|

Getting your Trinity Audio player ready...

|

Dogecoin (DOGE) has faced its share of ups and downs, but its recent price recovery has sparked renewed interest in the memecoin. Despite a sharp decline during a market downturn, DOGE has managed to regain some of its lost ground, raising the question of whether this resurgence is sustainable.

Positive Technical Indicators Suggest Bullish Potential

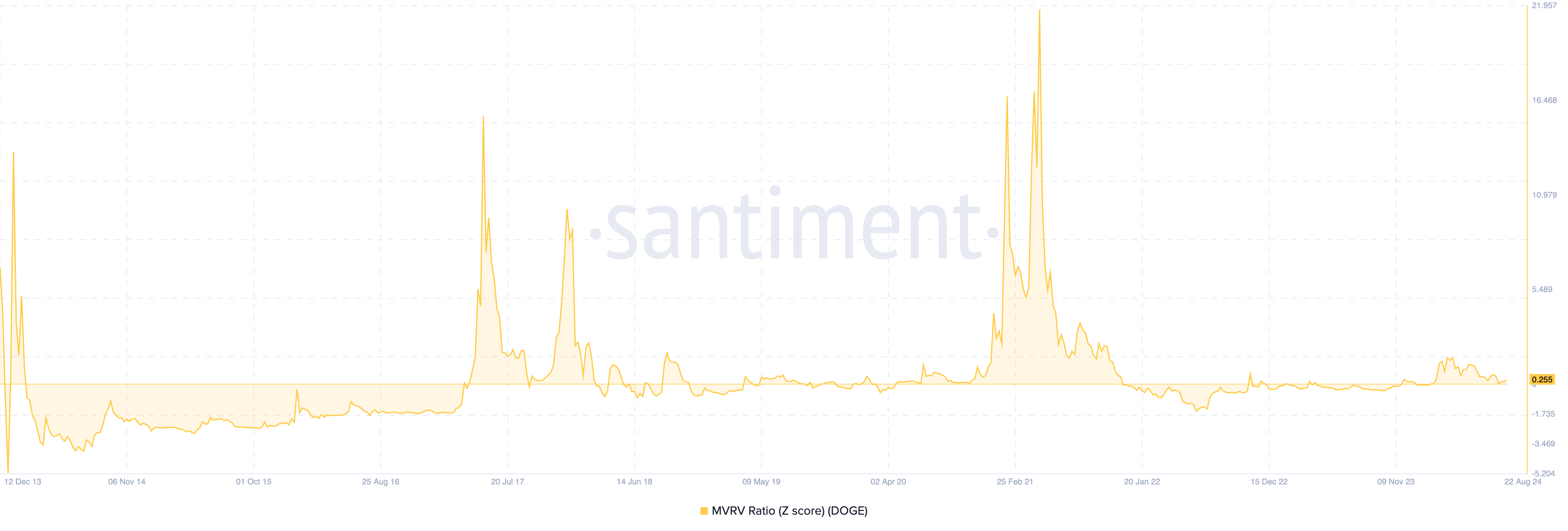

Several technical indicators suggest that Dogecoin may be poised for further price appreciation. The Market Value to Realized Value (MVRV) Z-Score, which measures the relative undervaluation or overvaluation of a cryptocurrency, has recently turned negative. This indicates that long-term holders may be poised to benefit from a potential bull market.

Additionally, the Bulls and Bears indicator, which tracks the activity of large-scale buyers and sellers, shows a predominance of bullish addresses. This suggests that there is strong support for Dogecoin’s price from major investors.

Breaking Out of a Descending Triangle

On the weekly chart, Dogecoin appears to be on the verge of breaking above a descending triangle. This technical pattern is generally considered bearish, but a successful breakout could signal a significant price increase. If Dogecoin can break above the 78.6% Fibonacci retracement level, it could target $0.16 in the mid-term and potentially $0.22 in the long term.

Also Read: Dogecoin (DOGE) Hits Resistance At $0.10 – Will Falling Trading Volume Derail The Breakout?

Market Conditions and Potential Risks

However, it’s important to note that this long-term prediction is contingent on the broader market remaining bullish. A significant downturn in the overall cryptocurrency market could derail Dogecoin’s upward trajectory. In such a scenario, the memecoin’s price could potentially decline to $0.049.

While Dogecoin has faced challenges in recent months, the current technical indicators and market sentiment suggest a bullish outlook. The potential for a breakout from a descending triangle and the growing support from large-scale investors could fuel further price appreciation. However, investors should remain cautious and be aware of the potential risks associated with the cryptocurrency market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.