|

Getting your Trinity Audio player ready...

|

Hedera Hashgraph (HBAR) continues to exhibit bullish momentum, but declining investor interest and reduced market activity are raising concerns about its long-term trajectory. Despite its potential, market indicators suggest that the altcoin’s upward momentum might face challenges without renewed investor confidence.

Investor Outflows Signal Growing Caution

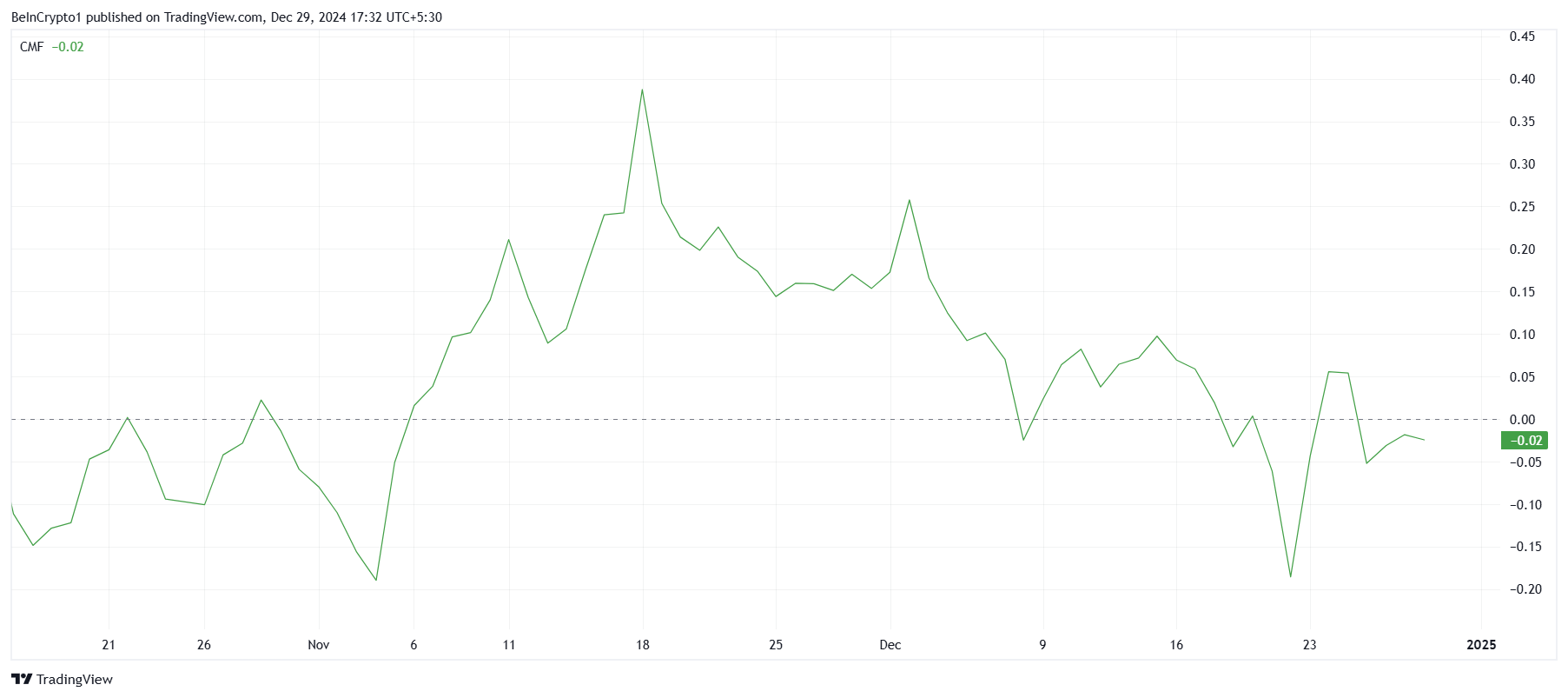

The Chaikin Money Flow (CMF) indicator paints a troubling picture for HBAR. Capital outflows now surpass inflows, indicating that investors are pulling funds amid uncertainty about the asset’s ability to sustain its bullish run. This trend reflects growing caution among market participants and could stall any short-term rallies.

Without a reversal in these outflows, HBAR may struggle to break out of its current trading range. The macro momentum shows signs of bearish pressure, as evidenced by a downward trend in the Relative Strength Index (RSI). While the RSI remains above the neutral line at 50.0, signaling that bearish control is not yet dominant, its trajectory suggests a cautious market sentiment.

Consolidation Persists Amid Mixed Signals

For the past month, HBAR has been consolidating between $0.40 and $0.25, trading at $0.28 at the time of writing. This prolonged stagnation highlights the broader uncertainty in the cryptocurrency market.

Market analysts suggest that this consolidation phase could persist into 2025 unless significant bullish triggers emerge. Positive developments or strong buying support are crucial to reignite investor interest and drive a breakout from this range.

However, risks remain. If investors begin liquidating to secure gains, HBAR could breach its critical $0.25 support level. Such a decline would invalidate the current bullish outlook, potentially pushing the altcoin to $0.18 and deepening skepticism among market participants.

Outlook: A Pivotal Moment for HBAR

As HBAR navigates this uncertain phase, its ability to regain investor confidence will be critical. While the altcoin retains the potential for a recovery, the current market dynamics suggest that renewed buying pressure is essential to overcome bearish sentiment and avoid further price declines.

Also Read: Hedera (HBAR) Soars 30% in Three-Day Rally: Bullish Patterns Signal Potential for $0.40 High

HBAR’s future depends on stronger inflows, bullish cues, and sustained market activity to regain its upward momentum and break free from its consolidation phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.