|

Getting your Trinity Audio player ready...

|

Michael Saylor, the executive chairman of MicroStrategy and a prominent Bitcoin advocate, has made waves with his latest remarks on the U.S. Crypto Strategic Reserve. While reaffirming his belief that Bitcoin is the “foundation” of the crypto economy, Saylor’s comments to CNBC indicate a surprising openness to the inclusion of other assets, including XRP, in the reserve.

The Right Digital Asset Policy is a $100 Trillion Opportunity for the U.S. pic.twitter.com/DTzATMIY8R

— Michael Saylor⚡️ (@saylor) March 3, 2025

Saylor described the initiative as “bullish” for Bitcoin and the broader cryptocurrency market, emphasizing that a progressive policy towards digital assets is the best way forward. His stance marks a notable shift from previous statements, where he expressed skepticism about XRP’s regulatory status. In a 2022 podcast, he controversially labeled XRP as a security, urging the SEC to take action against it. Again, in a 2024 appearance on the PBD Podcast, he maintained that he was “100% Bitcoin-only” and would not recommend XRP to investors.

Debate Over the Multi-Token Strategic Reserve

The concept of a multi-token reserve has sparked debate among financial analysts. Investment firm Bernstein’s analysts, including Gautam Chhugani and Mahika Sapra, argue that Bitcoin’s role as “digital gold” is well-established and that its inclusion in government reserves is logical. However, they question the rationale for including other cryptocurrencies, such as XRP, Ethereum, and Solana, citing their volatility and ecosystem-specific utility rather than universal value storage.

In contrast, Cardano co-founder Charles Hoskinson has defended XRP’s inclusion, citing its strong community, technological resilience, and longevity. He highlighted that XRP has weathered multiple market downturns and regulatory battles, solidifying its place in the crypto landscape.

XRP Price Analysis and Market Outlook

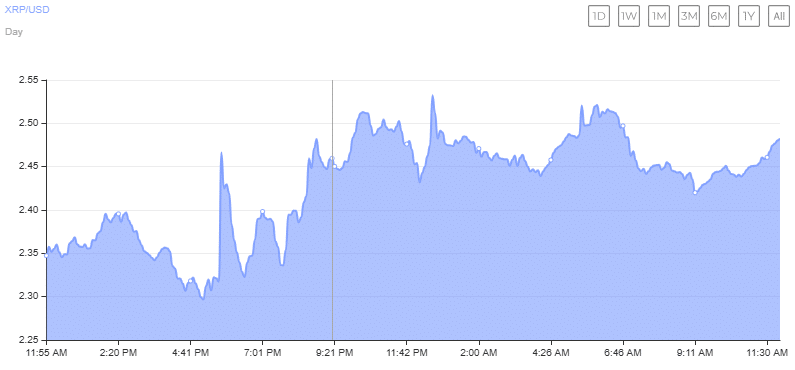

Despite concerns surrounding the reserve, XRP saw a sharp price surge following Donald Trump’s recent pro-crypto announcement, rising 16% to $2.6 before retracing to $2.3. Market analyst Random Crypto Pal predicts a potential parabolic move for XRP, referencing its historic 110,233% rally from $0.003 to $3.31 in 2017. He suggests a 99,900% surge from its July 2024 low could push XRP to an astronomical $385. However, this scenario would require a $22.1 trillion market cap, surpassing gold and Bitcoin. More conservative estimates place XRP at $15 this cycle.

As discussions on the multi-token reserve continue, Saylor’s evolving stance and XRP’s volatile price movements highlight the dynamic nature of the crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ripple (XRP) Mid-March 2025 Price Prediction: Can It Hit New Highs?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.