|

Getting your Trinity Audio player ready...

|

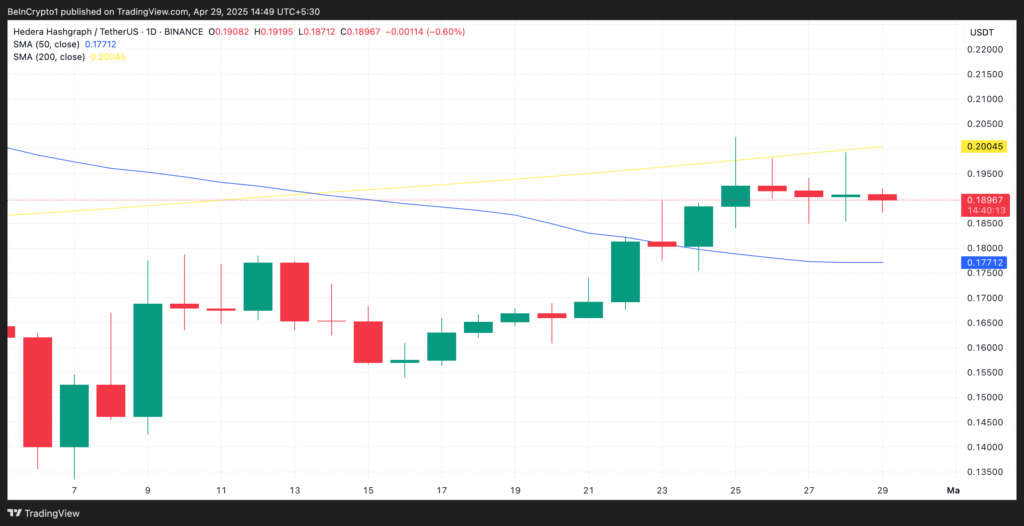

Despite the emergence of a bearish “death cross” pattern for HBAR, the digital asset’s bulls are maintaining control, fueled by consistent buying interest. A death cross, a technical indicator where the short-term 50-day moving average dips below the long-term 200-day moving average, typically signals weakening momentum and potential for a downtrend. However, HBAR’s recent price action suggests a different narrative.

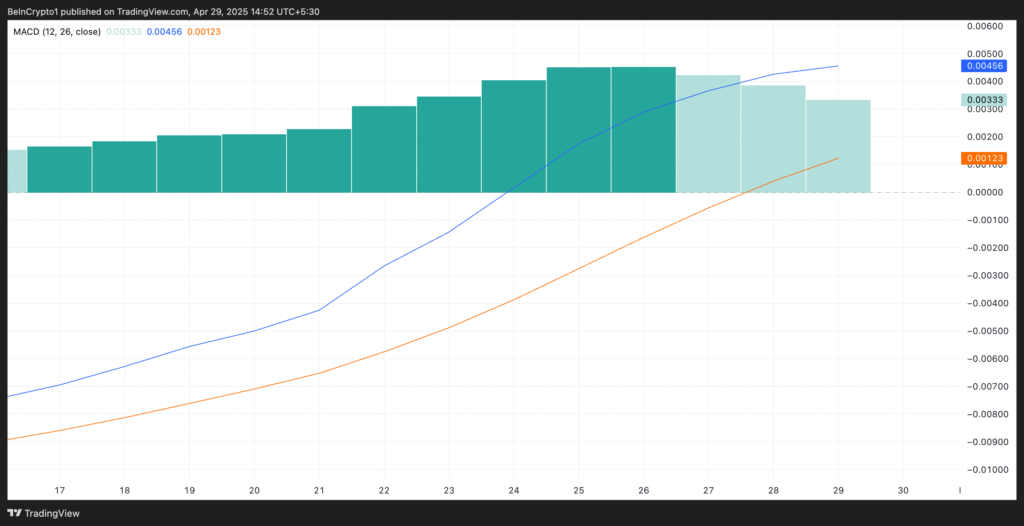

Over the past two weeks, HBAR has experienced a significant 20% surge in value, highlighting the underlying strength despite the ominous technical signal. While bullish momentum has tempered slightly in the last three trading sessions, analysis of the Moving Average Convergence Divergence (MACD) indicator reinforces the bullish sentiment.

Although the MACD bars have shrunk, indicating a temporary slowdown amidst broader market consolidation, the MACD line remains above the signal line. This crucial observation indicates that buying pressure continues to outweigh selling pressure, suggesting the potential for further upward movement.

Also Read: Hedera (HBAR) Bulls Beware: $0.176 Support Crucial as Rising Wedge Forms

Ascending Trend Line Underpins HBAR’s Bullish Outlook

Since April 16th, HBAR’s price trajectory has followed an ascending trend line, a classic bullish pattern characterized by consistently higher lows. This pattern signifies growing investor confidence and sustained upward momentum, effectively absorbing short-term pullbacks. For HBAR, this trend suggests that buyers are actively entering the market at progressively higher price points, establishing stronger support levels.

Should this trend persist, it could pave the way for further price appreciation, particularly if overall market sentiment remains favorable. Analysts suggest that a break above the $0.19 resistance level could propel HBAR towards the $0.23 mark. However, the possibility of renewed selloffs remains, which could potentially drive the price back down to the $0.15 support level.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!