|

Getting your Trinity Audio player ready...

|

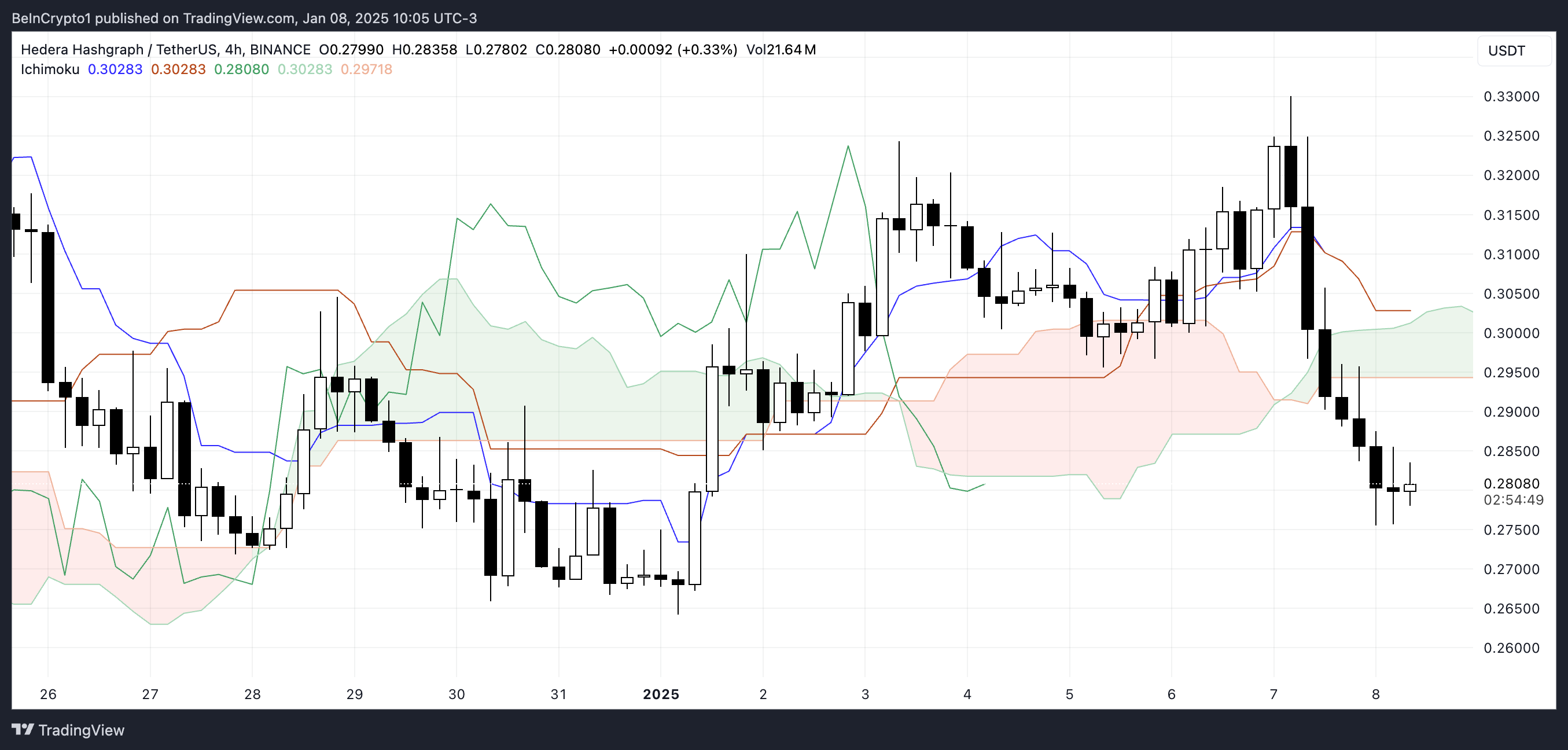

Hedera (HBAR) is currently facing significant price challenges, as it trades below its Ichimoku Cloud, indicating a bearish market sentiment. The Ichimoku Cloud serves as a critical indicator of support and resistance, and with HBAR below the red cloud, resistance is holding strong, continuing to pressure the price downward. However, the current setup isn’t entirely bleak, as HBAR’s momentum could shift if key support levels hold strong.

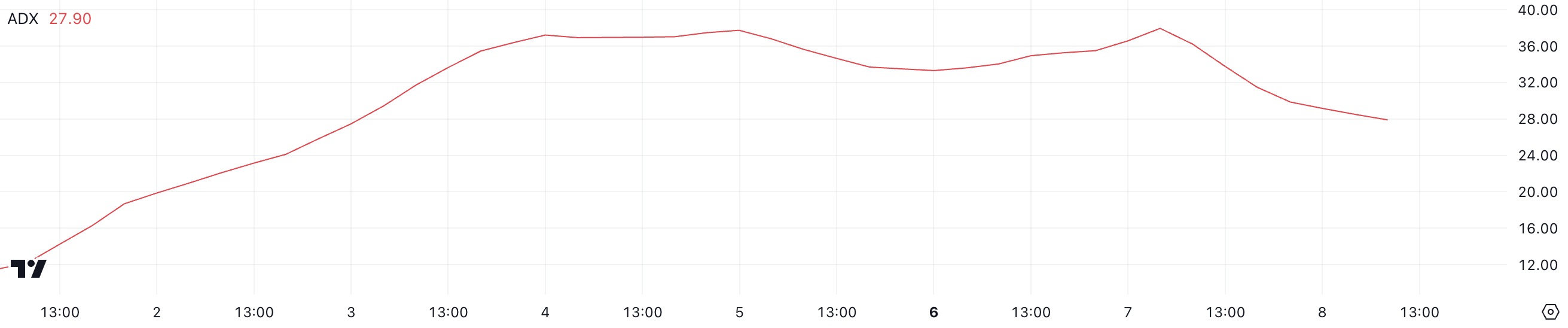

ADX Signals a Weakening Downtrend

The Average Directional Index (ADX) for Hedera has seen a notable drop from 37.9 to 27.9 in just 24 hours. ADX measures the strength of a trend, with values above 25 indicating a strong trend. HBAR’s current ADX level suggests that the downtrend remains intact, but the declining value indicates that bearish momentum might be losing steam. This shift could signal a potential period of consolidation, reducing volatility and pressure on the price. However, for a reversal to materialize, buying activity must substantially increase to counteract the current bearish sentiment.

Bearish Signals from the Ichimoku Cloud

The Ichimoku Cloud’s bearish setup further reinforces the downward pressure on HBAR’s price. The red cloud, created by the Senkou Span A and B, highlights the ongoing resistance, while the lagging Chikou Span confirms the bearish momentum. In order to see a reversal, HBAR would need to break above the cloud and shift the alignment of these key indicators, signaling a shift toward bullish momentum.

Support Levels Crucial for Reversal

HBAR’s price could test critical support levels in the near term. If the short-term Exponential Moving Averages (EMAs) continue to decline and cross below the long-term EMAs, a death cross could form, intensifying the downtrend and pushing HBAR closer to $0.27 or $0.26. However, if HBAR maintains its position above key supports, there could be potential for a reversal, with the price aiming for resistance at $0.30 and possibly reaching $0.32, reflecting a 20.7% upside.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hedera (HBAR) Surges 18.5% After 2025 Dip: Is $0.40 the Next Target for the Bullish Token?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.