|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- HBAR’s price rally has stalled, with volume and BoP readings suggesting bearish pressure.

- A short-term dip below $0.26 is possible if demand fails to recover.

- The upcoming mainnet upgrade could serve as a trigger—either for recovery or further decline depending on market reaction.

After surging nearly 60% in just under two weeks, Hedera Hashgraph’s native token HBAR is showing signs of exhaustion. With daily trading volume dropping sharply and key momentum indicators turning bearish, the altcoin may be on the brink of a short-term correction.

Trading Volume Divergence Signals Weakening Momentum

Between July 9 and July 20, HBAR posted an impressive 59% price increase, attracting bullish sentiment across the market. However, this surge has lost momentum in the past three days. While HBAR has managed a modest 2% price gain in the last 24 hours, it comes with a concerning 34% decline in trading volume.

This negative divergence—where price rises but volume drops—suggests that fewer traders are backing the move. Such patterns often indicate a lack of conviction and can precede pullbacks, especially when broader market catalysts fade.

BoP Indicator Flips Bearish Amid Waning Demand

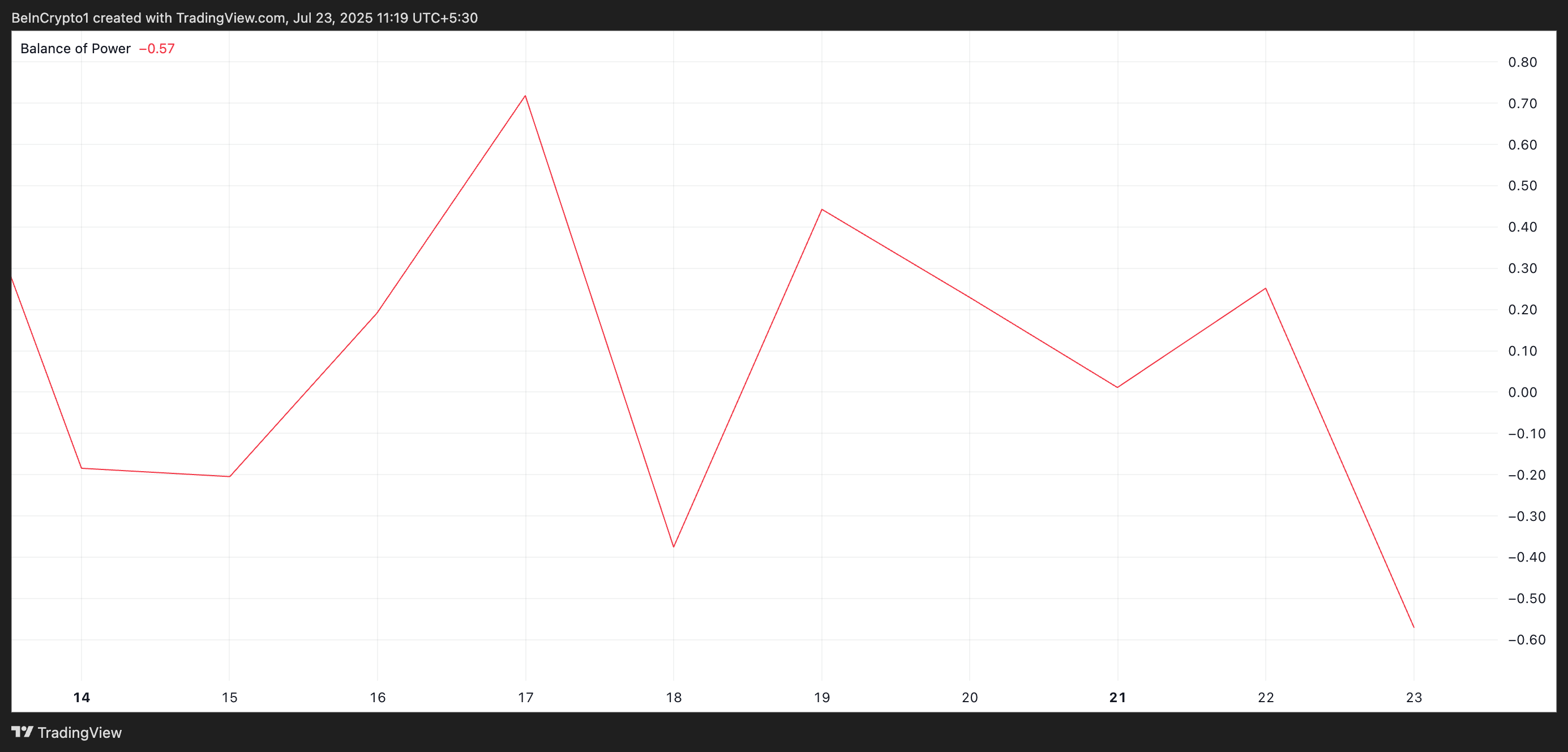

Further supporting the bearish outlook is HBAR’s Balance of Power (BoP) indicator, which has flipped into negative territory. At -0.57, the BoP reveals that sellers are now dominating the market. This shift in momentum signals a change in trader sentiment, potentially capping short-term upside for the token.

The BoP is a crucial technical tool for gauging the strength of buyers versus sellers. A negative reading typically aligns with downward pressure and increased risk of price retracements.

Also Read: Hedera (HBAR) Surges 125% — Will It Follow XRP to a New All-Time High?

Mainnet Upgrade Looms, But Will It Be Enough?

All eyes now turn to the upcoming Hedera mainnet upgrade. While such developments often bring optimism, there’s growing concern that the positive news may already be priced in. If demand doesn’t return swiftly after the upgrade, HBAR could break below the $0.26 support level and slide toward $0.22.

On the upside, a bullish reversal supported by renewed buying interest could help HBAR reclaim the $0.29 resistance zone, potentially reinvigorating its short-term uptrend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.