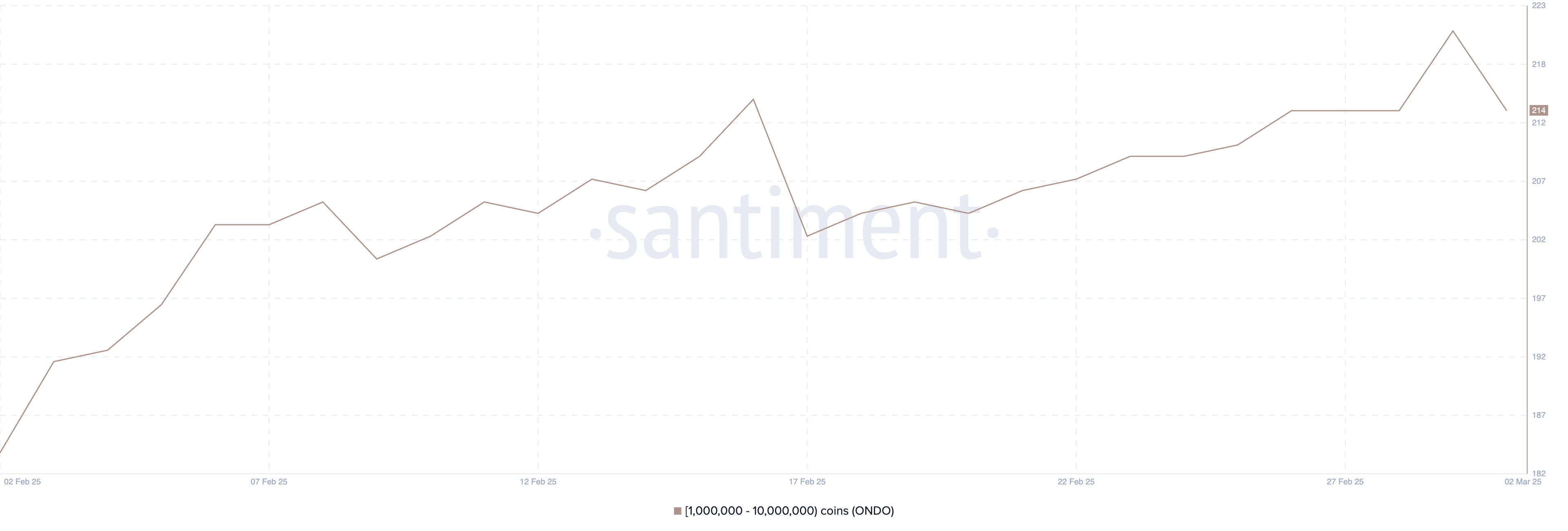

ONDO Whale Activity Declines for the First Time in Over Two Weeks

On-chain data indicates that the number of ONDO whales—wallets holding between 1 million and 10 million ONDO—had been steadily increasing since mid-February, climbing from 203 to 221 by March 1. However, the number has now dropped to 214, marking the first decline in over 15 days.

Whale activity is crucial to price trends, as large holders can influence market movements through their buying or selling decisions. A rising number of whales typically signals accumulation and confidence in long-term potential, whereas a decline may indicate profit-taking or distribution, potentially increasing selling pressure.

ONDO Falls Below $1, Eyes Key Support Levels

ONDO recently tested the $1.20 level before undergoing a correction, falling below the psychological $1 threshold. The next critical support levels lie around $0.95, with further downside potential toward $0.90 or even $0.88 if bearish momentum persists.

However, if bullish sentiment returns—possibly fueled by regulatory clarity or ONDO’s inclusion in the US strategic crypto reserve—resistance levels at $1.26 and $1.44 could be tested, with a potential rally toward $1.66.

Also Read: Pepe Coin Whale Dumps 262B PEPE, Redirects Focus to ONDO

As market sentiment continues to evolve, ONDO’s price trajectory remains uncertain, with key resistance and support levels dictating its next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.