|

Getting your Trinity Audio player ready...

|

As Hedera’s (HBAR) price continues its downward trajectory, futures traders are increasingly betting on further declines, suggesting a growing sense of pessimism in the market. According to Coinglass, the HBAR Long/Short Ratio has dropped to 0.86, indicating that more traders are placing short bets than long ones. For every 100 short positions, there are only 86 long positions, a clear sign of bearish sentiment.

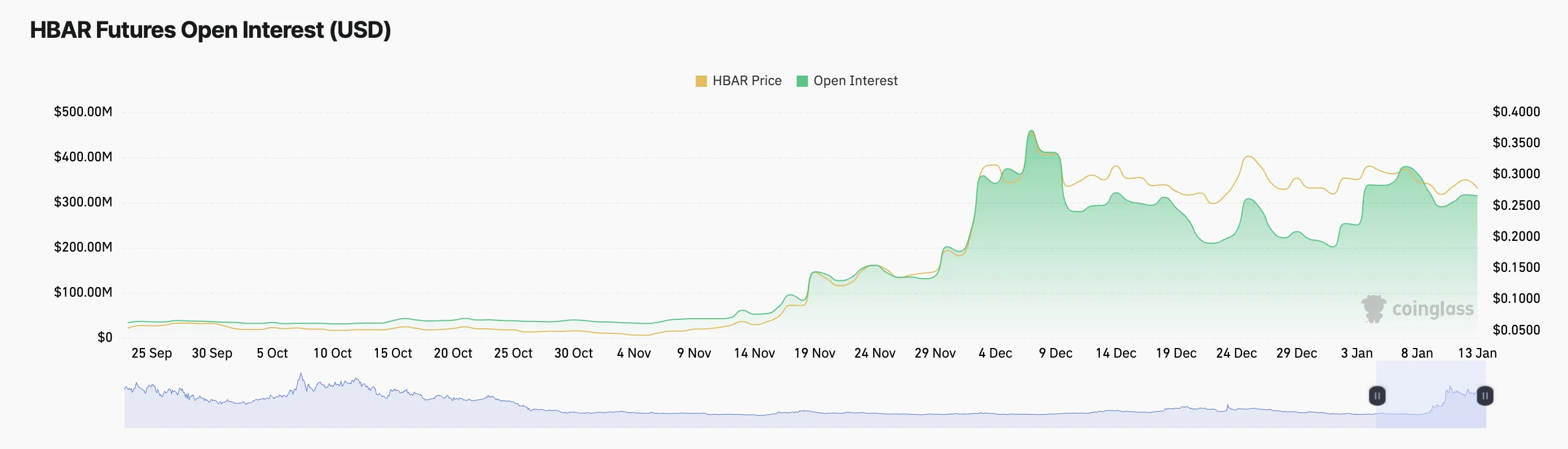

This shift in market sentiment comes amidst a significant drop in open interest in the Hedera futures market, which has fallen by 17% in just six days. Currently standing at $315 million, this declining open interest points to reduced market participation, as traders are closing positions rather than opening new ones. When open interest decreases in the midst of a price decline, it suggests weakening bearish momentum and hints that further drops may be on the horizon.

Analyzing the technical indicators, the falling Accumulation/Distribution (A/D) Line provides further evidence of a bearish outlook. Over the past week, the A/D Line has fallen by 6%, reflecting a decrease in buying activity. This volume-based indicator tracks the flow of money into or out of an asset, and its decline suggests that selling pressure is outpacing buying interest. As a result, confidence in HBAR’s price is waning, signaling that traders are more inclined to offload their holdings.

If the current selling pressure persists, Hedera’s price could breach key support at $0.24, with potential to decline further toward $0.16. However, a resurgence in buying interest could offer a glimmer of hope for HBAR’s recovery, pushing its price back up to $0.33.

Also Read: Can Hedera (HBAR) Break $0.504? Analysts Predict 75% Surge, But ETF News Falls Flat

In conclusion, the increasing short positions and declining open interest paint a grim picture for Hedera’s near-term price movement. Traders and investors will need to keep a close eye on upcoming price action and volume trends to gauge whether a rebound or continued decline is more likely in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.