|

Getting your Trinity Audio player ready...

|

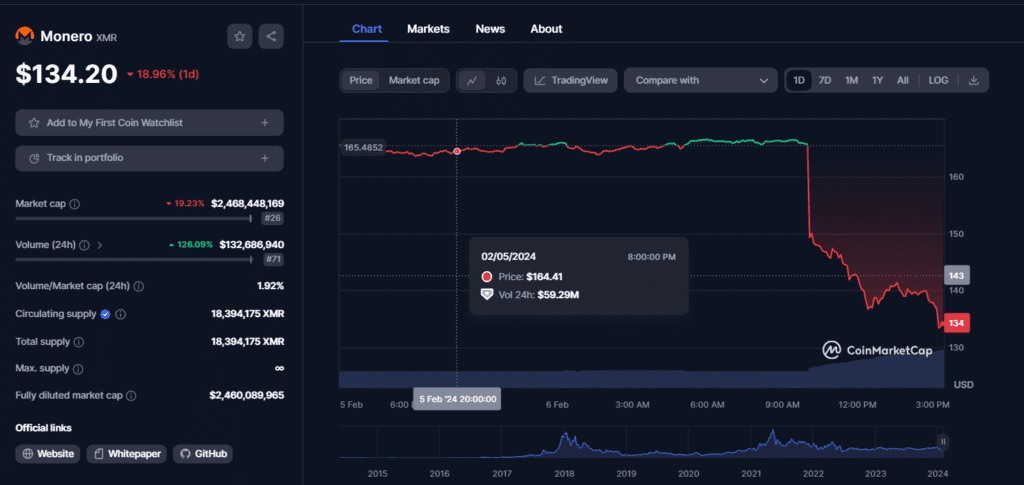

Major privacy-focused cryptocurrency Monero (XMR) has taken a hit, plummeting to multi-month lows after Binance announced its upcoming delisting from the platform. This move, effective February 20th, 2024, has sparked concerns about both Monero’s future and Binance’s potential struggles amidst regulatory pressure.

The Delisting Decision and Its Impact:

Binance cited various factors for the delisting, including its assessment of XMR’s contribution to a “healthy and sustainable crypto ecosystem.” This has fueled speculation about Binance’s motives, with some industry observers seeing it as a sign of bowing to regulatory pressure, particularly considering the exchange’s recent legal troubles.

The immediate impact was undeniable. Monero’s price saw a sharp decline, dropping nearly 19% within hours of the announcement. While it has shown slight recovery, it remains near its lowest point since mid-September 2023. This delisting isn’t an isolated incident. OKX delisted Monero and Zcash (ZEC) in January 2024, and Binance itself delisted privacy tokens in specific regions prior to this broader move.

Monero’s Uncertain Future:

The delisting raises questions about Monero’s long-term viability. While some commentators suggest alternative exchanges will pick up the slack, losing access to a major platform like Binance is undoubtedly a blow. Monero’s privacy features, while attracting loyal users, also make it less palatable to some regulators, potentially hindering wider adoption.

Also Read: Binance Launches $5M Bounty Amidst Controversy over RON Token Listing

Binance Under Scrutiny:

The timing of this delisting, coinciding with Binance’s ongoing legal battles and regulatory scrutiny, has led some to question the exchange’s own stability. CEO Changpeng Zhao’s recent guilty plea and upcoming sentencing add to the uncertainty. While Binance remains a major player, its future appears less clear than ever.

Beyond Monero and Binance:

This incident highlights the broader challenges facing privacy-focused cryptocurrencies and the impact of regulatory pressure on major exchanges. As the digital asset landscape continues to evolve, navigating these complexities will be crucial for both individual projects and industry leaders like Binance.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.